Price range: $ 1,390.00 through $ 5,520.00

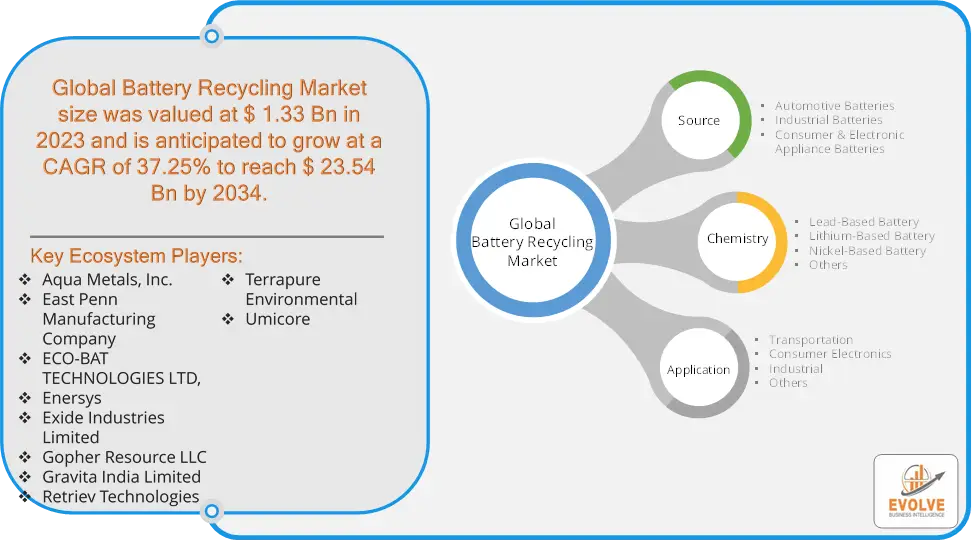

Battery Recycling Market Research Report: By Source (Automotive Batteries, Industrial Batteries, Consumer & Electronic Appliance Batteries), By Chemistry (Lead-Based Battery, Lithium-Based Battery, Nickel-Based Battery, Others), By Application (Transportation, Consumer Electronics, Industrial, Others), and by Region — Forecast till 2034

Page: 117

Description

Battery Recycling Market Overview

The Battery Recycling Market size accounted for USD 1.33 Billion in 2023 and is estimated to account for 2.20 Billion in 2024. The Market is expected to reach USD 23.54 Billion by 2034 growing at a compound annual growth rate (CAGR) of 37.25% from 2024 to 2034. In order to recover precious materials like lead, lithium, cobalt, and nickel, spent batteries are collected, disassembled, and processed. This process is known as battery recycling. In order to minimize environmental effect, reduce dependency on virgin materials, and satisfy sustainability goals, the market is driven by the increased demand for batteries in applications such as consumer electronics, renewable energy storage, and electric vehicles (EVs). Regulations, technological developments in recycling, and growing public awareness of the environmental risks associated with inappropriate battery disposal are major factors driving the industry. Batteries based on nickel, lithium-ion, and lead acid are the main varieties that are recycled.

Global Battery Recycling Market Synopsis

Global Battery Recycling Market Dynamics

Global Battery Recycling Market Dynamics

The major factors that have impacted the growth of Battery Recycling are as follows:

Drivers:

⮚ Technological Advancements in Recycling Processes

The efficiency and economics of recycling procedures are being improved by ongoing innovation in battery recycling technologies. Recycling has become more financially feasible thanks to new processes like hydrometallurgical and pyrometallurgical recycling procedures, which have made it simpler to recover valuable materials from discarded batteries. The market is anticipated to grow more productive and profitable as technology advances, which will further promote widespread usage.

Restraint:

- Lack of Adequate Collection Infrastructure

Much of the world’s infrastructure for recycling batteries is still in its infancy. The amount of used batteries that are properly disposed of or recycled is limited when there isn’t a strong and broad collection infrastructure in place. This is especially true in developing nations without adequate waste handling infrastructure. One major obstacle that still has to be overcome is the logistical difficulty of gathering batteries from enterprises, industries, and consumers—especially considering how widely distributed these sources are.

Opportunity:

⮚ Technological Advancements in Recycling Processes

Technological developments in battery recycling are opening doors to increase the process’s effectiveness and financial sustainability. Innovative techniques for recycling are being developed, like direct recycling, which makes it possible to recover cathode materials without disassembling them into basic materials. Technological innovations such as hydrometallurgical and pyrometallurgical processes are increasing the rate of material recovery while using less energy and cutting expenses. Manufacturers find recycling more enticing as a result of these technological advancements, which also raise the possibility of industry expansion, especially in emerging countries.

Battery Recycling Market Segment Overview

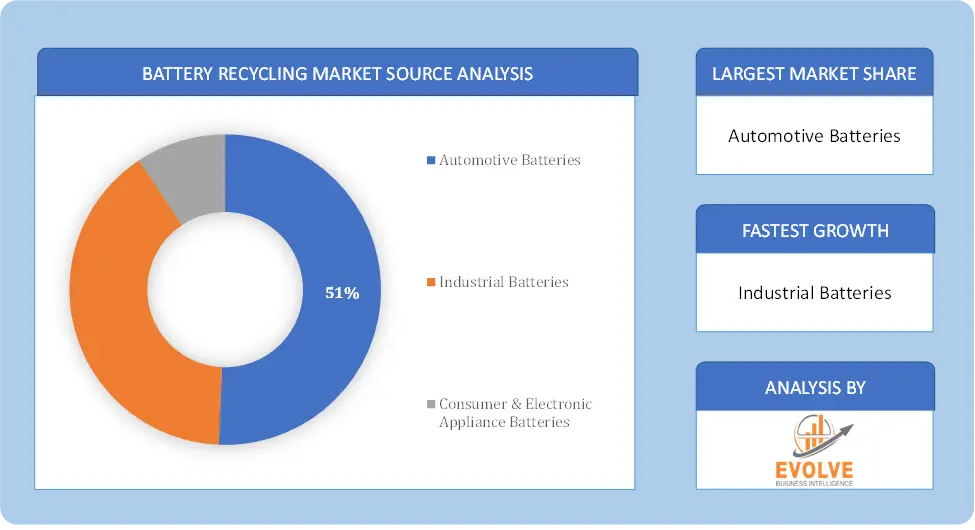

By Source

Based on the Source, the market is segmented based on Automotive Batteries, Industrial Batteries, Consumer & Electronic Appliance Batteries. the Automotive Batteries segment dominates, largely due to the high volume of lead-acid and lithium-ion batteries used in electric vehicles (EVs) and traditional automobiles, which require frequent recycling.

Based on the Source, the market is segmented based on Automotive Batteries, Industrial Batteries, Consumer & Electronic Appliance Batteries. the Automotive Batteries segment dominates, largely due to the high volume of lead-acid and lithium-ion batteries used in electric vehicles (EVs) and traditional automobiles, which require frequent recycling.

By Chemistry

Based on the Chemistry, the market has been divided into Lead-Based Battery, Lithium-Based Battery, Nickel-Based Battery, Others. the Lead-Based Battery segment dominates, primarily due to the widespread use and established recycling infrastructure for lead-acid batteries, particularly in automotive and industrial applications.

By Application

Based on Application, the market has been divided into Transportation, Consumer Electronics, Industrial, Others. the Transportation segment, driven by the increasing adoption of electric vehicles (EVs), dominates due to the high volume of lithium-ion batteries used in EVs that require recycling.

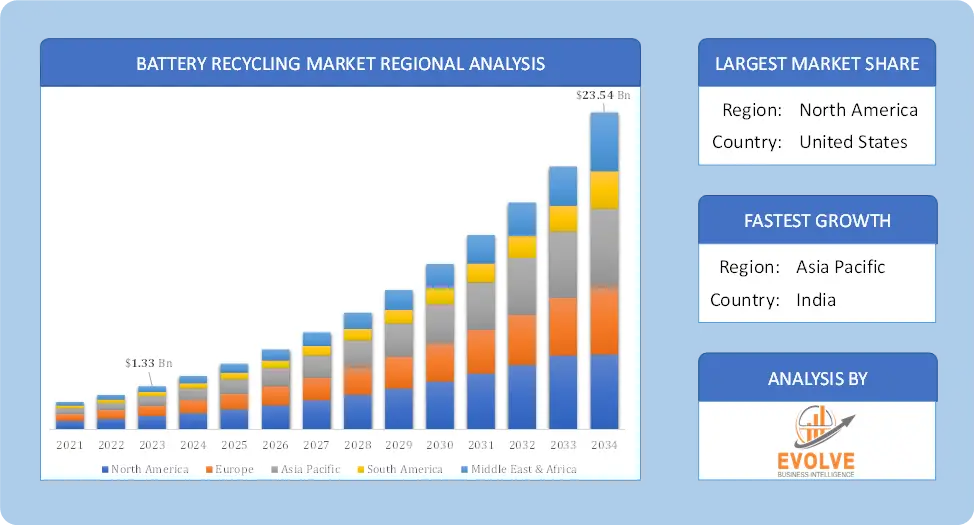

Global Battery Recycling Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Europe is anticipated to dominate the market for the usage of Battery Recycling, followed by those in Asia-Pacific and North America.

Battery Recycling Europe Market

Battery Recycling Europe Market

Europe dominates the Battery Recycling market due to several factors. Europe has long held a dominant position in the world market for recyclable batteries, with the UK, Germany, and Russia accounting for the majority of demand. In actuality, Germany continues to dominate the European lead-acid battery market. In addition to being consumed locally, lead-acid battery trade has continued to thrive in Germany as a regional hub.

Battery Recycling Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. During the projection period, the Asia Pacific region is expected to lead the market due to its highest predicted compound annual growth rate. The Asia Pacific market will expand as a result of rising environmental laws in the APAC region and a rise in the demand for electric vehicles. China, India, Japan, and South Korea will be the main drivers of this market.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Aqua Metals, Inc., East Penn Manufacturing Company, ECO-BAT TECHNOLOGIES LTD,, Enersys, and Exide Industries Limited are some of the leading players in the global Battery Recycling Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Aqua Metals, Inc.

- East Penn Manufacturing Company

- ECO-BAT TECHNOLOGIES LTD,

- Enersys

- Exide Industries Limited

- Gopher Resource LLC

- Gravita India Limited

- Retriev Technologies

- Terrapure Environmental

- Umicore

Key development:

In September 2023, Exide Industries made significant strides in the battery industry. The company invested an additional INR 1 billion in its lithium-ion cell manufacturing arm, Exide Energy Solutions Limited, which highlights its focus on expanding into the electric vehicle (EV) and energy storage markets. This move aligns with its broader strategy of growth in green technology solutions, particularly lithium-ion batteries, as it positions itself to meet the increasing demand for EVs and energy storage systems

Scope of the Report

Global Battery Recycling Market, by Source

- Automotive Batteries

- Industrial Batteries

- Consumer & Electronic Appliance Batteries

Global Battery Recycling Market, by Chemistry

- Lead-Based Battery

- Lithium-Based Battery

- Nickel-Based Battery

- Others

Global Battery Recycling Market, by Application

- Transportation

- Consumer Electronics

- Industrial

- Others

Global Battery Recycling Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $23.54 Billion |

| CAGR | 37.25% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Source, Chemistry, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Aqua Metals, Inc., East Penn Manufacturing Company, ECO-BAT TECHNOLOGIES LTD,, Enersys, Exide Industries Limited, Gopher Resource LLC, Gravita India Limited, Retriev Technologies, Terrapure Environmental, Umicore |

| Key Market Opportunities | • stringent government regulations and EPA (Environmental Protection Agency) guidelines aimed at reducing harmful emissions and reducing global pollution |

| Key Market Drivers | • Rising concerns over battery waste disposal, Strict government policies in light of the increased usage of lithium-ion battery |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Battery Recycling market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Battery Recycling market historical market size for the year 2022, and forecast from 2021 to 2034

- Battery Recycling market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Battery Recycling market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What are the 10 Years CAGR (2021 to 2034) of the global Battery Recycling market?

The global Battery Recycling market is growing at a CAGR of ~37.25% over the next 10 years

Which region has the highest growth rate in the market of Battery Recycling?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Battery Recycling?

Europe holds the largest share in 2023

Major Key Players in the Market of Battery Recycling?

Aqua Metals, Inc., East Penn Manufacturing Company, ECO-BAT TECHNOLOGIES LTD,, Enersys, Exide Industries Limited, Gopher Resource LLC, Gravita India Limited, Retriev Technologies, Terrapure Environmental, Umicore

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|

Table of Content

[html_block id="8559"]