Cold Chain Market Overview

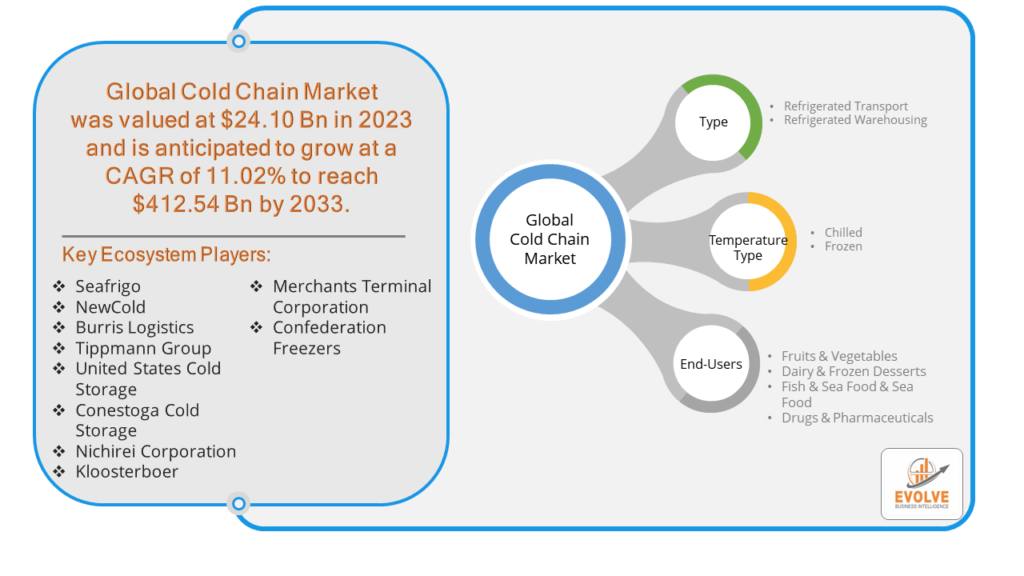

The Cold Chain Market Size is expected to reach USD 412.54 Billion by 2033. The Cold Chain industry size accounted for USD 24.10 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.02% from 2023 to 2033. The cold chain market refers to the infrastructure and processes required to maintain the integrity and quality of temperature-sensitive products throughout the supply chain. This includes refrigeration, transportation, and storage solutions to preserve items like food, pharmaceuticals, and chemicals. It ensures that these goods remain within specified temperature ranges from production to consumption, preventing spoilage, contamination, and ensuring safety and efficacy. The market is driven by increasing demand for perishable goods globally, stringent regulations, and advancements in refrigeration technology.

Global Cold Chain Market Synopsis

The Cold Chain market experienced a positive impact due to the COVID-19 pandemic. Due to supply chain interruptions brought on by the COVID-19 pandemic, there are now shortages or decreased demand in the cold chain sector. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, prompting manufacturers, developers, and service providers to implement diverse tactics aimed at stabilizing their businesses.

Global Cold Chain Market Dynamics

The major factors that have impacted the growth of Cold Chain are as follows:

Drivers:

⮚ Technological Advancements

Continuous advancements in refrigeration technology, cold storage facilities, and temperature monitoring systems have improved the efficiency, reliability, and sustainability of cold chain logistics. Innovations such as remote temperature monitoring, IoT-enabled sensors, and blockchain-based traceability solutions enhance transparency, reduce wastage, and optimize resource utilization within the cold chain.

Restraint:

- High Initial Investment and Operational Costs

Establishing and maintaining a cold chain infrastructure involves substantial initial investments in refrigeration equipment, cold storage facilities, transportation vehicles, and temperature monitoring systems.Additionally, the operational costs associated with energy consumption, maintenance, and skilled labor can be significant, posing a barrier to entry for small and medium-sized enterprises (SMEs) and businesses in developing regions.

Opportunity:

⮚ Rise of E-commerce and Direct-to-Consumer Delivery

The growth of e-commerce platforms and changing consumer behavior have accelerated the demand for online grocery shopping and direct-to-consumer delivery of perishable goods. Cold chain logistics companies can capitalize on this trend by offering last-mile delivery solutions, temperature-controlled packaging, and real-time tracking capabilities to ensure the freshness and safety of products during transit.

