Clinical Biomarkers Market Overview

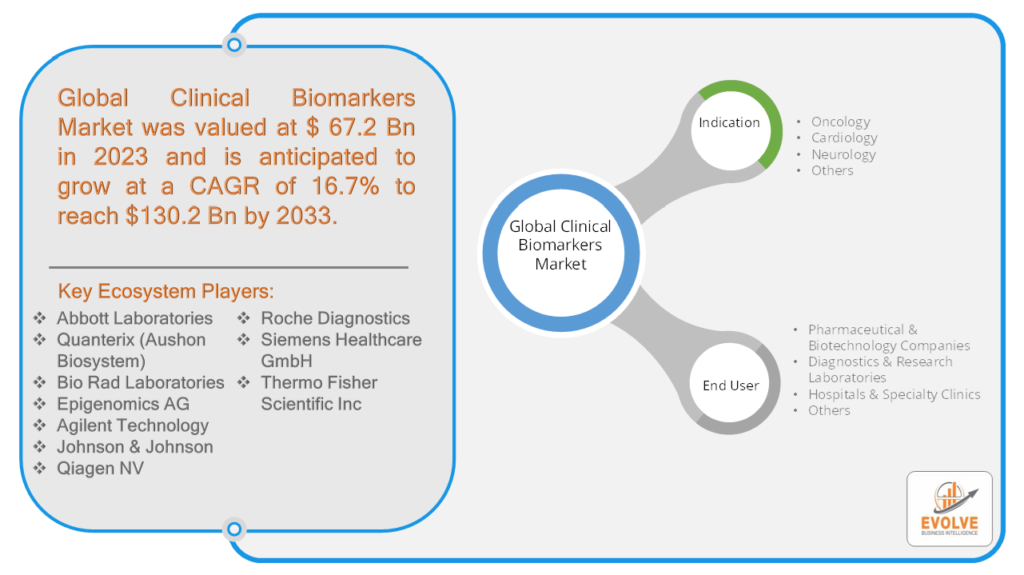

The global Clinical Biomarkers Market Size is expected to reach USD 130.2 Billion by 2033. The global Clinical Biomarkers industry size accounted for USD 67.2 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2023 to 2033. The clinical biomarkers market has witnessed significant growth in recent years, revolutionizing the way diseases are diagnosed, monitored, and treated. Biomarkers are measurable indicators that can be used to evaluate various physiological and pathological processes or responses to therapeutic interventions. They play a crucial role in providing valuable insights into the underlying mechanisms of diseases, enabling personalized medicine approaches, and facilitating the development of targeted therapies. With their wide range of applications across different medical fields, clinical biomarkers have become an indispensable tool in modern healthcare.

Global Clinical Biomarkers Market Synopsis

The COVID-19 pandemic has had a profound impact on the clinical biomarkers market. The urgent need for accurate and rapid diagnostic tests for SARS-CoV-2 led to the development and adoption of several biomarker-based assays. Biomarkers such as viral antigens, antibodies, and inflammatory markers have played a crucial role in detecting and monitoring COVID-19 infections. Moreover, biomarkers have been instrumental in identifying patients at high risk of severe disease outcomes, facilitating early intervention and treatment.

In the post-COVID scenario, the clinical biomarkers market is expected to witness continued growth. The lessons learned during the pandemic have highlighted the importance of biomarkers in infectious disease management. The demand for biomarker-based diagnostics is likely to increase, not only for COVID-19 but also for other infectious diseases. Additionally, the focus on precision medicine and targeted therapies is expected to drive the demand for biomarkers in various disease areas, such as oncology, cardiology, and neurology.

Clinical Biomarkers Market Dynamics

The major factors that have impacted the growth of Clinical Biomarkers are as follows:

Drivers:

Ø Advancements in Genomics and Proteomics

Advancements in genomics and proteomics have been a significant driving force behind the growth of the clinical biomarkers market. Genomic and proteomic technologies have revolutionized our understanding of disease mechanisms and have enabled the identification of novel biomarkers. Genomic biomarkers, such as genetic mutations or alterations, can provide critical information about an individual’s predisposition to certain diseases or their response to specific treatments. Proteomic biomarkers, on the other hand, offer insights into the protein expression patterns associated with disease states.

The availability of high-throughput sequencing technologies and mass spectrometry platforms has facilitated the discovery and validation of a vast number of genomic and proteomic biomarkers. These advancements have paved the way for personalized medicine, where treatment decisions can be tailored to an individual’s unique genetic or protein profile. By enabling targeted therapies and reducing the risk of adverse reactions, genomic and proteomic biomarkers hold immense potential to improve patient outcomes and reduce healthcare costs.

Restraint:

- Regulatory Challenges and Reimbursement Issues

While the clinical biomarkers market has experienced substantial growth, it is not without its challenges. One of the major restraining factors is the complex regulatory landscape and the associated challenges in obtaining regulatory approvals for biomarker-based tests. Regulatory agencies have stringent requirements for analytical and clinical validation, which can be time-consuming and expensive. The lack of standardized guidelines and harmonization across different regions further complicates the regulatory process.

Reimbursement is another critical issue that hinders the widespread adoption of biomarker-based tests. Establishing the clinical utility and cost-effectiveness of biomarkers is essential for securing reimbursement from healthcare payers. However, the evidence requirements and reimbursement policies vary across different healthcare systems, creating barriers for market access. The lack of reimbursement can limit the availability and affordability of biomarker-based tests, hindering their adoption in clinical practice.

Opportunity:

Growing Demand for Point-of-Care Testing

One of the key opportunity factors in the clinical biomarkers market is the growing demand for point-of-care testing. Point-of-care tests offer several advantages over traditional laboratory-based testing, including rapid results, convenience, and accessibility. These tests can be performed at the patient’s bedside, in physician offices, or even in remote locations, providing immediate diagnostic information and facilitating timely decision-making in patient care.

Clinical Biomarker segment Overview

By Indication

By End User

Based on End User, the market has been divided into Pharmaceutical & Biotechnology Companies, Diagnostics & Research Laboratories, Hospitals & Specialty Clinics, and Others. The pharmaceutical and biotechnology companies segment holds the largest share in the clinical biomarkers market. These companies play a crucial role in the development and commercialization of biomarker-based diagnostics and therapies. They invest significant resources in research and development to discover and validate biomarkers that can be used for disease diagnosis, patient stratification, and monitoring of treatment response.

Global Clinical Biomarkers Market Regional Analysis

Based on region, the global Clinical Biomarkers market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. North America is projected to dominate the use of the market followed by the Europe and Asia-Pacific regions.

North America Market

North America dominates the clinical biomarkers market, driven by factors such as robust healthcare infrastructure, advanced research facilities, and a high prevalence of chronic diseases. The United States, in particular, is a major contributor to the market growth in this region. The presence of leading pharmaceutical and biotechnology companies, academic research centers, and regulatory agencies fuels the rapid development and adoption of biomarker-based diagnostics and therapeutics.

The strong emphasis on precision medicine and personalized therapies has propelled the demand for biomarkers in North America. Biomarker research is focused on various indications, including oncology, cardiology, and neurology. The region has witnessed significant collaborations between academic institutions, healthcare providers, and industry players to advance biomarker discovery, validation, and clinical translation.

Europe Market

Europe is another key region in the clinical biomarkers market, with countries such as Germany, the United Kingdom, and France at the forefront of research and development. The region benefits from a well-established healthcare system, supportive regulatory frameworks, and a growing focus on precision medicine. European countries have made substantial investments in biomarker research, aiming to leverage their potential in disease diagnosis, patient stratification, and therapeutic monitoring.

In Europe, oncology is a primary focus area for biomarker research, with several ongoing clinical trials and research initiatives. The European Medicines Agency (EMA) has actively encouraged the integration of biomarkers into drug development programs, emphasizing their role in personalized medicine approaches. Collaborations between academic institutions, hospitals, and industry partners have facilitated biomarker discovery and validation, leading to the development of innovative diagnostic tests and targeted therapies.

Competitive Landscape

The global Clinical Biomarkers market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Abbott Laboratories

- Quanterix (Aushon Biosystem)

- Bio Rad Laboratories

- Epigenomics AG

- Agilent Technology

- Johnson & Johnson

- Qiagen NV

- Roche Diagnostics

- Siemens Healthcare GmbH

- Thermo Fisher Scientific Inc

Key Development:

May 2023: Roche Diagnostics announced a significant development in the clinical biomarkers market. The company introduced a novel biomarker-based diagnostic test for the early detection of Alzheimer’s disease. The test utilizes a combination of blood-based biomarkers to identify individuals at risk of developing Alzheimer’s disease before the onset of clinical symptoms.

Scope of the Report

Global Clinical Biomarkers Market, by Indication

- Oncology

- Cardiology

- Neurology

- Others

Global Clinical Biomarkers Market, by End User

- Pharmaceutical & Biotechnology Companies

- Diagnostics & Research Laboratories

- Hospitals & Specialty Clinics

- Others

Global Clinical Biomarkers Market, by Regional

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $130.2 Billion |

| CAGR | 16.7 % CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Indication, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Abbott Laboratories, Quanterix (Aushon Biosystem), Bio Rad Laboratories, Epigenomics AG, Agilent Technology, Johnson & Johnson, Qiagen NV, Roche Diagnostics, Siexmens Healthcare GmbH, and Thermo Fisher Scientific Inc |

| Key Market Opportunities | Growing Demand for Point-of-Care Testing |

| Key Market Drivers | Advancements in Genomics and Proteomics |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Clinical Biomarkers market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Clinical Biomarkers market historical market size for the year 2021, and forecast from 2023 to 2033

- Clinical Biomarkers market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, Diagnostics & Research Laboratories strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Clinical Biomarkers market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Diagnostics & Research Laboratories health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

The study period of the global Clinical Biomarkers market is 2021- 2033

The global Clinical Biomarkers market is growing at a CAGR of 16.7% over the next 10 years

North America is expected to register the highest CAGR during 2023-2033

Europe holds the largest share in 2022

Abbott Laboratories, Quanterix (Aushon Biosystem), Bio Rad Laboratories, Epigenomics AG, Agilent Technology, Johnson & Johnson, Qiagen NV, Roche Diagnostics, Siemens Healthcare GmbH, and Thermo Fisher Scientific Inc the major companies operating in the market.

Yes, we offer 16 hours of analyst support to solve the queries

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.