Aviation Fuel Market Overview

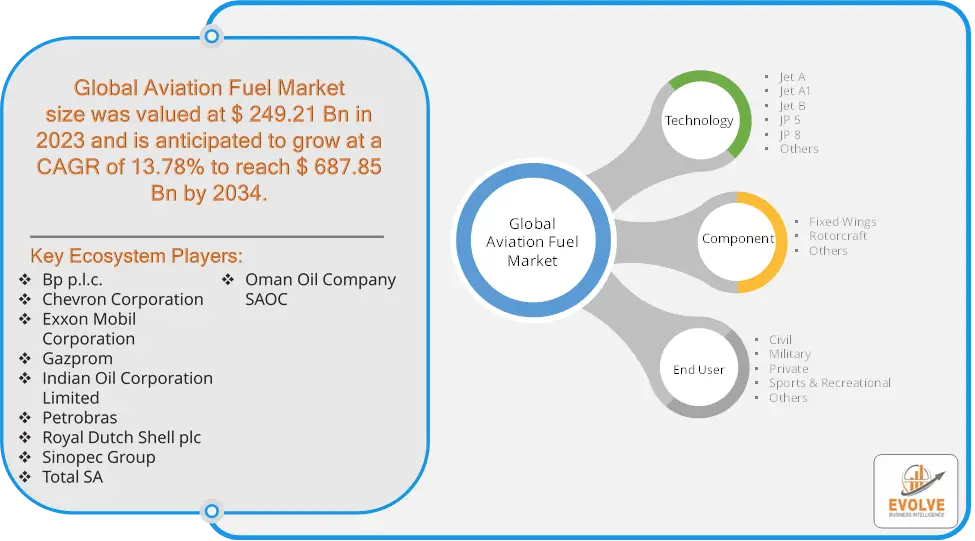

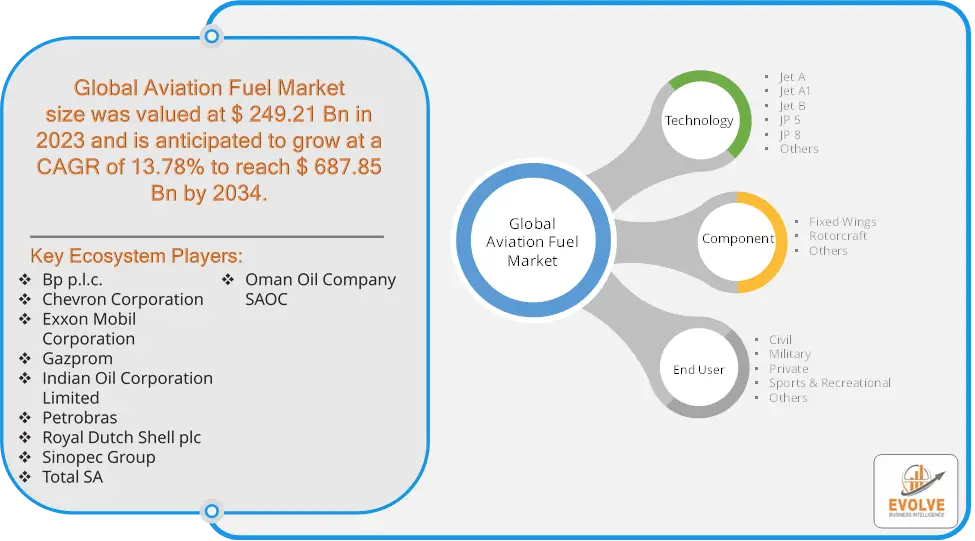

The Aviation Fuel Market size accounted for USD 249.21 Billion in 2023 and is estimated to account for 287.63 Billion in 2024. The Market is expected to reach USD 687.85 Billion by 2034 growing at a compound annual growth rate (CAGR) of 13.78% from 2024 to 2034. The aviation fuel market refers to the global industry involved in the production, distribution, and consumption of fuels used to power aircraft. It is a critical component of the aviation industry, as the availability and cost of aviation fuel directly impact the operations of airlines, airports, and other related businesses.

The aviation fuel market is a dynamic and essential component of the global aviation industry. It is influenced by various factors, including economic conditions, technological advancements, and environmental considerations. As the aviation industry continues to grow and evolve, the demand for aviation fuel is expected to remain strong, driving innovation and investment in this market.

Global Aviation Fuel Market Synopsis

The major factors that have impacted the growth of Aviation Fuel Market are as follows:

Drivers:

Ø Adoption of Sustainable Aviation Fuel (SAF)

Growing environmental concerns and strict government regulations regarding carbon emissions are driving the demand for eco-friendly alternatives like biofuels and synthetic fuels. The rise in aircraft production and fleet expansion by airlines contributes to a corresponding increase in fuel consumption. Rapid urbanization and the growth of international tourism, especially in developing regions, are contributing to the rising demand for aviation fuel. While newer aircraft are designed to be more fuel-efficient, the overall increase in the number of flights and aircraft in operation still leads to a growing fuel demand.