Cold Chain Market Segment Overview

By End-Users Industry

Based on the End-Users Industry, the market is segmented based on Fruits & Vegetables, Dairy & Frozen Desserts, Fish & Sea Food & Sea Food, Drugs & Pharmaceuticals. These segments represent key sectors relying on cold chain logistics for preserving freshness, quality, and safety of perishable goods, ensuring they reach consumers in optimal condition.

By Temperature Type

Based on the Temperature Type, the market has been divided into Frozen, Chilled. Frozen refers to products stored and transported at temperatures below freezing point, typically for long-term preservation. Chilled involves maintaining products at temperatures slightly above freezing, preserving freshness without freezing, and catering to shorter storage and transportation durations.

By Type

Global Cold Chain Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Cold Chain, followed by those in Asia-Pacific and Europe.

Cold Chain North America Market

North America dominates the Cold Chain market due to several factors. In North America, the cold chain market is robust and well-established, driven by stringent regulatory standards, technological advancements, and a mature logistics infrastructure. The region’s growing demand for perishable goods, including fresh produce, dairy products, seafood, and pharmaceuticals, fuels the expansion of cold chain services. Major players in the industry leverage advanced refrigeration technologies, temperature monitoring systems, and efficient transportation networks to ensure the integrity and safety of temperature-sensitive products throughout the supply chain.

Cold Chain Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. In Asia Pacific, the cold chain market is experiencing rapid growth driven by urbanization, rising disposable incomes, and changing consumption patterns. The region’s expanding population and increasing demand for fresh food, pharmaceuticals, and other temperature-sensitive products are key drivers. Investments in cold chain infrastructure, including refrigerated storage facilities, transportation networks, and technology solutions, are on the rise to meet the growing demand and address logistical challenges. Government initiatives aimed at improving food safety standards and reducing post-harvest losses further contribute to market expansion in Asia Pacific.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Seafrigo, NewCold, BURRIS LOGISTICS, Tippmann Group, and United States Cold Storage are some of the leading players in the global Cold Chain Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Seafrigo

- NewCold

- BURRIS LOGISTICS

- Tippmann Group

- United States Cold Storage

- Conestoga Cold Storage

- Nichirei Corporation

- Kloosterboer

- Merchants Terminal Corporation

- Confederation Freezers

Key development:

In September 2022, Burris Logistics expanded its cold chain capabilities by investing in state-of-the-art refrigerated storage facilities and implementing advanced technology solutions to enhance temperature control and traceability throughout its supply chain.

Scope of the Report

Global Cold Chain Market, by End-Users Industry

- Fruits & Vegetables

- Dairy & Frozen Desserts

- Fish & Sea Food & Sea Food

- Drugs & Pharmaceuticals

Global Cold Chain Market, by Temperature Type

- Frozen

- Chilled

Global Cold Chain Market, by Type

- Refrigerated Transport

- Refrigerated Warehousing

Global Cold Chain Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $412.54 Billion |

| CAGR | 11.02% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | End-Users Industry, Temperature Type, Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Seafrigo, NewCold, BURRIS LOGISTICS, Tippmann Group, United States Cold Storage, Conestoga Cold Storage, Nichirei Corporation, Kloosterboer, Merchants Terminal Corporation, Confederation Freezers. |

| Key Market Opportunities | • Creative Content Generation and Personalization |

| Key Market Drivers | • Advancements in AI research and technology • Growing demand for personalized and creative content |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Cold Chain Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Cold Chain market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Cold Chain market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Cold Chain Market.

Frequently Asked Questions (FAQ)

What is the growth rate of the Cold Chain Market?

The Cold Chain Market is expected to grow at a compound annual growth rate (CAGR) of 11.02% from 2023 to 2033.

Which region has the highest growth rate in the Cold Chain Market?

The Asia-Pacific region has the highest growth rate in the Cold Chain Market.

Which region has the largest share of the Cold Chain Market?

North America holds the largest share of the Cold Chain Market.

Who are the key players in the Cold Chain Market?

Key players in the Cold Chain Market include Seafrigo, NewCold, BURRIS LOGISTICS, Tippmann Group, and United States Cold Storage.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.