Blockchain in Energy Market Overview

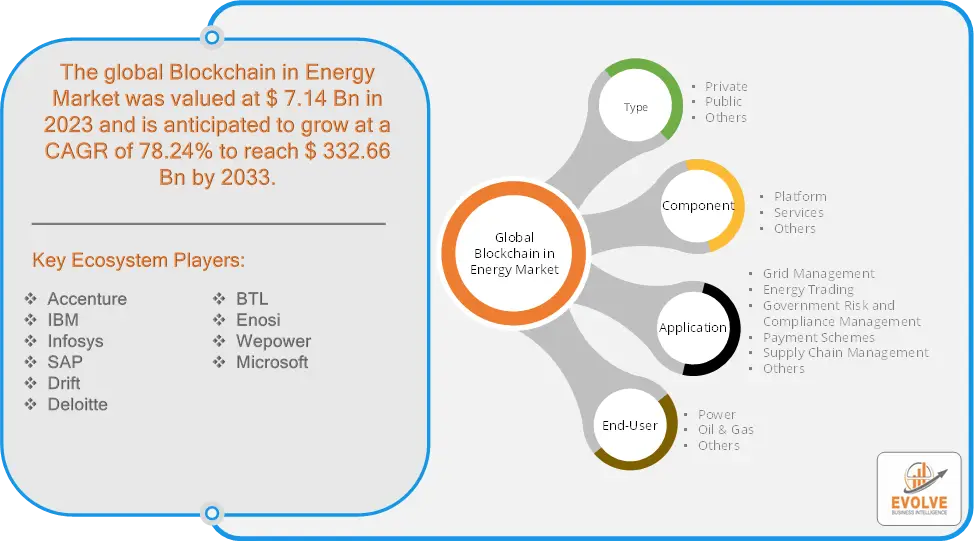

Blockchain in Energy Market Size is expected to reach USD 332.66 Billion by 2033. The Blockchain in Energy industry size accounted for USD 7.14 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 78.24% from 2023 to 2033. The Smart Buildings market encompasses buildings equipped with advanced technologies and integrated systems to optimize operations, enhance energy efficiency, and improve occupant comfort and safety. These buildings utilize IoT (Internet of Things), AI (Artificial Intelligence), and automation solutions to monitor and control various systems such as HVAC, lighting, security, and more. Key benefits include reduced energy consumption, lower operating costs, and increased sustainability. The market is driven by increasing urbanization, regulatory mandates for energy efficiency, and growing awareness of environmental impacts.

Global Blockchain in Energy Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Blockchain in Energy market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Global Blockchain in Energy Market Dynamics

The major factors that have impacted the growth of Blockchain in Energy are as follows:

Drivers:

⮚ Technological Advancements

Advances in IoT, artificial intelligence (AI), cloud computing, and data analytics enable more sophisticated and interconnected smart building solutions. These technologies support real-time monitoring, predictive analytics, and remote management capabilities.

Restraint:

- Data Security and Privacy Concerns

The proliferation of IoT devices and interconnected systems in smart buildings raises concerns about data security and privacy. Protecting sensitive information from cyber threats and unauthorized access is crucial. Building owners and operators must implement robust cybersecurity measures and adhere to data protection regulations to mitigate these risks.

Opportunity:

⮚ Data Analytics and AI

Utilizing big data analytics and AI algorithms enables predictive maintenance, fault detection, and optimization of building operations. Machine learning algorithms analyze vast amounts of data from sensors and systems to optimize HVAC, lighting, and other building functions, improving efficiency and reducing operational costs.

Blockchain in Energy Market Segment Overview

By Type

By Component

Based on Component, the market has been divided into Platform, Services, Others. Services” typically dominate the component segment. These services include installation, maintenance, consulting, and managed services related to smart building technologies.

By Application

Based on the Application, the market has been divided into Grid Management, Energy Trading, Government Risk And Compliance Management, Payment Schemes, Supply Chain Management, Others. Energy Trading” typically dominates. This segment involves the buying and selling of electricity or other forms of energy, facilitated by smart building technologies that optimize energy usage, storage, and distribution, thereby enhancing efficiency and cost-effectiveness within the energy sector.

By End-User

Based on End-User, the market has been divided into Power, Oil & Gas, Others. the “Others” category typically dominates among end-users, encompassing a diverse range of sectors including commercial real estate, healthcare facilities, educational institutions, and government buildings.

Global Blockchain in Energy Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Blockchain in Energy, followed by those in Asia-Pacific and Europe.

The North American region holds a dominant position in the Blockchain in Energy market. North America is a leading region in the smart buildings market, characterized by robust adoption of advanced technologies and stringent regulations promoting energy efficiency and sustainability. Major cities like New York, San Francisco, and Toronto are hubs for smart building innovation, driven by the demand for optimized building management, enhanced occupant experience, and cost savings. Key players in the region focus on IoT integration, AI-driven analytics, and smart energy management solutions to cater to diverse sectors including commercial, residential, and government buildings. The market’s growth is supported by favorable government initiatives, technological advancements, and a strong emphasis on environmental stewardship across the continent.

Blockchain in Energy Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Blockchain in Energy industry. Asia Pacific is a rapidly growing region in the smart buildings market, driven by urbanization, infrastructure development, and increasing awareness of sustainability. Countries like China, Japan, and India lead in adopting smart building technologies to address energy efficiency, reduce operational costs, and improve building performance. Key factors influencing the market include government initiatives promoting smart city development, rapid urban population growth, and advancements in IoT and AI technologies. The region sees significant investments in smart building solutions across commercial, residential, and industrial sectors, with a focus on enhancing urban living standards and environmental sustainability.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Accenture, IBM, Infosys, SAP, and Drift are some of the leading players in the global Blockchain in Energy Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Accenture

- IBM

- Infosys

- SAP

- Drift

- Deloitte

- BTL

- Enosi

- Wepower

- Microsoft

Key Development:

In September 2022, Infosys made significant strides in smart building technologies by enhancing its AI-powered automation platforms and integrating advanced IoT solutions for smarter and more sustainable building management.

Scope of the Report

Global Blockchain in Energy Market, by Type

- Private

- Public

- Others

Global Blockchain in Energy Market, by Component

- Platform

- Services

- Others

Global Blockchain in Energy Market, by Application

- Grid Management

- Energy Trading

- Government Risk and Compliance Management

- Payment Schemes

- Supply Chain Management

- Others

Global Blockchain in Energy Market, by End-User

- Power

- Oil & Gas

- Others

Global Blockchain in Energy Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $332.66 Billion |

| CAGR | 78.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Component, Application, End-User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Accenture, IBM, Infosys, SAP, Drift, Deloitte, BTL, Enosi, Wepower, Microsoft |

| Key Market Opportunities | Enabling real-time transactions Creating more dynamic business models |

| Key Market Drivers | Increased automation with data integrity and security |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Blockchain in Energy Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Blockchain in Energy market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Blockchain in Energy market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Blockchain in Energy Market.

Frequently Asked Questions (FAQ)

What are the 10 Years CAGR (2023 to 2033) of the global Blockchain in Energy market?

The global Blockchain in Energy market is growing at a CAGR of ~78.24% over the next 10 years

Which region has the highest growth rate in the market of Blockchain in Energy?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Blockchain in Energy?

North America holds the largest share in 2022

Major Key Players in the Market of Blockchain in Energy?

Accenture, IBM, Infosys, SAP, Drift, Deloitte, BTL, Enosi, Wepower, and Microsoft are the major companies operating in the Blockchain in Energy Industry.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives