Debt Collection Software Market Overview

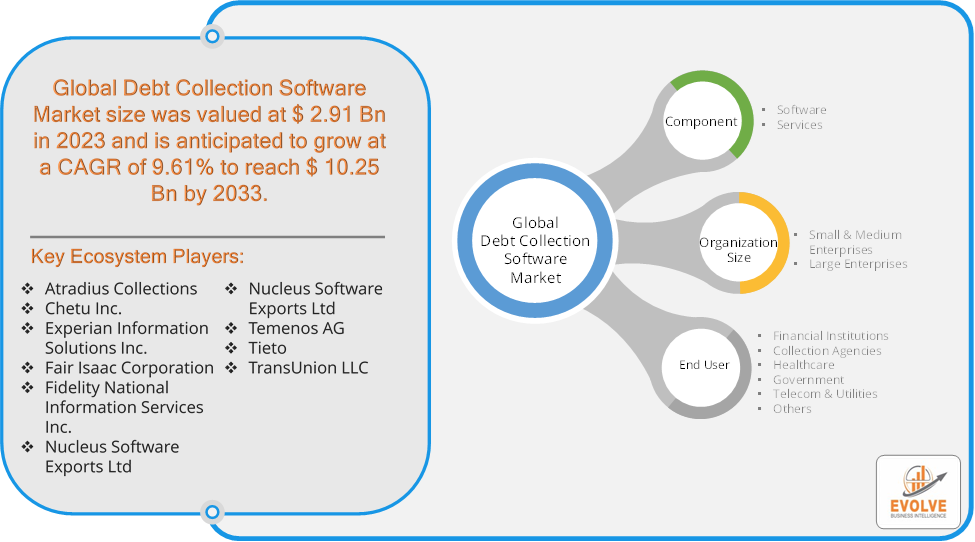

The Debt Collection Software Market Size is expected to reach USD 10.25 Billion by 2033. The Debt Collection Software Market industry size accounted for USD 2.61 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.61% from 2023 to 2033. The Debt Collection Software Market involves software solutions designed to assist businesses and organizations in managing and automating the process of collecting overdue debts from customers. These software applications help organizations, such as financial institutions, collection agencies, and healthcare providers, to efficiently manage their debt portfolios and increase their collection rates.

The market for debt collection software is driven by the need for efficient debt recovery processes, improved cash flow management, and reduced administrative costs. It serves various industries, including financial services, healthcare, utilities, and retail.

Global Debt Collection Software Market Synopsis

The COVID-19 pandemic had a significant impact on the Debt Collection Software Market. With physical offices closed and remote work becoming the norm, businesses needed digital solutions to manage debt collection processes. This led to a surge in demand for debt collection software that supports remote operations and automation. The pandemic introduced new regulations and guidelines for debt collection, such as temporary bans on debt collections and requirements for more transparent communication with debtors. Software vendors had to ensure their solutions complied with these evolving regulations. The need for better analytics and reporting tools grew as businesses sought to understand the impact of the pandemic on their debt portfolios. Debt collection software with advanced reporting capabilities became more valuable for tracking performance and making data-driven decisions.

Debt Collection Software Market Dynamics

The major factors that have impacted the growth of Debt Collection Software Market are as follows:

Drivers:

Ø Technological Advancements

Innovations such as artificial intelligence (AI), machine learning, and big data analytics are enhancing debt collection software. These technologies improve predictive analytics, customer segmentation, and collection strategies, driving market growth. Effective debt collection is crucial for maintaining healthy cash flow. Businesses are investing in software solutions to ensure timely recovery of outstanding debts and maintain financial stability. Modern debt collection software emphasizes a customer-centric approach, improving communication and interaction with debtors. Solutions that offer personalized communication and payment options are gaining popularity.

Restraint:

- Perception of High Implementation Costs and Data Security

The initial cost of purchasing and implementing debt collection software, including licensing fees, customization, and training, can be substantial. This can be a barrier for smaller organizations or those with limited budgets. Handling sensitive financial data raises concerns about data security and privacy. Organizations need to ensure that the software complies with data protection regulations and has robust security measures to prevent breaches.

Opportunity:

⮚ Growth of Cloud-Based Solutions

The increasing adoption of cloud-based solutions provides opportunities for vendors to offer scalable, flexible, and cost-effective debt collection software. Cloud solutions also facilitate remote access and integration with other cloud-based systems. Enhanced data analytics capabilities can provide valuable insights into debt collection performance, debtor behavior, and market trends. Leveraging big data analytics can help organizations make more informed decisions and optimize their collection strategies.

Debt Collection Software Market Segment Overview

Based on Component, the market is segmented based on Component Software and Services. The software segment dominant the market. Debt collection is a procedure that can be amicable or legal, and debt collection software is a solution that encompasses all steps of this process. This software represents the whole data set and operational plans of the debt recovery program, including the application programming interface (API). The popularity of web-based tools for debt collection has expanded dramatically, allowing for real-time account portfolio monitoring.

By Organization Size

Based on Organization Size, the market segment has been divided into Small & Medium Enterprises and Large Enterprises. The large enterprise segment dominant the market. Large companies use commercial debt collection tools. Large firms with significant spending power can quickly develop technology; thus, the software is likely to be accepted. Due to improved infrastructure, these firms can analyze enormous volumes of data and convey the results by mail, email, phone, and in-person.

By End User

Based on End Users, the market segment has been divided into Financial Institutions, Collection Agencies, Healthcare, Government, Telecom & Utilities and Others. The healthcare segment dominant the market. Bad debt has hampered healthcare’s expansion. Bad debt can hinder business and service flow owing to a lack of funds, which might influence industry revenue growth. The healthcare business adopts debt collection software to streamline payment processes. In the healthcare industry, medical debt collection is recovering bad debts and outstanding medical bills from past or present patients. Increased patient cost-sharing and bad debt in healthcare will increase debt collection software use.

Global Debt Collection Software Market Regional Analysis

Based on region, the global Debt Collection Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Debt Collection Software Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Debt Collection Software Market. North America, particularly the United States, is the largest and most mature market for debt collection software. There is significant demand for advanced analytics, cloud-based solutions, and AI-driven software. The market is mature with high competition among vendors and strict regulations such as the Fair Debt Collection Practices Act (FDCPA) drive demand for compliance-focused software solutions.

Debt Collection Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Debt Collection Software Market industry. The Asia-Pacific region is one of the fastest-growing markets for debt collection software, driven by economic growth, rising consumer debt, and the increasing adoption of technology. Growing adoption of cloud-based and mobile solutions, increasing focus on automation and AI, and rising demand in emerging markets.

Competitive Landscape

The global Debt Collection Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Atradius Collections

- Chetu Inc.

- Experian Information Solutions Inc.

- Fair Isaac Corporation

- Fidelity National Information Services Inc.

- Nucleus Software Exports Ltd

- Nucleus Software Exports Ltd

- Temenos AG

- Tieto

- TransUnion LLC.

Key Development

In January 2023, FPG Technologies and global analytics software supplier FICO partnered to offer decision management & analytics capabilities to businesses in West Africa.

In August 2022, ANZ Bank New Zealand chose FIS, a pioneer in financial technology, to upgrade its fundamental banking capabilities. Through a cloud-native architecture, FIS’ Modern Banking Platform makes it possible for digital banking services to be simple and convenient.

Scope of the Report

Global Debt Collection Software Market, by Component

- Software

- Services

Global Debt Collection Software Market, by Organization Size

- Small & Medium Enterprises

- Large Enterprises

Global Debt Collection Software Market, by End User

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom & Utilities

- Others

Global Debt Collection Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 10.25 Billion |

| CAGR (2023-2033) | 9.61% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Organization Size, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Atradius Collections, Chetu Inc., Experian Information Solutions, Inc., Fair Isaac Corporation, Fidelity National Information Services, Inc., Nucleus Software Exports Ltd, Nucleus Software Exports Ltd, Temenos AG, Tieto and TransUnion LLC. |

| Key Market Opportunities | · Growth of Cloud-Based Solutions

· Advancements in Data Analytics |

| Key Market Drivers | · Technological Advancements

· Need for Improved Cash Flow Management |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Debt Collection Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Debt Collection Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Debt Collection Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Debt Collection Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Debt Collection Software Market?

The global Debt Collection Software Market is growing at a CAGR of 9.61% over the next 10 years

Which region has the highest growth rate in the market of Debt Collection Software Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Debt Collection Software Market?

North America holds the largest share in 2022

Who are the key players in the global Debt Collection Software Market?

Atradius Collections, Chetu Inc., Experian Information Solutions Inc., Fair Isaac Corporation, Fidelity National Information Services Inc., Nucleus Software Exports Ltd, Nucleus Software Exports Ltd, Temenos AG, Tieto and TransUnion LLC. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.