Restraint:

- Perception of High Costs of Sustainable Aviation Fuels (SAF) and Slow Technological Transition

While SAF presents a cleaner alternative to conventional aviation fuels, its production costs are currently much higher. This price disparity limits widespread adoption and impacts the overall aviation fuel market. The adoption of more fuel-efficient aircraft and alternative propulsion technologies (such as electric or hydrogen-powered planes) is progressing slowly, which can delay any significant reduction in conventional aviation fuel demand.

Opportunity:

⮚ Development of Hybrid and Electric Aircraft

The development of hybrid-electric and fully electric aircraft presents an opportunity for fuel producers to diversify their offerings. The transition period will see a combination of conventional fuels and electric propulsion systems, creating room for innovation in fuel efficiency and cleaner alternatives. Improvements in fuel efficiency through new engine technologies and lighter aircraft materials offer opportunities for fuel producers to work closely with aircraft manufacturers. This could lead to specialized fuel formulations optimized for next-generation aircraft.

Aviation Fuel Market Segment Overview

By Technology

By Component

Based on Component, the market segment has been divided into Fixed Wings, Rotorcraft and Others. The Fixed Wings segment dominant the market. The use of fixed-wing aircraft in military operations, such as fighter jets, transport planes, and surveillance aircraft, contributes to substantial fuel consumption in this segment and With the growth of e-commerce and the expansion of global trade, air cargo fleets, which consist primarily of fixed-wing aircraft, require consistent fuel supplies to support worldwide logistics networks.

By End User

Based on End User, the market segment has been divided into Civil, Military, Private, Sports & Recreational and Others. The Military segment dominant the market. Military fuels typically undergo more stringent testing to ensure they meet the performance needs of various aircraft types, particularly under harsh conditions such as extreme temperatures and high altitudes and Ongoing military operations, training, and international deployments contribute to high fuel consumption. Geopolitical tensions and conflicts tend to increase operational flights and, subsequently, fuel demand.

Global Aviation Fuel Market Regional Analysis

Based on region, the global Aviation Fuel Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Aviation Fuel Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Aviation Fuel Market. North America is one of the largest aviation fuel markets due to its well-established commercial aviation sector, extensive air travel networks, and major airlines. The growing adoption of Sustainable Aviation Fuels (SAF), particularly in the U.S., is driven by stringent environmental regulations and industry commitments to reducing carbon emissions and Increased air travel, cargo transportation, and the presence of major airlines and aerospace companies contribute to the growth of the North American aviation fuel market.

Aviation Fuel Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Aviation Fuel Market industry. The Asia-Pacific region is experiencing rapid growth in air travel due to rising disposable incomes, expanding middle-class populations, and increasing tourism and business travel. This region is one of the fastest-growing aviation markets globally, driving high demand for conventional aviation fuel and the Asia-Pacific region is experiencing the most rapid growth in the aviation fuel market, fueled by rapid economic development, increasing urbanization, and rising disposable incomes. China, India, Japan, and South Korea are major markets for aviation fuel in this region.

Competitive Landscape

The global Aviation Fuel Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Bp p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- Gazprom

- Indian Oil Corporation Limited

- Petrobras

- Royal Dutch Shell plc

- Sinopec Group

- Total SA

- Oman Oil Company SAOC

Key Development

In January 2023, Abu Dhabi National Oil organization (ADNOC), Masdar, a United Arab Emirates renewable energy organization, and BP (BP.L), a major oil company, have chosen to conduct a cooperative study on the development of sustainable aviation fuel (SAF) in the United Arab Emirates (UAE).

Scope of the Report

Global Aviation Fuel Market, by Technology

- Jet A

- Jet A1

- Jet B

- JP 5

- JP 8

- Others

Global Aviation Fuel Market, by Component

- Fixed Wings

- Rotorcraft

- Others

Global Aviation Fuel Market, by End User

- Civil

- Military

- Private

- Sports & Recreational

- Others

Global Aviation Fuel Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $687.85 Billion |

| CAGR | 13.78% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Component, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Bp p.l.c., Chevron Corporation, Exxon Mobil Corporation, Gazprom, Indian Oil Corporation Limited, Petrobras, Royal Dutch Shell plc, Sinopec Group, Total SA and Oman Oil Company SAOC |

| Key Market Opportunities | • Development of Hybrid and Electric Aircraft • Technological Advancements in Fuel Efficiency |

| Key Market Drivers | • Adoption of Sustainable Aviation Fuel (SAF) • Urbanization and Tourism Growth |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Aviation Fuel Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Aviation Fuel Market historical market size for the year 2021, and forecast from 2023 to 2033

- Aviation Fuel Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Aviation Fuel Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Aviation Fuel Market?

The global Aviation Fuel Market is growing at a CAGR of 13.78% over the next 10 years

Which region has the highest growth rate in the market of Aviation Fuel Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Aviation Fuel Market?

North America holds the largest share in 2022

Who are the key players in the global Aviation Fuel Market?

Bp p.l.c., Chevron Corporation, Exxon Mobil Corporation, Gazprom, Indian Oil Corporation Limited, Petrobras, Royal Dutch Shell plc, Sinopec Group, Total SA and Oman Oil Company SAOC. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives