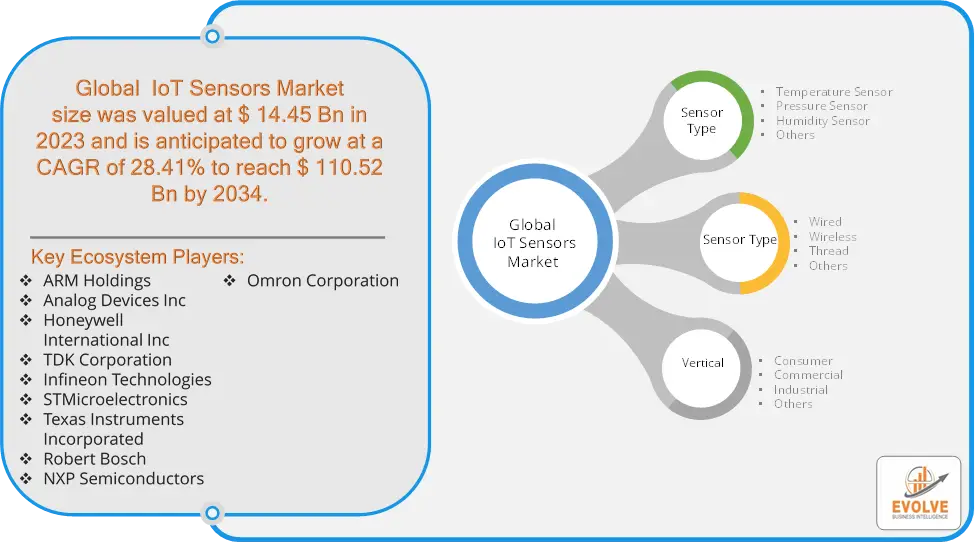

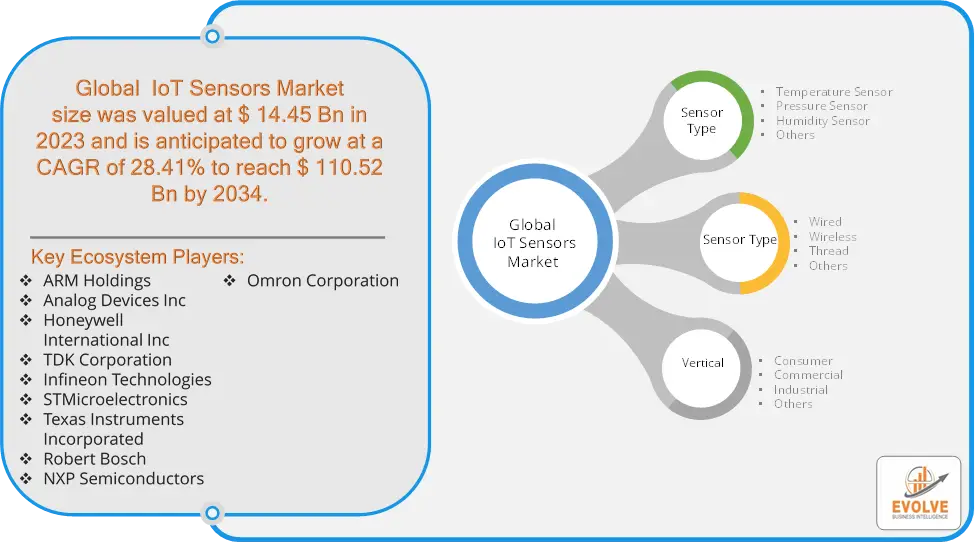

Global IoT Sensors Market Overview

The Global IoT Sensors Market size accounted for USD 14.45 Billion in 2023 and is estimated to account for 15.85 Billion in 2024. The Market is expected to reach USD 110.52 Billion by 2034 growing at a compound annual growth rate (CAGR) of 28.41% from 2024 to 2034. The Global IoT Sensors Market refers to the sector that encompasses various types of sensors used in Internet of Things (IoT) applications. These sensors collect data from the physical environment and transmit it to cloud-based platforms or other devices for analysis, enabling smarter decision-making across various industries.

The Global IoT Sensors Market is pivotal in transforming how industries operate, providing insights that lead to improved efficiency, cost savings, and enhanced customer experiences. The global IoT sensors market is a dynamic industry that plays a vital role in enabling the Internet of Things and driving innovation across various sectors.

Global IoT Sensors Market Synopsis

The major factors that have impacted the growth of Global IoT Sensors Market are as follows:

Drivers:

Ø Technological Advancements

Ongoing innovations in sensor technology, such as miniaturization, enhanced accuracy, and improved energy efficiency, make sensors more viable and attractive for diverse applications. Organizations are increasingly relying on real-time data to make informed decisions. IoT sensors enable continuous monitoring and data collection, facilitating timely insights and actions. The demand for remote patient monitoring and telemedicine solutions has surged, driving the need for wearable sensors that can track vital signs and health metrics. The industrial sector is increasingly adopting IoT technologies for predictive maintenance, asset tracking, and process optimization, driving demand for various sensors.

Restraint:

- Perception of High Deployment and Maintenance Costs

The proliferation of IoT sensors raises concerns about data breaches and unauthorized access to sensitive information. Ensuring robust security measures is crucial, but can be challenging and costly. The initial investment for deploying IoT sensors, along with ongoing maintenance costs, can be a barrier for small and medium-sized enterprises (SMEs). Budget constraints may limit their ability to adopt these technologies.

Opportunity:

⮚ Advancements in 5G Technology

The rollout of 5G networks enhances connectivity and enables faster data transmission, opening up opportunities for more advanced IoT applications that require real-time communication. Urbanization and smart city initiatives drive demand for IoT sensors for traffic management, waste management, energy efficiency, and public safety. Companies can develop tailored solutions to meet these needs. Precision agriculture is gaining traction, with sensors used for monitoring soil conditions, weather patterns, and crop health. Developing IoT solutions for farmers can enhance yield and resource management.

Global IoT Sensors Market Segment Overview

By Sensor Type

By Network Sensor Type

Based on Network Sensor Type, the market segment has been divided into Wired, Wireless, Thread and Others. The wireless technology segment dominant the market due to its scalability, flexibility, and cost-effectiveness. Wireless sensors offer easy deployment in large-scale networks without complex cabling, lowering upfront costs and facilitating rapid integration. They also require minimal maintenance, reducing operational expenses and downtime.

By Vertical

Based on Vertical, the market segment has been divided into Consumer, Commercial, Industrial and Others. The commercial segment dominant the market. Enterprises across various industries, including offices, retail, and hospitality, widely adopt IoT sensors to streamline operations and enhance customer experiences. These sensors are integral to smart building solutions, facilitating efficient management of lighting, HVAC systems, security, and occupancy. Moreover, businesses utilize IoT sensors for asset tracking and inventory management, improving asset visibility and reducing losses.

Global IoT Sensors Market Regional Analysis

Based on region, the Global IoT Sensors Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global IoT Sensors Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Global IoT Sensors Market. North America has been a dominant player in the IoT sensors market for a long time, driven by technological advancements and a strong focus on innovation and substantial investments in smart technologies and high adoption of smart devices and automation in industries such as manufacturing, healthcare, and transportation.

Global IoT Sensors Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global IoT Sensors Market industry. The Asia-Pacific region is the fastest-growing market for IoT sensors, driven by increasing urbanization, industrialization, and government support for IoT initiatives and Significant investments in smart manufacturing, agriculture, and urban development and rapid expansion of the telecommunications infrastructure, including 5G networks.

Competitive Landscape

The Global IoT Sensors Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- ARM Holdings

- Analog Devices Inc

- Honeywell International Inc

- TDK Corporation

- Infineon Technologies

- STMicroelectronics

- Texas Instruments Incorporated

- Robert Bosch

- NXP Semiconductors

- Omron Corporation

Key Development

In February 2023, Henkel unveiled an innovative sensor experience kit designed specifically for IoT development across various sectors. The Henkel Qhesive Solutions Sensor INKxperience Kit introduces four distinct printed electronics technologies, complete with pre-configured hardware and software for prototyping and conceptualizing engineering projects.

Scope of the Report

Global IoT Sensors Market, by Sensor Type

- Temperature Sensor

- Pressure Sensor

- Humidity Sensor

- Others

Global IoT Sensors Market, by Network Sensor Type

- Wired

- Wireless

- Thread

- Others

Global IoT Sensors Market, by Vertical

- Consumer

- Commercial

- Industrial

- Others

Global IoT Sensors Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $110.52 Billion |

| CAGR | 28.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Sensor Type, Network Sensor Type, Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ARM Holdings, Analog Device Inc, Honeywell International Inc, TDK Corporation, Infineon Technologies, STMicroelectronics, Texas Instruments Incorporated, Robert Bosch, NXP Semiconductors and Omron Corporation. |

| Key Market Opportunities | • Advancements in 5G Technology • Agricultural IoT Solutions |

| Key Market Drivers | • Technological Advancements • Growing Need for Real-Time Data |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global IoT Sensors Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global IoT Sensors Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global IoT Sensors Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the Global IoT Sensors Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the Global IoT Sensors Market?

The Global IoT Sensors Market is growing at a CAGR of 28.41% over the next 10 years

Which region has the highest growth rate in the market of Global IoT Sensors Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the Global IoT Sensors Market?

North America holds the largest share in 2022

Who are the key players in the Global IoT Sensors Market?

ARM Holdings, Analog Device Inc, Honeywell International Inc, TDK Corporation, Infineon Technologies, STMicroelectronics, Texas Instruments Incorporated, Robert Bosch, NXP Semiconductors and Omron Corporation. are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives