Bread Maker Market Overview

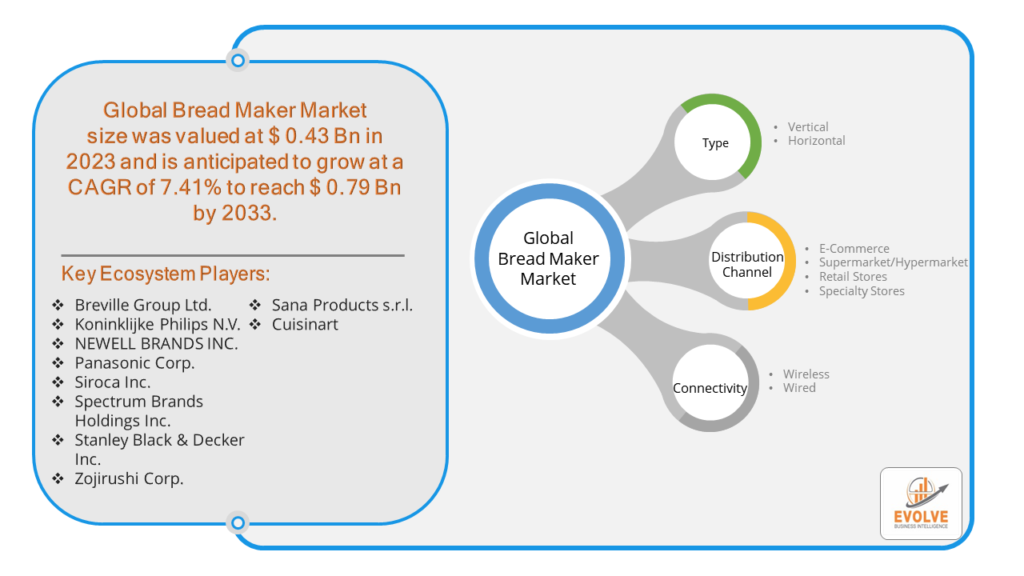

The Bread Maker Market Size is expected to reach USD 0.79 Billion by 2033. The Bread Maker industry size accounted for USD 0.43 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.41% from 2023 to 2033. The bread maker market encompasses the global industry involved in the production and sale of automated machines designed for home bread baking. This market includes various types of bread makers, ranging from basic models to advanced units with multiple features like customizable settings, gluten-free options, and programmable timers. The market is driven by factors such as increasing consumer interest in homemade food, the convenience of automated baking, and growing awareness of health and dietary concerns. Key players in this market often focus on innovation, product quality, and expanding their distribution channels to meet diverse consumer needs.

Global Bread Maker Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Bread Maker market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Global Bread Maker Market Dynamics

The major factors that have impacted the growth of Bread Maker are as follows:

Drivers:

Ø Trend towards Home Cooking

The broader trend towards home cooking and DIY food preparation has fueled interest in bread makers. As consumers seek to regain control over what they eat and engage in culinary experimentation, bread makers offer a fulfilling avenue for creative expression in the kitchen.

Restraint:

- High Initial Cost

One significant restraint is the relatively high initial cost associated with purchasing a bread maker. Despite potential long-term savings on store-bought bread, some consumers may be deterred by the upfront investment required to acquire a quality bread maker, especially if they perceive it as a non-essential kitchen appliance.

Opportunity:

⮚ Smart Technology Integration

The integration of smart technology into bread makers presents exciting opportunities for enhanced functionality and user experience. Features such as Wi-Fi connectivity, smartphone app control, and recipe databases can provide users with greater convenience, personalization, and access to a wealth of baking resources. Manufacturers can capitalize on the trend of connected appliances by incorporating smart features into their bread maker designs.

Bread Maker Market Segment Overview

By Type

By Distribution Channel

Based on the Distribution Channel, the market has been divided into E-Commerce, Supermarket/Hypermarket, Retail Stores, Specialty Store. In the bread maker market segmented by distribution channel, e-commerce channels dominate, providing consumers with convenient access to a wide range of bread maker models and accessories, along with the flexibility of online purchasing and doorstep delivery.

