Price range: $ 1,390.00 through $ 5,520.00

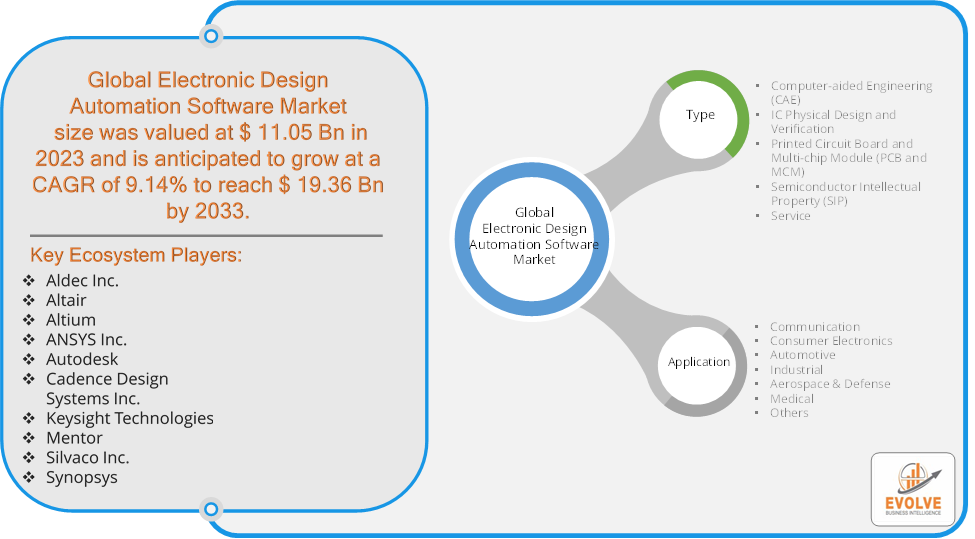

Electronic Design Automation Software Market Research Report: Information By Type (Computer-aided Engineering (CAE), IC Physical Design and Verification, Printed Circuit Board and Multi-chip Module (PCB and MCM), Semiconductor Intellectual Property (SIP), Service), By Application (Communication, Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Medical, Others), and by Region — Forecast till 2033

Page: 165

Description

Electronic Design Automation Software Market Overview

The Electronic Design Automation Software Market Size is expected to reach USD 19.36 Billion by 2033. The Electronic Design Automation Software Market industry size accounted for USD 11.05 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.14% from 2023 to 2033. The Electronic Design Automation (EDA) Software Market refers to the industry surrounding the development, distribution, and use of software tools that assist engineers in the design, analysis, and verification of electronic systems and components. EDA software is essential for designing complex electronics, such as integrated circuits (ICs), printed circuit boards (PCBs), and systems on chips (SoCs).

The EDA Software Market is crucial for enabling innovation and development in the electronics industry, supporting the creation of increasingly sophisticated electronic devices.

Global Electronic Design Automation Software Market Synopsis

The COVID-19 pandemic had significant impacts on the Electronic Design Automation (EDA) Software Market. The pandemic led to a surge in demand for electronics, driven by remote work, online education, and increased consumer spending on home entertainment. This, in turn, boosted the need for EDA tools to design and develop new electronic products. The shift towards digital platforms and the need for advanced technological solutions accelerated the adoption of EDA software. Companies invested in digital tools to maintain continuity in product development during lockdowns. The pandemic underscored the importance of remote collaboration, leading to increased adoption of cloud-based EDA tools. These tools allowed design teams to work together from different locations, ensuring project continuity. The pandemic disrupted global supply chains, affecting the production of semiconductors and other electronic components. This had a ripple effect on the EDA market, as delays in component availability slowed down design and development timelines.

Electronic Design Automation Software Market Dynamics

The major factors that have impacted the growth of Electronic Design Automation Software Market are as follows:

Drivers:

Ø Rise of Emerging Technologies

The emergence of technologies such as 5G, artificial intelligence (AI), the Internet of Things (IoT), and autonomous vehicles is pushing the boundaries of electronic design. EDA tools are crucial for developing the complex electronics that power these technologies, driving growth in the market. The integration of AI and machine learning into EDA tools is transforming the design process by automating repetitive tasks, improving accuracy, and reducing time to market. This shift towards automation enhances the efficiency of electronic design, making EDA tools increasingly attractive to companies.

Restraint:

- Perception of High Cost of EDA Tools and Complexity

EDA software tools are often expensive, particularly for small and medium-sized enterprises (SMEs). The high cost of acquiring and maintaining these tools can be a significant barrier for companies with limited budgets, restricting market penetration and adoption. The complexity of EDA tools can be daunting for new users. Engineers and designers require extensive training and experience to effectively use these tools, which can slow down adoption, especially in companies with limited expertise. The steep learning curve can also lead to productivity issues during the initial implementation phase.

Opportunity:

⮚ Growth in 5G and IoT

The rapid expansion of 5G technology and the Internet of Things (IoT) creates a substantial demand for advanced electronic designs. EDA tools are essential for developing the complex semiconductor components and circuits required for 5G and IoT devices. This presents an opportunity for EDA software providers to cater to the growing needs of these markets, particularly in areas like RF design, signal integrity, and power management. The automotive industry is undergoing a significant transformation with the rise of electric vehicles (EVs), autonomous driving, and advanced driver-assistance systems (ADAS). These trends are driving demand for sophisticated electronics and semiconductor components, creating opportunities for EDA software providers to develop tools tailored to automotive applications, such as functional safety verification, power electronics design, and sensor integration.

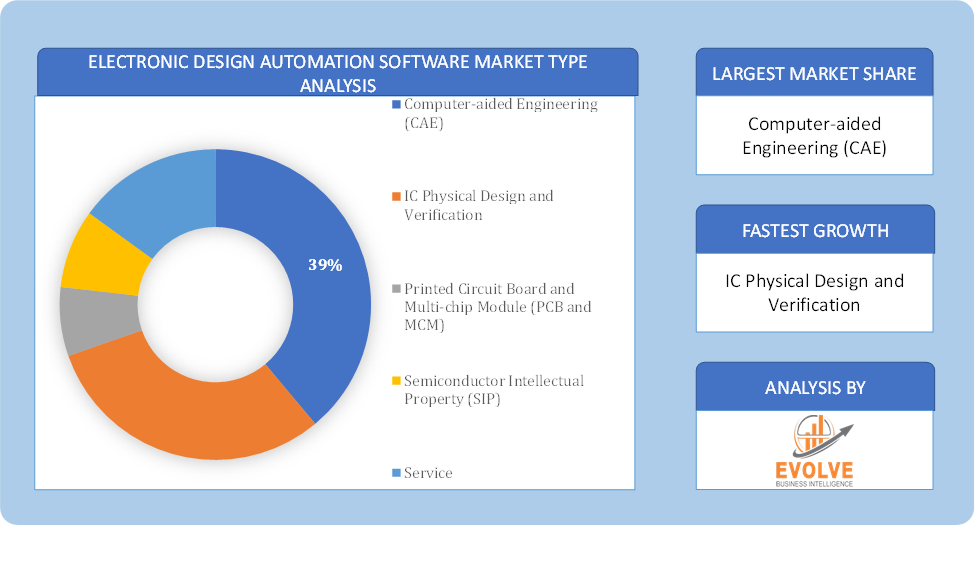

Electronic Design Automation Software Market Segment Overview

Based on Type, the market is segmented based on Computer-aided Engineering (CAE), IC Physical Design and Verification, Printed Circuit Board and Multi-chip Module (PCB and MCM), Semiconductor Intellectual Property (SIP) and Service. The semiconductor intellectual property (SIP) segment dominant the market. SIP typically consists of a reusable design or testbench module. Often referred to as a virtual component. IP is a vast category of legally recognized textual and electronic material belonging to a single entity.

By Application

Based on Application, the market segment has been divided into Communication, Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Medical and Others. The consumer electronics dominant the market. Consumer electronics is one of the key market sectors for EDA software. Consumer electronics include various electronic products, including intelligent wearables, cameras, video players, tv, radios, and air conditioners. From digital cameras to portable media players, the consumer electronics market is transforming how we share and communicate digital media.

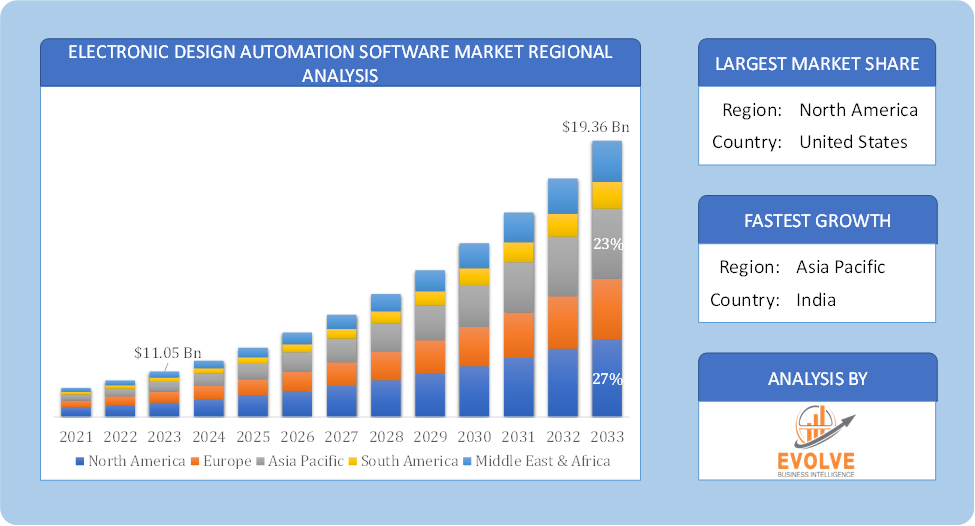

Global Electronic Design Automation Software Market Regional Analysis

Based on region, the global Electronic Design Automation Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Electronic Design Automation Software Market followed by the Asia-Pacific and Europe regions.

Electronic Design Automation Software North America Market

Electronic Design Automation Software North America Market

North America holds a dominant position in the Electronic Design Automation Software Market. North America, particularly the United States, is a dominant player in the EDA Software Market. The region is home to some of the largest semiconductor companies, technology firms, and EDA tool providers, such as Cadence Design Systems, Synopsys, and Mentor Graphics (a Siemens company) and the U.S. is a global leader in technology innovation, with significant investments in R&D. The presence of top-tier universities and research institutions also contributes to the development and adoption of advanced EDA tools.

Electronic Design Automation Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Electronic Design Automation Software Market industry. Asia-Pacific is one of the fastest-growing regions in the EDA Software Market, driven by the booming electronics manufacturing sector, particularly in countries like China, Japan, South Korea, and Taiwan and countries like China and India are increasingly investing in R&D, supported by government initiatives to boost domestic semiconductor capabilities. This is creating new opportunities for EDA software providers in the region.

Competitive Landscape

The global Electronic Design Automation Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Aldec Inc.

- Altair

- Altium

- ANSYS Inc.

- Autodesk

- Cadence Design Systems Inc.

- Keysight Technologies

- Mentor

- Silvaco Inc.

- Synopsys

Key Development

In February 2023: Ansys has extended its partnership with Microsoft, aiming to broaden the accessibility of its simulation solutions through integration with the Microsoft Azure cloud-computing platform. This strategic expansion of collaboration seeks to leverage the capabilities of Azure to make Ansys’ simulation tools more widely available to users across various industries.

In January 2023: Siemens AG has introduced Questa, an advanced verification IQ software designed to address the intricate challenges posed by the increasing complexity of integrated circuits (ICs) in the field of logic verification. This software offers a robust solution for logic verification teams, empowering them to effectively navigate and conquer the intricacies that arise during the design process of modern ICs.

Scope of the Report

Global Electronic Design Automation Software Market, by Type

- Computer-aided Engineering (CAE)

- IC Physical Design and Verification

- Printed Circuit Board and Multi-chip Module (PCB and MCM)

- Semiconductor Intellectual Property (SIP)

- Service

Global Electronic Design Automation Software Market, by Application

- Communication

- Consumer Electronics

- Automotive

- Industrial

- Aerospace & Defense

- Medical

- Others

Global Electronic Design Automation Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 19.36 Billion |

| CAGR (2023-2033) | 9.14% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Aldec Inc, Altair, Altium, ANSYS Inc., Autodesk, Cadence Design Systems Inc., Keysight Technologies, Mentor, Silvaco Inc. and Synopsys |

| Key Market Opportunities | · Growth in 5G and IoT

· Opportunities in Automotive Electronics |

| Key Market Drivers | · Rise of Emerging Technologies

· Shift Towards Automation and AI in Design |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Electronic Design Automation Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Electronic Design Automation Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Electronic Design Automation Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Electronic Design Automation Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Electronic Design Automation Software Market?

The global Electronic Design Automation Software Market is growing at a CAGR of 9.14% over the next 10 years

Which region has the highest growth rate in the market of Electronic Design Automation Software Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Electronic Design Automation Software Market?

North America holds the largest share in 2022

Who are the key players in the global Electronic Design Automation Software market?

Aldec Inc., Altair, Altium, ANSYS Inc., Autodesk, Cadence Design Systems Inc., Keysight Technologies, Mentor, Silvaco Inc. and Synopsys

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|

Table of Content

[html_block id="8143"]