Biopesticides Market Overview

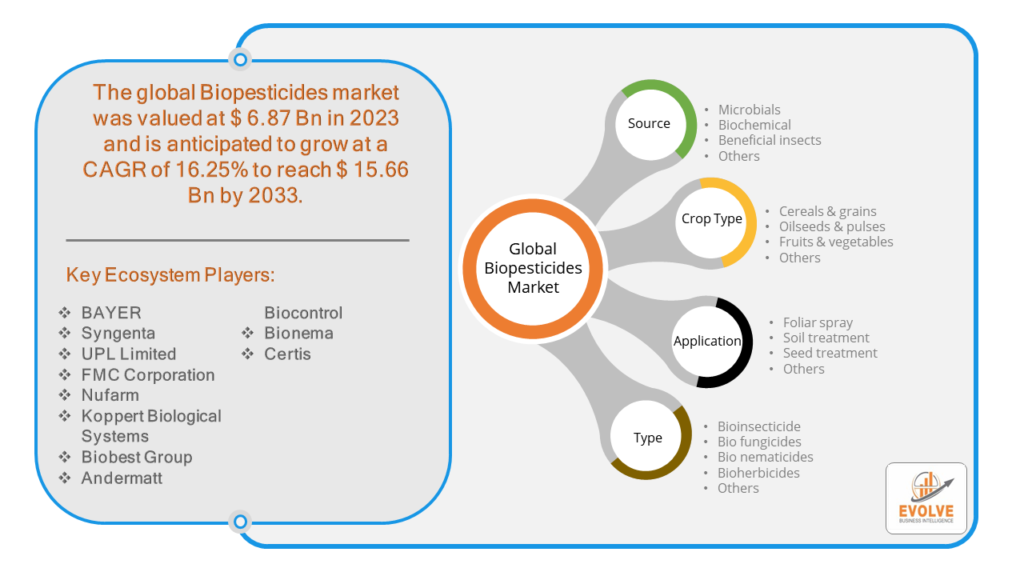

Biopesticides Market Size is expected to reach USD 15.66 Billion by 2033. The Biopesticides industry size accounted for USD 6.87 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.25% from 2023 to 2033. The biopesticides market refers to the segment of the agricultural industry focused on environmentally friendly pest management solutions derived from natural sources such as animals, plants, bacteria, and certain minerals. Unlike traditional chemical pesticides, biopesticides offer reduced environmental impact and pose fewer risks to human health. They are increasingly adopted in integrated pest management strategies due to their efficacy against pests and diseases while maintaining ecosystem balance. The market encompasses various types of biopesticides including microbial pesticides, plant-incorporated protectants, and biochemical pesticides. Growing consumer demand for organic and sustainable agricultural practices has fueled the expansion of this market globally, with North America, Europe, and Asia-Pacific being key regions for biopesticide adoption

Global Biopesticides Market Synopsis

The Biopesticides market experienced a detrimental effect due to the Covid-19 pandemic. The COVID-19 pandemic has caused supply chain hiccups that have reduced demand or created shortages in the biopesticide sector. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, leading manufacturers, developers, and service providers to implement several measures in an attempt to stabilize their businesses.

Global Biopesticides Market Dynamics

The major factors that have impacted the growth of Biopesticides are as follows:

Drivers:

⮚ Advancements in Biotechnology

Advances in biotechnology have facilitated the development of more effective and economically viable biopesticides. Techniques such as genetic engineering and microbial fermentation enable the production of biopesticides with enhanced potency, specificity, and stability, driving market growth.

Restraint:

- Limited Availability of Commercial Products

Despite the increasing demand for biopesticides, the range of commercially available products remains relatively limited compared to synthetic pesticides. Developing and commercializing biopesticides requires substantial investment in research, development, and regulatory compliance, which may be prohibitive for smaller companies or startups. As a result, farmers may face challenges in accessing a diverse range of biopesticide options tailored to their specific pest management needs.

Opportunity:

⮚ Increasing Demand for Sustainable Agriculture

Growing awareness among consumers about the environmental and health impacts of chemical pesticides has fueled the demand for sustainable agricultural practices. Biopesticides, derived from natural sources, offer an environmentally friendly alternative to conventional pesticides, aligning with the preferences of consumers and regulators for safer and more sustainable farming practices.

Biopesticides Market Segment Overview

By Source

By Crop Type

Based on Crop Type, the market has been divided into Cereals & grains, Oilseeds & pulses, Fruits & vegetables and Others. Given that vegetables are among the crops that are grown most intensively globally and are frequently more sensitive to pests and illnesses than other crops, the vegetable segment retained the biggest market share in 2022. For vegetable growers, biopesticides can offer sustainable and efficient pest management solutions that also lower the possibility of residues in the finished product.

By Application

Based on the Application, the market has been divided into Foliar spray, Soil treatment, Seed treatment and Others. Since soil application has the greatest potential for long-term pest management, it held the largest market share in 2022. Biopesticides sprayed on the soil can continue to work for weeks or months, giving ongoing defense against diseases and pests that are carried by the soil.

By Type

Based on Type, the market has been divided into Bioinsecticide, Bio fungicides, Bio nematicides, Bioherbicides and Others. When it came to the income generated by biopesticides in 2022, the bioinsecticide segment accounted for the majority. The usage of bioinsecticides has increased as a result of rising agricultural productivity and growing pest resistance. A lot of insect pests are known to impair plant growth and crops after harvest or while they are being stored, which results in agricultural loss.

Global Biopesticides Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Blister Packaging, followed by those in Asia-Pacific and Europe.

The North American region holds a dominant position in the Biopesticides market. North America is the market leader. The market for biopesticides in North America is being driven by two factors: the growing interest in ecologically friendly agricultural practices and the loss of many conventional products as a result of reregistration and/or performance concerns. Today, the development and/or marketing of biopesticide products is carried out by more than 60 companies in the US alone. Product development has also led to an increase in the market for biopesticides.

Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Biopesticides industry The demand for organic food, growing worries about the effects of chemicals on the environment, and the availability of a simplified registration process are the primary factors driving the anticipated high compound annual growth rate (CAGR) of the Asia-Pacific biopesticides market from 2022 to 2030. In addition, the biopesticide market in China had the most market share, while the biopesticide market in India had the quickest rate of growth in the Asia-Pacific area.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BAYER, Syngenta, UPL Limited, FMC Corporation, and Nufarm are some of the leading players in the global Biopesticides Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BAYER

- Syngenta

- UPL Limited

- FMC Corporation

- Nufarm

- Koppert Biological Systems

- Biobest Group

- Andermatt Biocontrol

- Bionema

- Certis

Key Development:

June 2022: FMC Corporation announced its new plant health business brand, “Biologicals by FMC,” as part of the company’s plans to expand into the biopesticides market and to reflect the company’s commitment to biological crop protection.

Jan 2022: Syngenta Crop Protection AG has acquired two next generation bioinsecticides from Bionema Limited, a biocontrol technology developer, NemaTrident and UniSpore. With this move, the company hopes to combat rising resistance and a diverse range of insects and pests in horticulture and ornamentals, turf amenity, and forestry, providing customers with even more options.

Scope of the Report

Global Biopesticides Market, by Source

- Microbials

- Biochemical

- Beneficial insects

- Others

Global Biopesticides Market, by Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Others

Global Biopesticides Market, by Application

- Foliar spray

- Soil treatment

- Seed treatment

- Others

Global Biopesticides Market, by Type

- Bioinsecticide

- Bio fungicides

- Bio nematicides

- Bioherbicides

- Others

Global Biopesticides Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $15.66 Billion |

| CAGR | 16.25% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Source, Crop Type, Application, Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BAYER, Syngenta, UPL Limited, FMC Corporation, Nufarm, Koppert Biological Systems, Biobest Group, Andermatt Biocontrol, Bionema, Certis |

| Key Market Opportunities | • Emerging Markets: Asia-Pacific and Latin America |

| Key Market Drivers | • Increasing Investment from Leading Crop Protection Companies • Growing Awareness About Environmental Safety • Increasing Government Initiatives to Promote the Use of Biopesticides |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Biopesticides Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Biopesticides market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Biopesticides market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Biopesticides Market.

Frequently Asked Questions (FAQ)

2. What are the 10 Years CAGR (2023 to 2033) of the global Biopesticides market?

- The global Biopesticides market is growing at a CAGR of ~25% over the next 10 years

3. Which region has the highest growth rate in the market of Biopesticides?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4. Which region accounted for the largest share of the market of Biopesticides?

- North America holds the largest share in 2022

5. Major Key Players in the Market of Blister Packaging?

- BAYER, Syngenta, UPL Limited, FMC Corporation, Nufarm, Koppert Biological Systems, Biobest Group, Andermatt Biocontrol, Bionema, and Certis are the major companies operating in the Biopesticides

6. Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7. Do you deliver sections of a report?

- Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.