By Connectivity

Based on Connectivity, the market has been divided into Wireless, Wired. In the bread maker market segmented by connectivity, wired bread makers currently dominate, offering reliable performance and ease of use without reliance on wireless technology.

Global Bread Maker Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Bread Maker, followed by those in Asia-Pacific and Europe.

North America dominates the Bread Maker market due to several factors. In North America, the bread maker market is robust, driven by factors such as a strong culture of home baking, rising health consciousness, and technological advancements. Consumers in the region value convenience and customization, leading to a steady demand for bread makers with features like programmable settings and gluten-free options. Additionally, the proliferation of e-commerce platforms has facilitated easy access to a wide range of bread maker models, contributing to market growth. With a focus on innovation and product diversification, North American manufacturers are poised to capitalize on the continued popularity of bread makers among home cooks and baking enthusiasts.

Bread Maker Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. In the Asia Pacific region, the bread maker market is experiencing rapid growth fueled by changing lifestyles, urbanization, and increasing disposable incomes. Rising consumer awareness about the convenience and health benefits of homemade bread is driving demand for bread makers across the region. Additionally, the expanding e-commerce landscape is making bread makers more accessible to consumers in remote areas. Manufacturers in Asia Pacific are innovating to cater to diverse tastes and preferences, offering features such as smart connectivity and multi-functionality to appeal to tech-savvy consumers. With a growing population and evolving consumer preferences, the Asia Pacific bread maker market presents significant opportunities for expansion and market penetration.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Breville Group Ltd., Koninklijke Philips N.V., NEWELL BRANDS INC., Panasonic Corp., and Siroca Inc. are some of the leading players in the global Bread Maker Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Breville Group Ltd.

- Koninklijke Philips N.V.

- NEWELL BRANDS INC.

- Panasonic Corp.

- Siroca Inc.

- Spectrum Brands Holdings Inc.

- Stanley Black & Decker Inc.

- Zojirushi Corp.

- Sana Products s.r.l.

- Cuisinart

Key development:

In September 2022, Panasonic Corp. unveiled its latest bread maker model featuring advanced smart connectivity, allowing users to control and monitor the baking process remotely via a smartphone app, signaling the company’s commitment to innovation and meeting the evolving needs of consumers.

Scope of the Report

Global Bread Maker Market, by Type

- Vertical

- Horizontal

Global Bread Maker Market, by Distribution Channel

- E-Commerce

- Supermarket/Hypermarket

- Retail Stores

- Specialty Stores

Global Bread Maker Market, by Connectivity

- Wireless

- Wired

Global Bread Maker Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $0.79 Billion |

| CAGR | 7.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Distribution Channel , Connectivity |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Breville Group Ltd., Koninklijke Philips N.V., NEWELL BRANDS INC., Panasonic Corp., Siroca Inc., Spectrum Brands Holdings Inc., Stanley Black & Decker Inc., Zojirushi Corp., Sana Products s.r.l., Cuisinart |

| Key Market Opportunities | • Creative Content Generation and Personalization • Expanding Distribution Channel s in industries like media & entertainment, gaming, healthcare, design |

| Key Market Drivers | • Advancements in AI research and technology • Growing demand for personalized and creative content |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Bread Maker Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Bread Maker market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Bread Maker market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Bread Maker Market.

Frequently Asked Questions (FAQ)

What is the growth rate of the Bread Maker Market?

The Bread Maker Market is expected to grow at a CAGR of 7.41% from 2023 to 2033.

Which region has the highest growth rate in the Bread Maker Market?

The Asia-Pacific region has the highest growth rate in the Bread Maker Market.

Which region has the largest share of the Bread Maker Market?

North America holds the largest share of the Bread Maker Market.

Who are the key players in the Bread Maker Market?

Key players in the Bread Maker Market include Breville Group Ltd., Koninklijke Philips N.V., NEWELL BRANDS INC., and Panasonic Corp.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.