Construction Equipment Market Overview

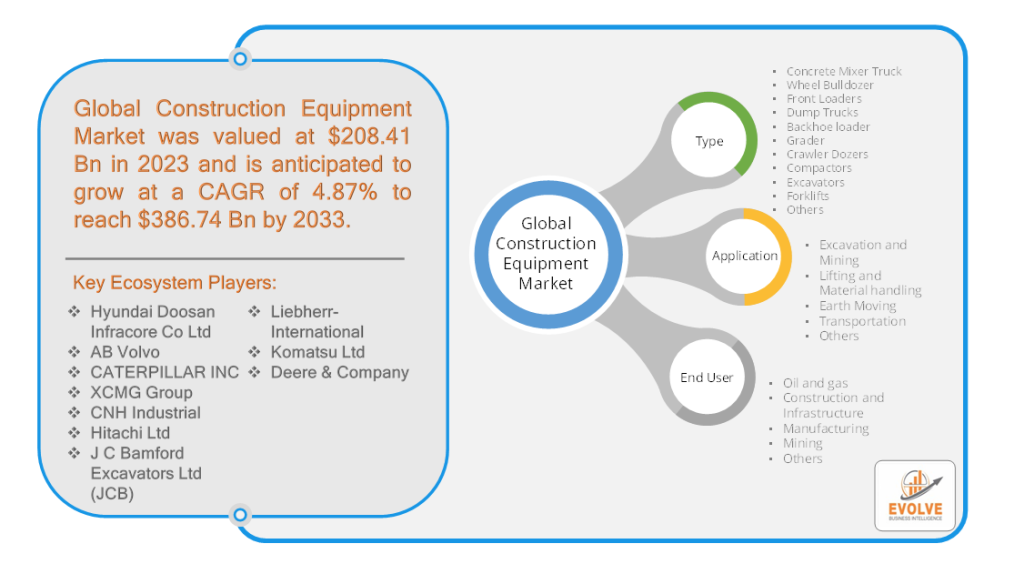

Construction Equipment Market Size is expected to reach USD 386.74 Billion by 2033. The Construction Equipment industry size accounted for USD 208.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.87% from 2023 to 2033. Construction equipment refers to a broad category of machinery, tools, and vehicles used in the construction industry for various tasks and operations related to building, infrastructure development, and maintenance. These equipment are specifically designed to perform heavy-duty tasks, increase efficiency, and enhance productivity in construction projects. Construction equipment can vary widely in size, complexity, and purpose, depending on the specific construction activity and the scale of the project.

Global Construction Equipment Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the Construction Equipment market. Initially, many construction projects were halted or delayed due to lockdown measures, travel restrictions, and supply chain disruptions. This led to a decline in demand for construction equipment as construction activities came to a standstill in many regions. The pandemic also affected the manufacturing and production of construction equipment. With factories shutting down or operating at reduced capacity, there were disruptions in the supply of components and parts, leading to delays in equipment delivery and increased costs.

Furthermore, the uncertainty caused by the pandemic led to a decline in investments in new construction projects, which further impacted the demand for construction equipment. Many construction companies faced financial challenges and were hesitant to invest in new equipment or expand their fleets. However, as restrictions eased and construction activities resumed, there was a gradual recovery in the construction equipment market. Governments implemented stimulus packages and infrastructure development plans to stimulate economic growth, which helped drive demand for construction equipment. Additionally, the pandemic highlighted the importance of automation and digitization in the construction industry. Construction companies started adopting technologies such as remote monitoring, telematics, and autonomous machinery to minimize human contact, improve efficiency, and enhance safety on construction sites.

Global Construction Equipment Market Dynamics

The major factors that have impacted the growth of Construction Equipment are as follows:

Drivers

⮚ Infrastructure Development

The demand for construction equipment is closely tied to infrastructure development projects, including the construction of roads, bridges, airports, and buildings. Governments and private sectors recognize the critical role of infrastructure in supporting economic growth, improving transportation systems, and enhancing the overall quality of life. Investments in infrastructure by governments and private sectors create a sustained demand for construction equipment. Governments allocate significant budgets to infrastructure development, aiming to address transportation challenges, enhance connectivity, and stimulate economic activity. These investments drive the need for various types of construction equipment, such as excavators, bulldozers, loaders, cranes, and concrete mixers, to efficiently carry out the construction and maintenance of infrastructure projects.

Restraint:

- Volatility in Raw Material Prices

Volatility in Raw Material Prices: Fluctuations in raw material prices, such as steel, rubber, and fuel, can significantly impact the manufacturing and production costs of construction equipment. These price fluctuations can pose a challenge for equipment manufacturers in terms of cost management and profitability.

Opportunity:

Adoption of Green Construction Equipment

The growing focus on environmental sustainability presents an opportunity for the construction equipment market. There is an increasing demand for eco-friendly and energy-efficient construction equipment that minimizes emissions and reduces the environmental impact of construction activities. Manufacturers who develop and offer greener equipment have the potential to capture a niche market and gain a competitive advantage.

Construction Equipment Market Segment Overview

By Type

Based on the Type, the market is segmented based Concrete Mixer Truck, Wheel Bulldozer, Front Loaders, Dump Trucks, Backhoe loaders, Grader, Crawler Dozers, Compactors, Excavators, Forklifts, and Others. The largest market share is anticipated to go to the Excavators segment. Excavators are versatile and essential equipment used in a wide range of construction activities, such as digging, trenching, material handling, and demolition. They offer high power and efficiency, making them suitable for various construction projects.

