Feed Enzymes Market Overview

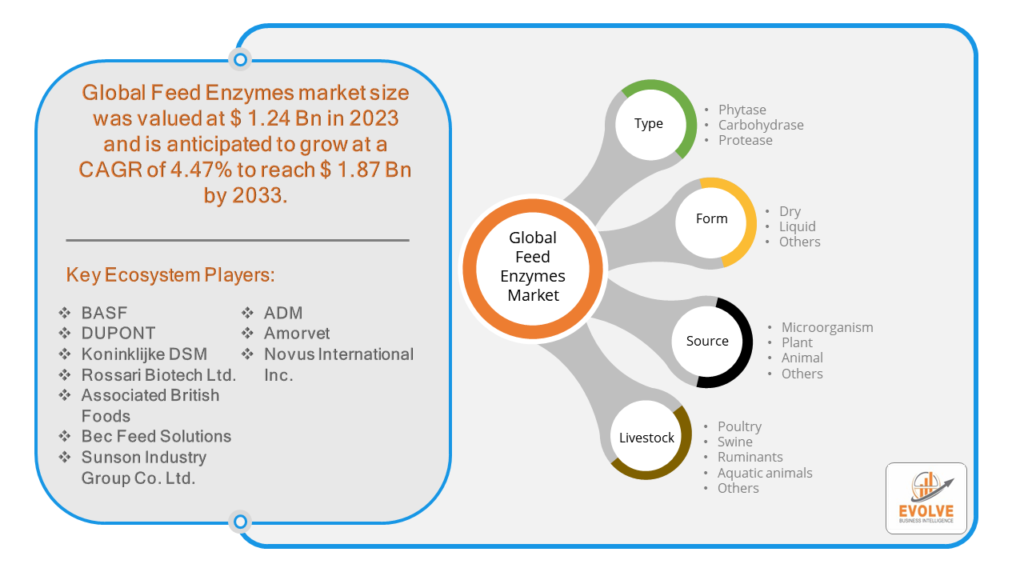

The Feed Enzymes market Size is expected to reach USD 1.87 Billion by 2033. The Feed Enzymes market industry size accounted for USD 1.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.47% from 2023 to 2033. The Feed Enzymes market refers to the global industry involved in the production, distribution, and sale of enzymes used as feed additives in animal nutrition. Feed enzymes are natural proteins that catalyze biochemical reactions in the digestive systems of animals, aiding in the breakdown of complex nutrients such as carbohydrates, proteins, and lipids, into simpler forms that are more easily absorbed by the animal’s body. These enzymes are commonly added to animal feed to enhance feed efficiency, improve nutrient utilization, promote animal growth, and reduce environmental pollution through decreased excretion of undigested nutrients.

Key Factors driving the growth of the Feed Enzymes market include increasing demand for meat and dairy products, rising awareness about animal health and nutrition, advancements in enzyme technology, and growing concerns regarding feed efficiency and sustainability in animal production. The market is influenced by factors such as feed industry regulations, consumer preferences, economic conditions, and technological developments.

Global Feed Enzymes market Synopsis

The COVID-19 pandemic had significant impacts on the Feed Enzymes market. During the initial phases of the pandemic, the feed industry experienced disruptions in the supply chain due to lockdowns, travel restrictions, and workforce shortages. This led to delays in the production and distribution of feed enzymes, affecting the availability of these additives for animal nutrition. The pandemic has caused fluctuations in demand for meat and dairy products, as well as changes in consumer preferences towards more sustainable and healthy food options. This has influenced the demand for feed enzymes, as producers adjust their animal diets to optimize nutrient utilization and improve feed efficiency in response to market dynamics. The pandemic has accelerated the adoption of digital technologies and automation in agriculture, including feed production and animal management. This could drive increased demand for enzyme products that offer improved efficiency, consistency, and cost-effectiveness in feed formulations.

Feed Enzymes Market Dynamics

The major factors that have impacted the growth of Feed Enzymes market are as follows:

Drivers:

Ø Growing Demand for Animal Protein

As global populations increase and incomes rise, there is a corresponding increase in the demand for animal protein such as meat, eggs, and dairy products. This surge in demand necessitates efficient and sustainable methods of livestock production, driving the need for feed enzymes to optimize nutrient utilization and improve feed efficiency. There is a growing awareness among livestock producers about the importance of animal health and nutrition in optimizing productivity and profitability. Feed enzymes play a crucial role in enhancing digestive health, reducing gut inflammation, and improving nutrient absorption in animals, thereby promoting overall health and well-being. Ongoing research and development efforts in biotechnology and enzyme engineering have led to significant advancements in enzyme technology. This has resulted in the development of more potent, stable, and cost-effective feed enzyme products with enhanced efficacy and versatility, driving adoption and market expansion.

Restraint:

- Perception of Risk and Uncertainty

Some livestock producers may perceive feed enzymes as novel or unfamiliar additives, raising concerns about potential risks, side effects, or unknown long-term consequences. Uncertainty about the safety, efficacy, and reliability of enzyme products may lead to hesitancy or resistance to adoption, particularly among risk-averse stakeholders. The Feed Enzymes market is characterized by a high degree of fragmentation and intense competition among manufacturers, suppliers, and distributors. This competitive landscape can result in pricing pressures, reduced profit margins, and challenges in building brand recognition and market share, especially for smaller players.

Opportunity:

⮚ Increasing Demand for Animal Protein

The rising global population, coupled with growing incomes and changing dietary preferences, is driving increased demand for animal protein such as meat, eggs, and dairy products. This creates a significant opportunity for feed enzymes, as they play a crucial role in optimizing nutrient utilization and feed efficiency in livestock production systems, thereby supporting the sustainable growth of the animal protein industry. There is a growing emphasis on sustainability and environmental stewardship within the agriculture and livestock sectors. Feed enzymes offer tangible benefits in terms of improving feed efficiency, reducing nutrient waste, and minimizing the environmental footprint of livestock production. This aligns with the sustainability goals of livestock producers, retailers, and consumers, creating opportunities for market expansion.

Feed Enzymes market Segment Overview

By Type

By Livestock

Based on Livestock, the market has been divided into the Swine, Poultry, Ruminants, Aquatic Animals and Others. The Swine segment dominated the market. Genetic and technological advancements can absorb numerous nutrients not digested in swine production. Animal feed frequently uses feed enzymes to break down protein and make digestion easier. The demand for animal feed enzymes will probably increase as swine production keeps rising, and implants for Feed Enzymes positively impact the market growth.

By Form

Based on Form, the market has been divided into the Dry, Liquid and Others. The Dry segment dominated the market. Due to their straightforward and practical use, enzymes in the dry formulation have emerged as a crucial format in the animal feed industry. It has greater thermal stability and can withstand the temperature during fodder processing. Using dry-form animal feed enzymes has several benefits, including straightforward handling, spill-free storage, and easy transportation.

By Source

Based on Source, the market has been divided into the Microorganism, Plant, Animal and Others. Some feed enzymes are derived from plants and plant-based sources. While less common than microorganism-derived enzymes, plant-derived enzymes offer specific benefits in animal nutrition

Global Feed Enzymes market Regional Analysis

Based on region, the global Feed Enzymes market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Feed Enzymes market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Feed Enzymes market. North America is a significant market for feed enzymes, driven by the presence of large-scale livestock production operations, particularly in the United States and Canada. The region’s advanced agricultural practices, stringent regulations on animal nutrition and welfare, and increasing demand for high-quality animal protein contribute to the adoption of feed enzyme products.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Feed Enzymes market industry. The Asia-Pacific region represents one of the fastest-growing markets for feed enzymes, driven by rapid urbanization, population growth, and rising incomes leading to increased consumption of animal protein. Countries such as China, India, Japan, and Southeast Asian nations have large and diverse livestock industries, with a growing demand for feed additives to enhance feed efficiency and productivity. Aquaculture is a particularly important segment in this region, driving demand for enzymes tailored to the nutritional needs of aquatic species.

Competitive Landscape

The global Feed Enzymes market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- BASF

- DUPONT

- Koninklijke DSM

- Rossari Biotech Ltd.

- Associated British Foods

- Bec Feed Solutions

- Sunson Industry Group Co. Ltd.

- ADM

- Amorvet

- Novus International Inc.

Key Development

In November 2022, Novozymes, the world leader in biological solutions, and Linus Bio (Linus Biotechnology Inc.), a leader in precision exposome sequencing, announced the companies are forming a collaboration to test a new, non-invasive technology in a clinical trial.

In November 2022, Novozymes launched the first enzymatic corn separation solution ever, revolutionizing the industry by allowing starch manufacturers to run their corn mills in a more efficient way which is not possible with mechanical separation only.

Scope of the Report

Global Feed Enzymes Market, by Type

- Protease

- Phytase

- Others

Global Feed Enzymes market, by Livestock

- Swine

- Poultry

- Ruminants

- Aquatic Animals

- Others

Global Feed Enzymes market, by Form

- Dry

- Liquid

- Others

Global Feed Enzymes market, by Source

- Microorganism

- Plant

- Animal

- Others

Global Feed Enzymes market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $1.87 Billion |

| CAGR | 4.47% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Livestock, Form, Source |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF, DUPONT, Koninklijke DSM,Rossari Biotech Ltd., Associated British Foods, Bec Feed Solutions, Sunson Industry Group Co. Ltd., ADM, Amorvet, Novus International Inc. |

| Key Market Opportunities | • Increasing Demand for Animal Protein • Focus on Sustainable Agriculture |

| Key Market Drivers | • Growing Demand for Animal Protein • Advancements in Enzyme Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Feed Enzymes market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Feed Enzymes market historical market size for the year 2021, and forecast from 2023 to 2033

- Feed Enzymes market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Feed Enzymes market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

2. What is the growth rate of the global Feed Enzymes market?

- The global Feed Enzymes market is growing at a CAGR of 4.41% over the next 10 years

3. Which region has the highest growth rate in the market of Feed Enzymes market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4. Which region has the largest share of the global Feed Enzymes market?

- North America holds the largest share in 2022

5. Who are the key players in the global Feed Enzymes market?

BASF, DUPONT, Koninklijke DSM,Rossari Biotech Ltd., Associated British Foods, Bec Feed Solutions, Sunson Industry Group Co. Ltd., ADM, Amorvet and Novus International Inc. are the major companies operating in the market

6. Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7. Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.