E-commerce Packaging Market Overview

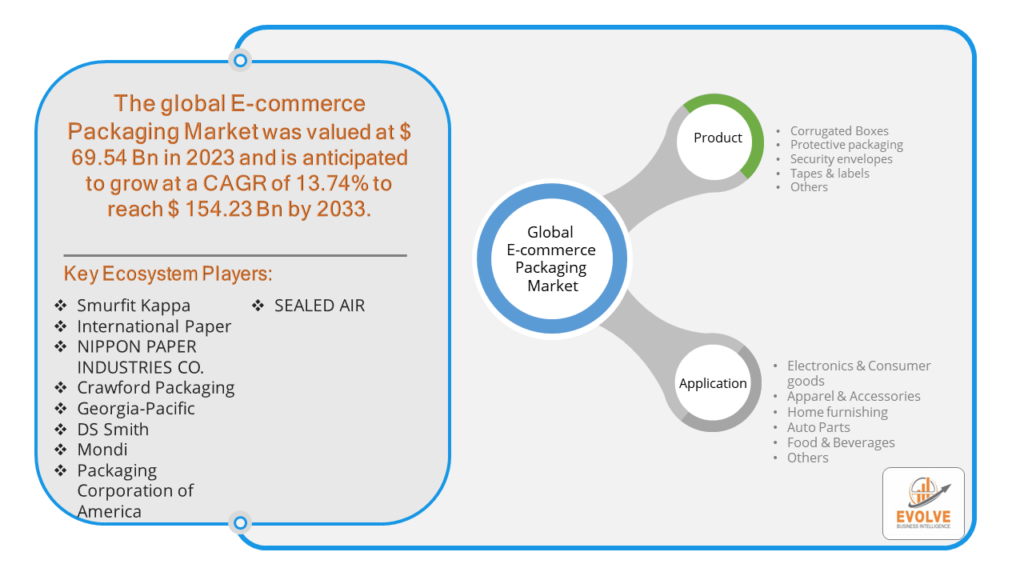

The E-commerce Packaging Market Size is expected to reach USD 154.23 Billion by 2033. The E-commerce Packaging industry size accounted for USD 69.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 13.74% from 2023 to 2033. The e-commerce packaging market refers to the production and distribution of packaging materials specifically designed for shipping products bought online. It includes a wide range of materials such as cardboard boxes, bubble mailers, protective wraps, and tape, tailored to ensure safe transit and presentable delivery of goods. With the growth of online shopping, the demand for sustainable, cost-effective, and secure packaging solutions has surged. This market also encompasses innovations in design to reduce environmental impact, improve efficiency in shipping, and enhance customer experience through branded packaging solutions.

Global E-commerce Packaging Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the E-commerce Packaging market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

E-commerce Packaging Market Dynamics

The major factors that have impacted the growth of E-commerce Packaging are as follows:

Drivers:

Ø Technological Advancements

Innovations in packaging technology have enabled the development of lightweight yet durable materials that offer enhanced protection during shipping. Advanced packaging solutions also contribute to reducing logistics costs and improving operational efficiencies for e-commerce businesses.

Restraint:

- Regulatory Compliance

Meeting diverse regulatory requirements across different regions and countries adds complexity to e-commerce packaging. Regulations related to materials, labeling, product safety, and environmental standards vary significantly, requiring companies to invest in compliance measures and adapt packaging strategies accordingly.

Opportunity:

⮚ Technological Innovations

Advances in packaging technology, such as smart packaging solutions and anti-counterfeiting measures, present opportunities to enhance product security, track shipments in real-time, and improve overall customer satisfaction. Integrating technologies like QR codes, RFID tags, and augmented reality (AR) enhances transparency and engagement throughout the supply chain.

E-commerce Packaging Segment Overview

By Product

By Application

Based on Applications, the market has been divided into the Electronics & Consumer goods, Apparel & Accessories, Home furnishing, Auto Parts, Food & Beverages, Others. In the E-commerce Packaging market, Electronics & Consumer goods segment holds a significant share due to the rise in online purchases of gadgets and household electronics. Apparel & Accessories follow closely, driven by the increasing trend of online fashion retailing and accessories sales.

Global E-commerce Packaging Market Regional Analysis

Based on region, the global E-commerce Packaging market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Asia-Pacific is projected to dominate the use of the E-commerce Packaging market followed by the North America and Europe regions.

Asia-Pacific holds a dominant position in the E-commerce Packaging Market. In fact, Asia Pacific has become the world’s largest retail e-commerce packaging market, and the e-commerce industry in the region is expanding quickly. The region’s sizable and expanding population is one of the main factors, offering a sizable market for e-commerce businesses. Furthermore, the region’s internet penetration rates have increased quickly, making it simpler for customers to shop online. The demand for e-commerce packaging solutions that can safeguard goods throughout transportation and give customers a satisfying unboxing experience will rise as the Asia Pacific region’s e-commerce industry expands.

E-commerce Packaging North America Market

The North America region has indeed emerged as the fastest-growing market for the E-commerce Packaging industry. From 2023 to 2030, North America is predicted to have the fastest compound annual growth rate (CAGR) in the retail e-commerce packaging market. The growing popularity of online shopping, the adoption of e-commerce and m-commerce platforms, and the need for environmentally friendly packaging solutions are the main drivers of the North American e-commerce packaging industry. Furthermore, the retail e-commerce packaging market in the United States had the most market share, while the retail e-commerce packaging market in Canada had the highest rate of growth on the North American continent.

Competitive Landscape

The global E-commerce Packaging market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Smurfit Kappa

- International Paper

- NIPPON PAPER INDUSTRIES CO.

- Crawford Packaging

- Georgia-Pacific

- DS Smith

- Mondi

- Packaging Corporation of America

- SEALED AIR

Key Development

August 2023: Packaging Corporation of America (PCA), a leading provider of packaging solutions, announced that it has partnered with e-commerce company Target to develop a new e-commerce packaging solution that is designed to be both secure and convenient. The new solution is made from durable materials and features an easy-to-open design.

Scope of the Report

Global E-commerce Packaging Market, by Product

- Corrugated Boxes

- Protective packaging

- Security envelopes

- Tapes & labels

- Others

Global E-commerce Packaging Market, by Application

- Electronics & Consumer goods

- Apparel & Accessories

- Home furnishing

- Auto Parts

- Food & Beverages

- Others

Global E-commerce Packaging Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $154.23 Billion/strong> |

| CAGR | 13.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Smurfit Kappa, International Paper, NIPPON PAPER INDUSTRIES CO., Crawford Packaging, Georgia-Pacific, DS Smith, Company 7, Mondi, Packaging Corporation of America, SEALED AIR |

| Key Market Opportunities | • Growing Demand For Protective Packaging Increase In Disposable Income Of Developing Countries |

| Key Market Drivers | • Increase In Online Shopping Market Growing Demand Of Packaged Food Rapid Growth In Electronic Sector |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future E-commerce Packaging market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- E-commerce Packaging market historical market size for the year 2021, and forecast from 2023 to 2033

- E-commerce Packaging market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global E-commerce Packaging market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

2. What is the growth rate of the global E-commerce Packaging market?

- The global E-commerce Packaging market is growing at a CAGR of 13.74% over the next 10 years

3. Which region has the highest growth rate in the market of E-commerce Packaging?

- North America is expected to register the highest CAGR during 2023-2033

4. Which region has the largest share of the global E-commerce Packaging market?

- Asia Pacific holds the largest share in 2022

5. Who are the key players in the global E-commerce Packaging market?

Smurfit Kappa, International Paper, NIPPON PAPER INDUSTRIES CO., Crawford Packaging, Georgia-Pacific, DS Smith, Company 7, Mondi, Packaging Corporation of America, and SEALED AIR are the major companies operating in the market

6. Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7. Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.