By Application

Based on Application, the market has been divided into Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, and Others. The Lifting and Material handling segment is expected to hold the largest market share in the Market, due to infrastructure development projects requiring the use of lifting equipment for tasks such as moving heavy materials and construction components. The segment finds extensive applications in industrial and warehouse settings, where material-handling equipment like forklifts are essential for efficient operations. Additionally, the growth of e-commerce and logistics industries has increased the demand for material handling equipment. Furthermore, technological advancements, such as automation and digitization, have improved the efficiency and safety of lifting and material handling equipment, driving their adoption in various industries.

By End User

Based on End User, the market has been divided into Oil and gas, Construction and Infrastructure, Manufacturing, Mining, and Others. The market is projected to see significant growth in the Construction and Infrastructure segment. This growth is driven by increasing investments in construction and infrastructure projects, both by governments and private sectors, to support economic growth, address urbanization challenges, and enhance connectivity. The demand for construction equipment is fueled by the need for new residential and commercial buildings, infrastructure modernization, and upgrades. The construction and infrastructure segment presents substantial opportunities for the construction equipment market as it plays a vital role in meeting the construction requirements of urban areas and supporting the development and maintenance of various infrastructure projects.

Global Construction Equipment Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Construction Equipment, followed by those in Asia-Pacific and Europe.

North America Market

North America is a dominant player in the global construction equipment market. The region’s dominance can be attributed to its strong infrastructure development, robust construction industry, and high demand for construction projects. With well-developed road networks, bridges, airports, and commercial buildings, there is a continuous need for construction equipment to support maintenance, repair, and expansion activities. The construction industry in North America is substantial, driving consistent demand for construction equipment across residential, commercial, and industrial sectors. This combination of infrastructure development, a strong construction industry, and high demand for construction projects has positioned North America as a significant market for construction equipment.

Asia Pacific Market

The Asia-Pacific region has become a rapidly growing market for the construction equipment industry. This growth is primarily driven by the region’s rapid urbanization and infrastructure development, with countries like China, India, and Southeast Asian nations investing heavily in construction projects. The expanding construction industry in the region, along with increasing demand for residential, commercial, and infrastructure projects, fuels the need for construction equipment. As a result, the Asia-Pacific market presents significant opportunities for manufacturers and suppliers of construction equipment to cater to the growing demand in the region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Hyundai Doosan Infracore Co Ltd, AB Volvo, CATERPILLAR INC, XCMG Group, CNH Industrial, and Hitachi Ltd are some of the leading players in the global Construction Equipment Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Hyundai Doosan Infracore Co Ltd

- AB Volvo

- CATERPILLAR INC

- XCMG Group

- CNH Industrial

- Hitachi Ltd

- J C Bamford Excavators Ltd (JCB)

- Liebherr-International

- Komatsu Ltd

- CanLift Equipment Ltd

- Deere & Company

Key Development:

On January 2022, CanLift Equipment Ltd. entered into a strategic partnership with Xuzhou Construction Machinery Group Co Ltd. As a result of this partnership, CanLift Equipment Ltd. expanded its product line for construction machinery equipment and obtained exclusive sales rights for earthmoving equipment in Ontario. This collaboration not only enhances CanLift’s offerings but also paves the way for new connections and opportunities within the construction machinery industry.

On March 2021, Hitachi unveiled its latest addition to the lineup, the ZW220-7 wheel loader. This wheel loader is designed to meet the Stage V emission standards. Weighing between 18,190 and 19,450 kilograms and boasting a net power of 157 kW (210 horsepower), the ZW220-7 offers excellent performance. Its heaped bucket capacity, measured according to ISO standards, ranges from 2.8 to 10.0 cubic meters.

Scope of the Report

Global Construction Equipment Market, by Type

- Concrete Mixer Truck

- Wheel Bulldozer

- Front Loaders

- Dump Trucks

- Backhoe loader

- Grader

- Crawler Dozers

- Compactors

- Excavators

- Forklifts

- Others

Global Construction Equipment Market, by Application

- Excavation and Mining

- Lifting and Material handling

- Earth Moving

- Transportation

- Others

Global Construction Equipment Market, by End User

- Oil and gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

Global Construction Equipment Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $ 386.74 Billion |

| CAGR | 4.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Gender, Product Type, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Hyundai Doosan Infracore Co Ltd, AB Volvo, CATERPILLAR INC, XCMG Group, CNH Industrial, Hitachi Ltd, J C Bamford Excavators Ltd (JCB), Liebherr-International, Komatsu Ltd, Deere & Company |

| Key Market Opportunities | Rising in Rental and Leasing Services, Technological Advancements |

| Key Market Drivers | Infrastructure Development • Urbanization and Population Growth |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Construction Equipment Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Construction Equipment market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Construction Equipment market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Construction Equipment Market.

Frequently Asked Questions (FAQ)

What are the 10 Years CAGR (2023 to 2033) of the global Construction Equipment market?

The global Construction Equipment market is growing at a CAGR of ~87% over the next 10 years

Which region has the highest growth rate in the market of Construction Equipment?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Construction Equipment?

North America holds the largest share in 2022

Major Key Players in the Market of Construction Equipment?

Hyundai Doosan Infracore Co Ltd, AB Volvo, CATERPILLAR INC, XCMG Group, CNH Industrial, Hitachi Ltd, J C Bamford Excavators Ltd (JCB), Liebherr-International, Komatsu Ltd, Deere & Company are the major companies operating in the Construction Equipment

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.