Cell Therapy Market Overview

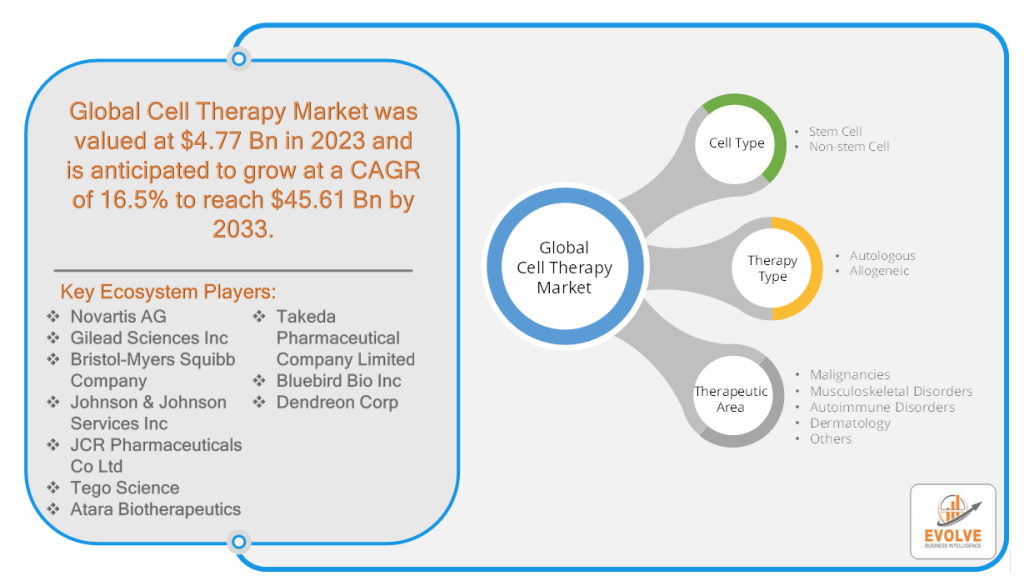

The Cell Therapy Market Size is expected to reach USD 45.61 Billion by 2033. The Cell Therapy industry size accounted for USD 4.77 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.5% from 2023 to 2033. Cell therapy, also known as cellular therapy or regenerative medicine, refers to a form of medical treatment that involves the use of living cells to treat or potentially cure various diseases and conditions. It aims to restore or replace damaged, dysfunctional, or missing cells within the body. Cell therapy typically involves the isolation, manipulation, and administration of cells to the patient to repair or regenerate the affected tissues or organs. The cells used in this type of therapy can be derived from various sources, including the patient’s cells (autologous), cells from a compatible donor (allogeneic), or even genetically modified cells.

Global Cell Therapy Market Synopsis

The COVID-19 pandemic had a profound effect on the Cell Therapy market. While the pandemic posed significant challenges to healthcare systems worldwide, it also highlighted the potential of cell therapy in addressing critical medical needs. The urgent demand for effective treatments and vaccines against COVID-19 accelerated research and development in cell-based therapies, such as convalescent plasma therapy and mesenchymal stem cell therapy, for treating severe cases and modulating the immune response. Additionally, the pandemic led to increased investments in cell therapy research, manufacturing capabilities, and infrastructure, as well as regulatory adaptations to facilitate the development and deployment of novel cell-based treatments. Despite disruptions in clinical trials and supply chains, the pandemic has spurred innovation and collaboration, positioning the Cell Therapy market for continued growth and advancements in the post-pandemic era.

Global Cell Therapy Market Dynamics

The major factors that have impacted the growth of Cell Therapy are as follows:

Drivers:

Increasing prevalence of chronic diseases

The rising prevalence of chronic diseases, such as cancer, cardiovascular disorders, and neurodegenerative conditions, is a significant driver for the cell therapy market. Cell therapy offers potential solutions by providing regenerative and immunotherapeutic approaches to treat or manage these diseases. The increasing burden of chronic diseases worldwide has created a demand for innovative therapies, driving the growth of the cell therapy market.

Restraint:

- High costs and reimbursement challenges

One of the key restraints for the cell therapy market is the high costs associated with research, development, and manufacturing of cell-based therapies. The complex and specialized nature of cell therapies often requires extensive resources and infrastructure, contributing to their high price tags. Additionally, reimbursement challenges and uncertainties surrounding the coverage and reimbursement policies by healthcare systems pose barriers to the widespread adoption of cell therapies, limiting patient access to these innovative treatments.

Opportunity:

Advancements in stem cell research and genetic engineering

The field of stem cell research and genetic engineering holds significant opportunities for the cell therapy market. Advances in understanding stem cell biology, including the development of induced pluripotent stem cells (iPSCs), have expanded the potential applications of cell therapy. iPSCs offer the possibility of generating patient-specific cells, minimizing immune rejection, and enabling personalized therapies. Moreover, breakthroughs in genetic engineering techniques, such as CRISPR-Cas9, have opened new avenues for modifying cells to enhance their therapeutic properties, leading to improved efficacy and safety of cell-based treatments. These advancements present promising opportunities for the development of next-generation cell therapies.

Cell Therapy Market Segment Overview

By Cell Type

By Therapy Type

Based on Therapy Type, the market has been divided into Autologous, Allogeneic. The Autologous segment is expected to hold the largest market share in the Market. Autologous cell therapies are custom-made for each patient, increasing the likelihood of compatibility and reducing the need for immunosuppressive drugs. Additionally, the availability of a patient’s cells eliminates the need for finding suitable donors and mitigates ethical concerns associated with allogeneic (donor-derived) cell therapies.

By Therapeutic Area

Based on the Therapeutic Area, the market has been divided into Malignancies, Musculoskeletal Disorders, Autoimmune Disorders, Dermatology, and Others. The Malignancies segment is projected to experience significant growth in the Cell Therapy market. Cell therapies have shown promising results in the treatment of various malignancies, including hematological cancers (such as leukemia and lymphoma) and solid tumors (such as melanoma and lung cancer). Chimeric Antigen Receptor (CAR) T-cell therapy, a type of cell therapy, has emerged as a breakthrough treatment for certain malignancies. CAR T-cell therapy involves genetically modifying a patient’s T cells to express specific receptors (CARs) that recognize and target cancer cells. This approach has demonstrated remarkable efficacy in certain hematological malignancies, such as acute lymphoblastic leukemia (ALL) and diffuse large B-cell lymphoma (DLBCL).

Global Cell Therapy Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Cell Therapy, followed by those in Asia-Pacific and Europe.

North America has consistently held the largest market share in the Cell Therapy market due to several factors. The region benefits from a well-established healthcare infrastructure, including advanced research facilities and clinical centers, which facilitate the development and adoption of cell therapies. Additionally, the favorable regulatory environment, particularly in the United States, with initiatives like the RMAT designation and breakthrough therapy designation, expedites the approval process for cell therapies. North America also boasts strong research and development activities, driven by leading institutions and biotechnology companies, which contribute to advancements in the field. These factors collectively attract investments, foster innovation, and position North America as a dominant player in the Cell Therapy market.

Asia Pacific Market

The Cell Therapy industry in the Asia-Pacific region has been experiencing remarkable growth. Several factors contribute to this expansion. First, the region has a large patient population, including a significant number of individuals with chronic diseases such as cancer and cardiovascular disorders, creating a demand for innovative therapies. Additionally, countries in the Asia-Pacific region, such as China, Japan, and South Korea, have made substantial investments in research and development, infrastructure, and manufacturing capabilities, fostering a supportive ecosystem for cell therapy advancements. Moreover, the region benefits from a comparatively lower cost of conducting clinical trials and manufacturing, attracting global companies to establish collaborations and expand their operations in the region. These factors, combined with the region’s increasing focus on healthcare advancements, are propelling the growth of the Cell Therapy industry in the Asia-Pacific region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Novartis AG, Gilead Sciences Inc, Bristol-Myers Squibb Company, Johnson & Johnson Services Inc, and JCR Pharmaceuticals Co Ltd are some of the leading players in the global Cell Therapy Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Novartis AG

- Gilead Sciences Inc

- Bristol-Myers Squibb Company

- Johnson & Johnson Services Inc

- JCR Pharmaceuticals Co Ltd

- Tego Science

- Atara Biotherapeutics

- Takeda Pharmaceutical Company Limited

- Bluebird Bio Inc

- Dendreon Corp

Key development:

In January 2022, Immunocore received the Food and Drug Administration approval of KIMMTRAK (tebentafusp-tebn) for the treatment of unresectable or metastatic uveal melanoma.

In March 2021, Novadip Biosciences secured Investigational New Drug (IND) approval from the FDA for their regenerative bone product NVD-003, designed specifically for treating rare pediatric bone disease.

Scope of the Report

Global Cell Therapy Market, by Cell Type

- Stem Cell

- Non-stem Cell

Global Cell Therapy Market, by Therapy Type

- Autologous

- Allogeneic

Global Cell Therapy Market, by Therapeutic Area

- Malignancies

- Musculoskeletal Disorders

- Autoimmune Disorders

- Dermatology

- Others

Global Cell Therapy Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $45.61 Billion |

| CAGR | 16.5% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Cell Type, Therapy Type, Therapeutic Area |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Novartis AG, Gilead Sciences Inc, Bristol-Myers Squibb Company, Johnson & Johnson Services Inc, JCR Pharmaceuticals Co Ltd, Tego Science, Atara Biotherapeutics, Takeda Pharmaceutical Company Limited, Bluebird Bio Inc, Dendreon Corp |

| Key Market Opportunities | • Growing regulatory support and streamlined approvals • Advancements in personalized medicine |

| Key Market Drivers | • Increasing investment and funding • Increasing prevalence of chronic diseases |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Cell Therapy Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Cell Therapy market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Cell Therapy market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Cell Therapy Market.

Frequently Asked Questions (FAQ)

What are the 10 Years CAGR (2023 to 2033) of the global Cell Therapy market?

The global Cell Therapy market is growing at a CAGR of ~5% over the next 10 years

Which region has the highest growth rate in the market of Cell Therapy?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Cell Therapy?

North America holds the largest share in 2022

Major Key Players in the Market of Stem Cell Manufacturers?

Novartis AG, Gilead Sciences Inc, Bristol-Myers Squibb Company, Johnson & Johnson Services Inc, JCR Pharmaceuticals Co Ltd, Tego Science, Atara Biotherapeutics, Takeda Pharmaceutical Company Limited, Bluebird Bio Inc, Dendreon Corp are the major companies operating in the Cell Therapy

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.