Global Corrugated Packaging Market Overview

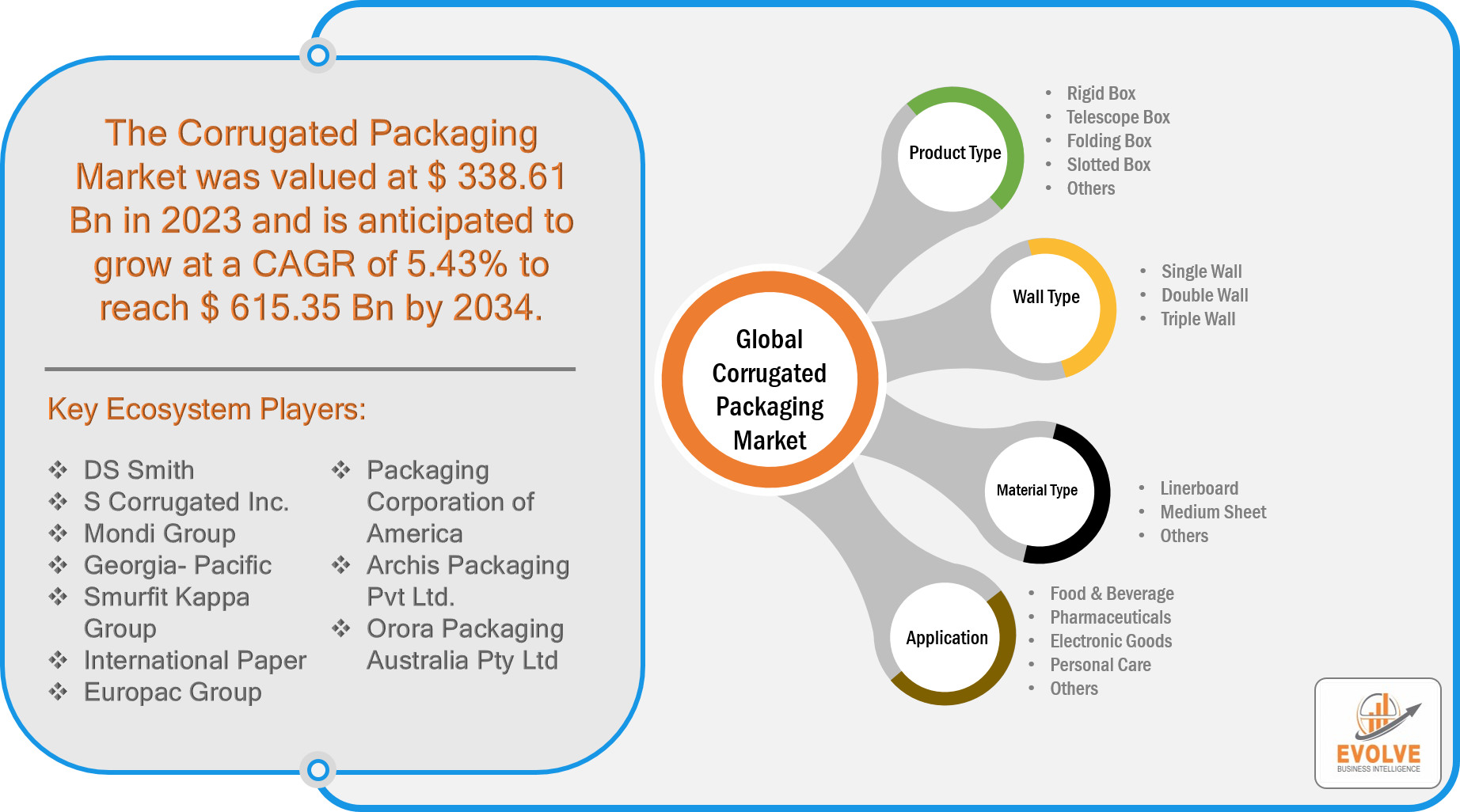

Global Corrugated Packaging Market Size is expected to reach USD 615.35 Billion by 2034. The Global Corrugated Packaging industry size accounted for USD 338.61 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.43% from 2024 to 2034. The corrugated packaging market encompasses the production and utilization of corrugated cardboard materials for packaging purposes. Corrugated packaging is renowned for its durability, versatility, and eco-friendliness, making it a popular choice across various industries for shipping and storing goods. This market is driven by factors such as e-commerce growth, increasing demand for sustainable packaging solutions, and advancements in printing and design technologies. Key players in this market include packaging manufacturers, suppliers of raw materials like paperboard, and technology providers for machinery used in corrugated box production. The market is characterized by ongoing innovation in materials, designs, and production processes to meet evolving consumer and industry needs. Globalization and the rise of online retail continue to fuel the expansion of the corrugated packaging market worldwide.

Global Corrugated Packaging Market Synopsis

The Corrugated Packaging market experienced a detrimental effect due to the Covid-19 pandemic. The COVID-19 pandemic significantly impacted the corrugated packaging market, initially witnessing a surge in demand due to stockpiling behaviors and increased online shopping. However, supply chain disruptions, labor shortages, and fluctuating raw material costs posed challenges. The market adapted by prioritizing safety measures, implementing remote work where possible, and leveraging digital solutions to maintain operations amidst the uncertainties.

Global Corrugated Packaging Market Dynamics

The major factors that have impacted the growth of Corrugated Packaging are as follows:

Drivers:

⮚ Technological Advancements

Innovations in corrugated packaging technology have led to improvements in strength, durability, and customization options. Advanced printing techniques and digitalization have allowed for more intricate designs and branding opportunities, appealing to both businesses and consumers.

Restraint:

- Raw Material Costs

Fluctuations in the prices of raw materials, particularly paper and wood fibers used in corrugated packaging production, can significantly impact manufacturing costs. Volatility in raw material prices may affect profit margins for packaging companies, potentially restraining market growth.

Opportunity:

⮚ E-commerce Expansion

The continued growth of e-commerce presents a significant opportunity for corrugated packaging manufacturers. As online shopping becomes increasingly prevalent worldwide, there is a growing demand for sturdy and sustainable packaging solutions to ensure the safe delivery of goods to consumers.

Global Corrugated Packaging Market Segment Overview

By Product Type

By Wall Type

Based on Wall Type, the market has been divided into Single Wall, Double Wall, and Triple Wall. The single-wall segment held a dominant position in the market in 2021 and is anticipated to develop at a quicker rate over the 2022–2030 projection period. This is because lowering the package’s weight results in cheaper transportation costs. As a result, the category is anticipated to have the highest CAGR throughout the projection period.

By Material Type

Based on the Material Type, the market has been divided into Linerboard, Medium Sheet, and Others. In terms of both volume and value, the linerboard material category dominated the market. At least 80% of the fibers in kraft liner are virgin kraft pulp. Kraft liner is utilized as an outer and intermediate ply in corrugated boxes because of its great strength and resistance to moisture.

By Application

Based on Application, the market has been divided into Food & Beverage, Pharmaceuticals, Consumer Goods, and Others. Food and drink, which are perishable goods with a short shelf life, had the most category share in 2021. It is therefore imperative to safeguard the product against bacterial deterioration, pathogens, and external disruptions

Global Corrugated Packaging Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Corrugated Packaging, followed by those in North America and Europe.

Corrugated Packaging Asia-Pacific Market

The Asia-Pacific region holds a dominant position in the Corrugated Packaging market. Asia-Pacific With a market value of USD 153.226 billion in 2021, corrugated packaging is predicted to grow at a compound annual growth rate of 6.1% throughout the course of the study. Asia Pacific’s packaging industry is growing quickly. China has consistently ranked in the top 15 countries in the world for corrugated output, along with South Korea, Australia, and India. Revenue growth in this region is being driven by factors including the growing number of urban residents, increased environmental consciousness, the demand for convenient and sustainable packaging, the expansion of e-commerce, and the adoption of electronic goods, home goods, and personal care products.

Corrugated Packaging North America Market

The North America region is witnessing rapid growth and emerging as a significant market for the Corrugated Packaging industry. From 2022 to 2030, the North American corrugated packaging market is projected to expand at a compound annual growth rate (CAGR) of 3.3%. This is because the corrugated packaging market’s revenue growth has been bolstered by growing environmental awareness. Important businesses are making progress toward achieving sustainable objectives. Corrugated boxes used for e-commerce are more likely to be printed with high-quality graphics and adapted to fit packaged contents to minimize costs and boost the visual impact while unwrapping. Additionally, Canada maintained the greatest market share for corrugated packaging.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as DS Smith, S Corrugated Inc., Mondi Group, Georgia- Pacific, and Smurfit Kappa Group are some of the leading players in the global Corrugated Packaging Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- DS Smith

- S Corrugated Inc.

- Mondi Group

- Georgia- Pacific

- Smurfit Kappa Group

- International Paper

- Europac Group

- Packaging Corporation of America

- Archis Packaging Pvt Ltd.

- Orora Packaging Australia Pty Ltd

Key Development:

April 2022: DS Smith, a UK-based sustainable packaging provider, developed and launched a corrugated cardboard box for e-commerce shipments of medical devices. This new corrugated cardboard box features a single-material solution in place of glued packaging with a single-use plastic insert.

Scope of the Report

Global Corrugated Packaging Market, by Product Type

- Rigid Box

- Telescope Box

- Folding Box

- Slotted Box

- Others

Global Corrugated Packaging Market, by Wall Type

- Single Wall

- Double Wall

- Triple Wall

Global Corrugated Packaging Market, by Material Type

- Linerboard

- Medium Sheet

- Others

Global Corrugated Packaging Market, by Application

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Others

Global Corrugated Packaging Market, by Region

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: $615.35 Billion |

| CAGR | 5.43% CAGR (2024-2034) |

| Base year | 2023 |

| Forecast Period | 2024-2034 |

| Historical Data | 2022 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Wall Type, Material Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | DS Smith, S Corrugated Inc., Mondi Group, Georgia- Pacific, Smurfit Kappa Group, International Paper, Europac Group, Packaging Corporation of America, Archis Packaging Pvt Ltd., Orora Packaging Australia Pty Ltd |

| Key Market Opportunities | Market penetration of different application in emerging nation. |

| Key Market Drivers | Growing Demand for product safety Technological innovations |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Corrugated Packaging Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2022, and forecast from 2024 to 2034

- Corrugated Packaging market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Corrugated Packaging market affected by the pandemic

- To provide year-on-year growth from 2021 to 2034

- To provide short-term, long-term, and overall CAGR comparison from 2024 to 2034.

- Provide Total Addressable Market (TAM) for the Global Corrugated Packaging Market.

Frequently Asked Questions (FAQ)

What is the growth rate of the Corrugated Packaging market?

The Corrugated Packaging market is expected to grow at a compound annual growth rate (CAGR) of 4.24% from 2023 to 2033.

Which region has the highest growth rate in the Corrugated Packaging market?

The Asia-Pacific region is anticipated to have the highest growth rate in the Corrugated Packaging market.

Which region has the largest share of the Corrugated Packaging market?

Currently, the Asia-Pacific region holds the largest share of the Corrugated Packaging market.

Who are the key players in the Corrugated Packaging market?

Key players in the Corrugated Packaging market include DS Smith, S Corrugated Inc., Mondi Group, Georgia-Pacific, Smurfit Kappa Group, International Paper, Europac Group, Packaging Corporation of America, Archis Packaging Pvt Ltd., and Orora Packaging Australia Pty Ltd.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.