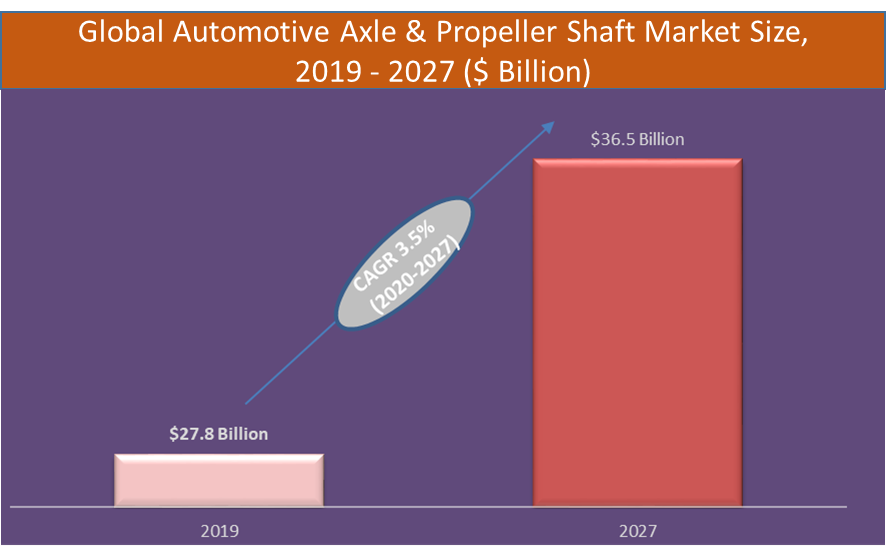

The Global Automotive Axle & Propeller Shaft market was valued at $ 27.8 billion in 2019 and is anticipated to grow at a CAGR of 3.5% from 2020 to 2027.

Key Insight in the report:

The Global Automotive Axle & Propeller Shaft market report covers Executive Summary, Market Dynamics, Trend Analysis, Market Size and Forecast, Competitive Intelligence, Market Positioning, Product Benchmarking, and Opportunity Analysis.

The report covers extensive competitive intelligence which include the following data points:

- Business Overview

- Business Model

- Financial Data

- Financial – Existing

- Financial – Funding

- Product Segment Analysis and specification

- Recent Development and Company Strategy Analysis

- SWOT Analysis

The report covers market sizing and forecasting at the country level as well as at the segment level. The Market is analyzed across below-mentioned different segments:

| AXLE TYPE | VEHICLE TYPE | PROPELLER SHAFT TYPE | SALES CHANNEL |

|---|---|---|---|

| Dead Axle | Two Wheeler | Single Piece | OEM |

| Live Axle | Passenger Cars | Multi Piece | Aftermarket |

| Tandem Axle | Commercial Vehicles |

Automotive Axle & Propeller Shaft Market is also analyzed across below-mentioned regions/countries

The some of the key players in of Automotive Axle & Propeller Shaft Market include:

- Friedrichshafen AG

- GKN PLC

- Dana Incorporated

- American Axle & Manufacturing Holdings, Inc.

- Meritor, Inc.

- Showa Corporation

- Hyundai Wia Corporation

- Gestamp

- JTEKT Corporation

- IFA Rotorion

REPORT CONTENT BRIEF:

- High level analysis of the current and future market trends and opportunities

- Detailed analysis on current market drivers, restraining factors, and opportunities in the future

- Historic market size for year 2019, market estimates for 2020 and forecast from 2020 to 2027

- Vendor market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations and partnerships as well as funding taken and investment done, among others