Construction 4.0 Market Overview

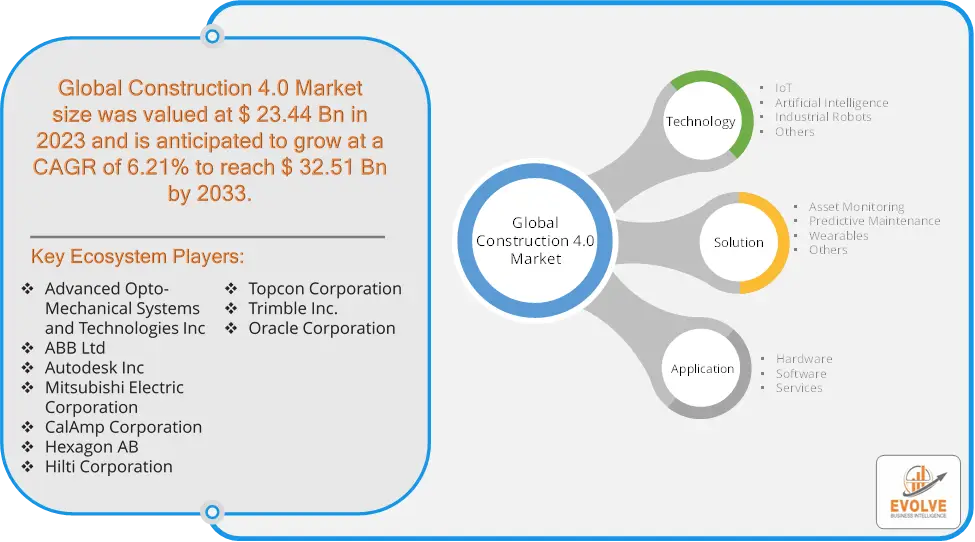

The Construction 4.0 Market Size is expected to reach USD 62.54 Billion by 2033. The Construction 4.0 Market industry size accounted for USD 11.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 17.24% from 2023 to 2033. The Construction 4.0 Market refers to the integration of advanced technologies and innovations within the construction industry, akin to the principles of Industry 4.0. This market encompasses the use of digital tools, automation, and smart technologies to enhance efficiency, productivity, and sustainability in construction processes.

The market is driven by the need for cost efficiency, improved safety, enhanced productivity, and reduced environmental impact in construction projects. Construction 4.0 also aligns with sustainable development goals by promoting energy efficiency and reducing waste.

Global Construction 4.0 Market Synopsis

The COVID-19 pandemic had a significant impact on the Construction 4.0 Market. The need to maintain social distancing and reduce on-site labour led to a surge in the use of automation and robotics in construction projects. The pandemic emphasized the importance of digital tools for remote collaboration, such as Building Information Modeling (BIM), which allowed teams to work together without being physically present on-site. The pandemic caused widespread delays and cancellations of construction projects, leading to reduced demand and slowed growth in the market. The shift to digital tools and automation required significant training and upskilling of the workforce, which was challenging to implement quickly during the pandemic. Rapid changes in regulations and compliance requirements related to health and safety during the pandemic created additional hurdles for the construction industry, slowing down the implementation of new technologies.

Construction 4.0 Market Dynamics

The major factors that have impacted the growth of Construction 4.0 Market are as follows:

Drivers:

Ø Advancements in Technology

Rapid advancements in digital technologies, such as IoT, AI, robotics, and 3D printing, have made Construction 4.0 solutions more accessible and practical. These technologies enhance project planning, execution, and management, driving their adoption across the industry. Worker safety is a top priority in construction, and Construction 4.0 technologies offer significant improvements in this area. Wearable devices, drones, and AI-driven safety monitoring systems help prevent accidents and ensure compliance with safety regulations. The global trend of rapid urbanization and the need for modern infrastructure drive demand for more efficient and scalable construction solutions. Construction 4.0 technologies enable faster and more precise construction, meeting the needs of growing urban populations.

Restraint:

- Perception of High Initial Costs and Lack of Skilled Workforce

Implementing Construction 4.0 technologies, such as advanced robotics, automation, and digital tools like BIM, often requires significant upfront investment. This includes the cost of hardware, software, and training, which can be prohibitive for small and medium-sized construction firms. The successful implementation of Construction 4.0 technologies requires a workforce skilled in digital tools, data analytics, and advanced machinery. However, there is a significant skills gap in the construction industry, making it challenging for companies to adopt and fully utilize these technologies.

Opportunity:

⮚ Sustainability and Green Building:

Construction 4.0 technologies can contribute to building energy-efficient structures by optimizing design, construction processes, and resource management, aligning with global sustainability goals. Advanced technologies can help reduce construction waste through better planning, materials management, and recycling processes. Automating repetitive tasks and using robotics can reduce labor costs and improve construction speed, offering significant cost savings and efficiency gains. IoT and AI can enable predictive maintenance of construction equipment and infrastructure, reducing downtime and extending asset lifespan.

Construction 4.0 Market Segment Overview

By Technology

By Application

Based on Application, the market segment has been divided into Asset Monitoring, Predictive Maintenance, Wearables and Others. The asset monitoring segment dominated the market. This can be linked to the growing use of asset management software by construction companies, who want to maximize the value of their assets and manage them effectively. The increasing use of AI algorithms, ML, and data analytics by asset managers to schedule maintenance, detect maintenance needs, and forecast possible failures will contribute to the segment’s growth.

By Solution

Based on Solution, the market segment has been divided into Hardware, Software and Services. The software segment dominated the market. Construction 4.0 techniques are enabled and supported in large part by software. The software component includes a variety of tools such as data analytics software, scheduling and planning tools, BIM software, collaboration platforms, and project management software.

Global Construction 4.0 Market Regional Analysis

Based on region, the global Construction 4.0 Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Construction 4.0 Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Construction 4.0 Market. North America is a leading adopter of Construction 4.0 technologies due to advanced infrastructure, high levels of investment in technology, and a focus on efficiency and sustainability. The market benefits from significant government and private sector investment in smart cities, green building initiatives, and advanced construction technologies and there is high demand for smart buildings, energy-efficient solutions, and advanced construction management systems. The U.S. and Canada are also focusing on integrating IoT, AI, and robotics into construction processes.

Construction 4.0 Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Construction 4.0 Market industry. China is a major player in the Construction 4.0 market due to its rapid urbanization, large-scale infrastructure projects, and significant investments in smart city development. The country is also a leader in the use of construction robotics and automation and India is witnessing increased adoption of Construction 4.0 technologies driven by urbanization, infrastructure development, and government initiatives aimed at improving construction efficiency and sustainability.

Competitive Landscape

The global Construction 4.0 Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Advanced Opto-Mechanical Systems and Technologies Inc

- ABB Ltd

- Autodesk Inc

- Mitsubishi Electric Corporation

- CalAmp Corporation

- Hexagon AB

- Hilti Corporation

- Topcon Corporation

- Trimble Inc.

- Oracle Corporation.

Key Development

In November 2022, Trimble and the Hilti Group, a global leader providing innovative tools, technology, software, and services to the commercial construction industry, announced that the Hilti ON!Track asset management system will integrate with Trimble Viewpoint Vista, an ERP solution within the Trimble Construction One suite. This will allow contractors to track and manage their tools and equipment.

In January 2023, Topcon Positioning Systems announced the expanding of compact solutions portfolio with 2D-MC automatic grade control solution for compact track loaders. 2D-MC is a low-cost 2D machine control system that is designed to be installed directly onto select grading attachments and provide simplified operational visibility.

Scope of the Report

Global Construction 4.0 Market, by Technology

- IoT

- Artificial Intelligence

- Industrial Robots

- Others

Global Construction 4.0 Market, by Application

- Asset Monitoring

- Predictive Maintenance

- Wearables

- Others

Global Construction 4.0 Market, by Solution

- Hardware

- Software

- Services

Global Construction 4.0 Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $62.54 Billion |

| CAGR | 17.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Application, Solution |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Advanced Opto-Mechanical Systems and Technologies Inc, ABB Ltd, Autodesk Inc, Mitsubishi Electric Corporation, CalAmp Corporation, Hexagon AB, Hilti Corporation, Topcon Corporation, Trimble Inc. and Oracle Corporation. |

| Key Market Opportunities | • Sustainability and Green Building • Cost Reduction and Efficiency Gains |

| Key Market Drivers | • Advancements in Technology • Rising Focus on Safety |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Construction 4.0 Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Construction 4.0 Market historical market size for the year 2021, and forecast from 2023 to 2033

- Construction 4.0 Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Construction 4.0 Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Construction 4.0 Market?

The global Construction 4.0 Market is growing at a CAGR of 17.24% over the next 10 years

Which region has the highest growth rate in the market of Construction 4.0 Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Construction 4.0 Market?

North America holds the largest share in 2022

Who are the key players in the global Construction 4.0 Market?

Advanced Opto-Mechanical Systems and Technologies Inc, ABB Ltd, Autodesk Inc, Mitsubishi Electric Corporation, CalAmp Corporation, Hexagon AB, Hilti Corporation, Topcon Corporation, Trimble Inc. and Oracle Corporation are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives