Batter & Breader Premixes Market Overview

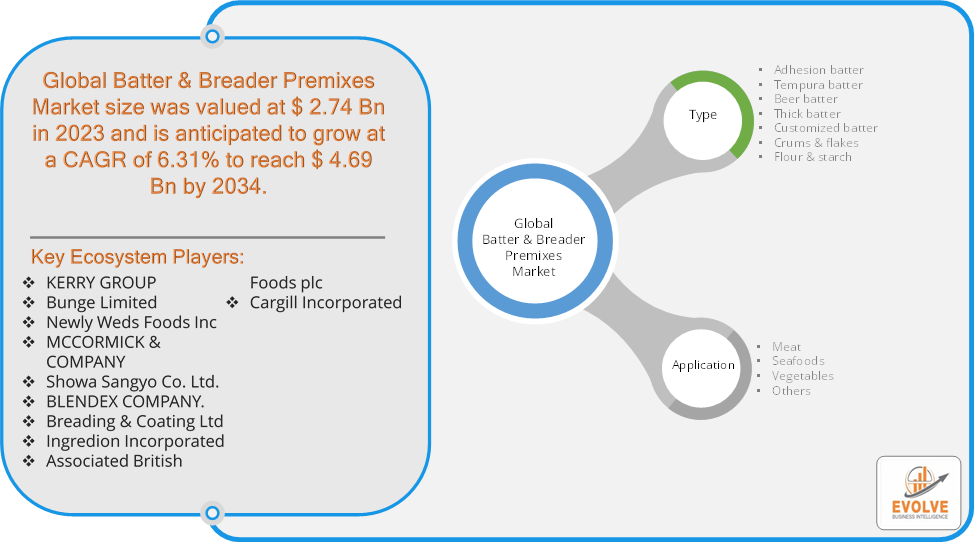

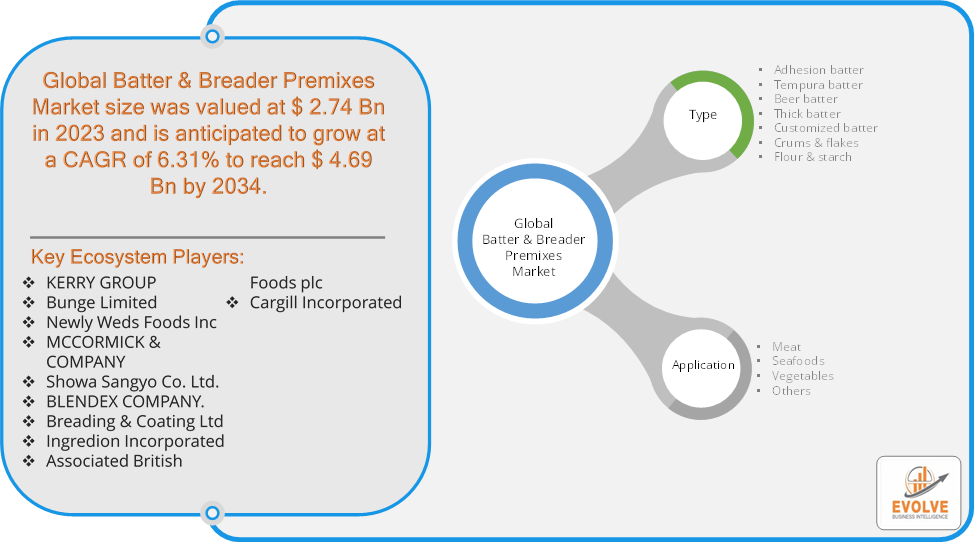

The Batter & Breader Premixes Market size accounted for USD 2.74 Billion in 2023 and is estimated to account for 2.91 Billion in 2024. The Market is expected to reach USD 4.69 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.31% from 2024 to 2034. Batter & breader premixes are pre-packaged blends of ingredients designed to coat food items before frying, baking, or grilling. These premixes typically include a combination of flours, starches, seasonings, and other additives to create a crispy, flavorful coating.

The batter & breader premixes market has seen significant growth, driven by factors such as increasing urbanization, busy lifestyles, and a growing preference for convenient and flavorful food. The Batter & Breader Premixes Market caters to both commercial and consumer needs, driven by the desire for convenience, quality, and innovation in food preparation.

Global Batter & Breader Premixes Market Synopsis

The major factors that have impacted the growth of Batter & Breader Premixes Market are as follows:

Drivers:

Ø Growing Fast Food and Quick Service Restaurants (QSR) Sector

The rise in fast food and QSR establishments increases the demand for premixes, as these businesses require efficient and consistent coating solutions for their menu items. The continuous introduction of new flavors, textures, and formulations in premixes caters to evolving consumer preferences and market trends. Innovations in health-conscious ingredients, such as reduced sodium or gluten-free options, also drive market growth. As global cuisines become more popular, there is a growing demand for diverse batter and breader options to cater to different culinary traditions and tastes.

Restraint:

- Perception of High Cost of Premium Ingredients and Fluctuations in Raw Material Prices

The use of high-quality or specialty ingredients in premixes can lead to higher production costs. This can affect the pricing of the final product and may limit market growth, especially in price-sensitive segments. The prices of key raw materials used in premixes, such as flour and spices, can fluctuate due to supply chain issues, environmental factors, or market conditions. These fluctuations can impact production costs and pricing.

Opportunity:

⮚ Growing Food Service Industry

The rise in fast food chains, quick-service restaurants (QSRs), and casual dining establishments drives demand for efficient and consistent batter and breader solutions. Providing customized solutions for these businesses can be a significant opportunity. The trend towards convenience foods and ready-to-eat products supports the growth of batter and breader premixes. As consumers seek quick meal solutions, premixes can offer a convenient and consistent coating option. Leveraging e-commerce platforms to reach a wider audience and offer direct-to-consumer sales can open up new distribution channels and increase market reach.

Batter & Breader Premixes Market Segment Overview

Based on Type, the market is segmented based on Adhesion batter, Tempura batter, Beer batter, Thick batter, Customized batter, Crums & flakes and Flour & starch. The adhesion batters dominant the market. They are designed to adhere to the crumbs or breading of the product, creating a binding layer that ensures the coating stays intact during cooking. They contain various ingredients like starches, flours, and gums, which enhance their stickiness and binding properties.

By Application

Based on Application, the market has been divided into Meat, Seafoods, Vegetables and Others. The meat segment dominant the market. due to the changing consumption patterns across the globe that favor meat as a primary source of protein. Batter and breader premixes are extensively used in preparing various meat dishes, including beef, pork, and lamb, to enhance flavor, texture, and appearance. Moreover, the increasing versatility of the premixes that allow for a range of culinary techniques, such as frying and baking, is boosting the market growth.

Global Batter & Breader Premixes Market Regional Analysis

Based on region, the global Batter & Breader Premixes Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Batter & Breader Premixes Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Batter & Breader Premixes Market. North America, particularly the United States and Canada, has a well-established food processing industry with high demand for convenience foods. The region sees significant use of batter and breader premixes in fast food and quick-service restaurants and growth is driven by innovation in flavors and formulations, along with increasing demand for healthier options. The presence of major food processing companies also supports market expansion.

Batter & Breader Premixes Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Batter & Breader Premixes Market industry. The Asia-Pacific region is experiencing rapid growth due to increasing urbanization, rising disposable incomes, and a booming food service industry. Countries like China, India, and Japan are key markets and there is significant potential in emerging markets due to the expanding middle class and changing eating habits. The demand for diverse flavors and ethnic premixes is also rising.

Competitive Landscape

The global Batter & Breader Premixes Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- KERRY GROUP

- Bunge Limited

- Newly Weds Foods Inc

- MCCORMICK & COMPANY

- Showa Sangyo Co. Ltd.

- BLENDEX COMPANY.

- Breading & Coating Ltd

- Ingredion Incorporated

- Associated British Foods plc

- Cargill Incorporated.

Key Development

In July 2022, Ingredion Incorporated opened a cutting-edge manufacturing facility in Shandong, China that has doubled its starch production capacity in the country.

In March 2023, Kerry Group plc inaugurated the Southern Europe Innovation Centre in Barcelona, Spain to develop novel and tailored batter and breader premixes solutions for the region.

Scope of the Report

Global Batter & Breader Premixes Market, by Type

- Adhesion batter

- Tempura batter

- Beer batter

- Thick batter

- Customized batter

- Crums & flakes

- Flour & starch.

Global Batter & Breader Premixes Market, by Application

- Meat

- Seafoods

- Vegetables

- Others

Global Batter & Breader Premixes Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 4.69 Billion |

| CAGR (2023-2033) | 6.31% |

| Base year | 2024 |

| Forecast Period | 2024-2034 |

| Historical Data | 2024 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | KERRY GROUP, Bunge Limited, Newly Weds Foods Inc, MCCORMICK & COMPANY, Showa Sangyo Co. Ltd., BLENDEX COMPANY, Breading & Coating Ltd, Ingredion Incorporated, Associated British Foods plc and Cargill Incorporated. |

| Key Market Opportunities | · Growing Food Service Industry

· E-commerce and Online Retail |

| Key Market Drivers | · Growing Fast Food and Quick Service Restaurants (QSR) Sector

· Innovation and Product Development |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Batter & Breader Premixes Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Batter & Breader Premixes Market historical market size for the year 2021, and forecast from 2023 to 2033

- Batter & Breader Premixes Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Batter & Breader Premixes Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Batter & Breader Premixes Market?

The global Batter & Breader Premixes Market is growing at a CAGR of 4.41% over the next 10 years

Which region has the highest growth rate in the market of Batter & Breader Premixes Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Batter & Breader Premixes Market?

North America holds the largest share in 2022

Who are the key players in the global Batter & Breader Premixes Market?

KERRY GROUP, Bunge Limited, Newly Weds Foods Inc, MCCORMICK & COMPANY, Showa Sangyo Co. Ltd., BLENDEX COMPANY, Breading & Coating Ltd, Ingredion Incorporated, Associated British Foods plc and Cargill Incorporated. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.