Anti-Drone Market Overview

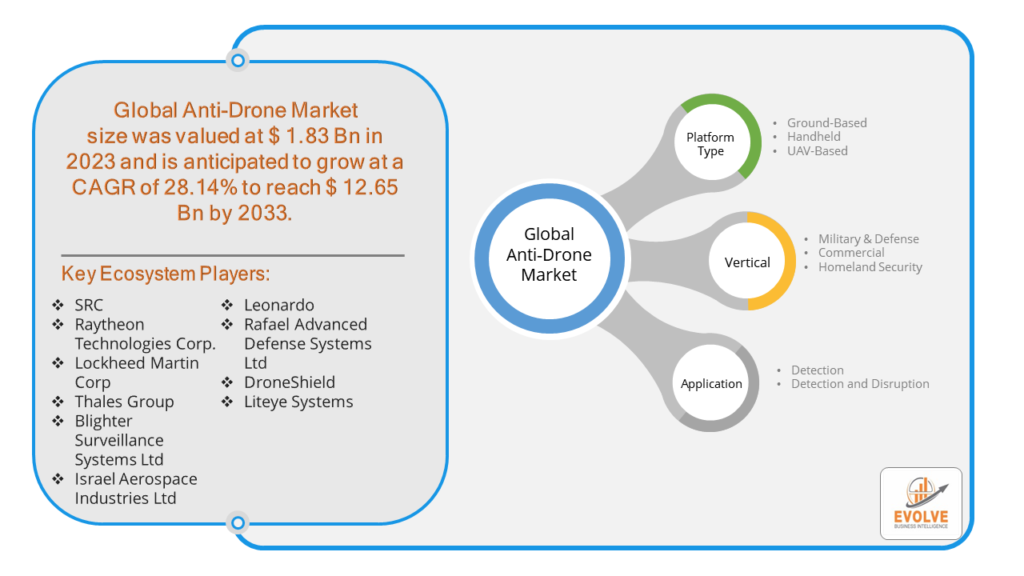

The Anti-Drone Market Size is expected to reach USD 12.65 Billion by 2033. The Anti-Drone Market industry size accounted for USD 1.83 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 28.14% from 2023 to 2033. The Anti-Drone Market refers to the industry focused on developing and providing technologies, solutions, and services aimed at detecting, identifying, and neutralizing unauthorized or hostile drones. As the use of drones has become widespread for various applications, including commercial, recreational, and military purposes, there has been a growing need to address the potential threats and security risks posed by their misuse.

The Anti-Drone Market is a rapidly evolving sector with significant growth potential, driven by the need for enhanced security measures and the continuous advancement in drone technology. The type of anti-drone system that is best for a particular application will depend on the specific threat that needs to be addressed.

Global Anti-Drone Market Synopsis

The COVID-19 pandemic had a significant impact on the Anti-Drone Market. The pandemic heightened the need for security around critical infrastructure, healthcare facilities, and public spaces to ensure compliance with lockdowns and prevent unauthorized drone activity. With restrictions on movement, there was an increase in the use of drones for delivery services, surveillance, and medical supply transport. This heightened drone activity led to a corresponding demand for anti-drone technologies to manage and control unauthorized use. The pandemic caused significant disruptions in global supply chains, affecting the manufacturing and distribution of anti-drone systems. Delays in the production of components and the availability of raw materials impacted the timely delivery of these systems. Many anti-drone technology deployment projects were delayed or put on hold due to lockdowns, travel restrictions, and the need to prioritize immediate pandemic response measures. The pandemic accelerated innovation in remote monitoring and automation, leading to the development of more advanced and efficient anti-drone technologies.

Anti-Drone Market Dynamics

The major factors that have impacted the growth of Anti-Drone Market are as follows:

Drivers:

Ø Technological Advancements

Advancements in radar, radio frequency (RF) detection, acoustic sensors, and optical systems have enhanced the ability to detect and identify drones more accurately and at greater distances. The development of advanced neutralization techniques, such as jamming, GPS spoofing, lasers, and kinetic interceptors, has improved the effectiveness of anti-drone systems. Sectors such as airports, prisons, stadiums, and power plants are increasingly adopting anti-drone technologies to prevent disruptions and enhance security. Heightened awareness of the potential risks posed by drones has led to greater acceptance and demand for anti-drone solutions among individuals and businesses. The integration of anti-drone technologies with existing security systems, such as surveillance cameras and alarm systems, provides comprehensive security solutions, attracting more users.

Restraint:

- Perception of High Costs

The cost of developing and deploying advanced anti-drone technologies can be prohibitive for many organizations. High initial investment in detection and countermeasure systems may deter potential buyers, particularly small and medium-sized enterprises (SMEs). Ongoing costs for maintaining and upgrading these systems can also be significant, impacting long-term adoption. A lack of awareness and understanding of the capabilities and benefits of anti-drone technologies can limit their adoption. Educating potential users about the importance of these systems is crucial for market growth.

Opportunity:

⮚ Growing demand for AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) can enhance the detection, identification, and neutralization of drones. These technologies can improve accuracy and response times, making anti-drone systems more effective. Development of advanced sensors, such as hyperspectral imaging and high-resolution radar, can improve the ability to detect and track drones in various environments and conditions. Increased efforts to educate the public and potential users about the risks posed by unauthorized drones and the benefits of anti-drone technologies. Development of training programs for security personnel and law enforcement to effectively use and manage anti-drone systems.

Anti-Drone Market Segment Overview

By Platform Type

By Application

Based on Application, the market segment has been divided into the Detection and Disruption. The detection radar segment dominated the market, due to the unauthorized; drones can be neutralized with the help of this machine after the detection, classification, and identification of the particular device. The defense forces mainly use these machines and technologies, which help them, provide maximum security against the unauthorized entry of drones in restricted areas and bases. The potential attacks can be avoided with the help of these systems as it monitors the entry and exit of every drone spotted on the premises.

By Vertical

Based on Vertical, the market segment has been divided into the Military & Defense, Commercial and Homeland Security. Defense has emerged as the leading segment due to the huge consumption and utilization of such technologies in this field. The usage of anti-drone systems has been rapidly absorbed in this particular sector which deals with a country’s national security. The various terrorist activities and illegal operations have recently increased, which can be curtailed with advanced technologies such as anti-drone systems.

Global Anti-Drone Market Regional Analysis

Based on region, the global Anti-Drone Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Anti-Drone Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Anti-Drone Market. North America is one of the largest and most mature markets for anti-drone technologies, driven by high adoption rates and significant investments in security infrastructure. Increased drone activity, stringent regulations, and a high incidence of security breaches involving drones. Government initiatives, such as the U.S. Federal Aviation Administration (FAA) regulations, support market growth.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Anti-Drone Market industry. The Asia-Pacific region is expected to experience significant growth due to increasing drone usage and rising security concerns in countries like China, India, and Japan. Rapid urbanization, increasing drone incidents, and government initiatives to enhance airspace security. Countries like China and India are investing heavily in anti-drone technologies for both civilian and military applications.

Competitive Landscape

The global Anti-Drone Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- SRC

- Raytheon Technologies Corp.

- Lockheed Martin Corp

- Thales Group

- Blighter Surveillance Systems Ltd

- Israel Aerospace Industries Ltd

- Leonardo

- Rafael Advanced Defense Systems Ltd

- DroneShield

- Liteye Systems

Key Development

In May 2022, DroneShield, a prominent provider of RF sensing, artificial intelligence, and machine learning systems, successfully deployed its DroneSentry solution to ensure comprehensive coverage for the 2022 IRONMAN Texas triathlon event held in April 2022. This deployment showcased the company’s ability to provide city-wide protection against unauthorized drones during high-profile events.

In October 2021, DroneShield Ltd announced that the US Department of Homeland Security had procured multiple units of its DroneSentry-X systems. These cutting-edge systems offer on-the-move capabilities for countering unmanned aerial systems (C-UAS), further strengthening the Department’s ability to detect and mitigate potential threats from unauthorized drones.

Scope of the Report

Global Anti-Drone Market, by Platform Type

- Ground-Based

- Handheld

- UAV-Based

Global Anti-Drone Market, by Application

- Detection

- Detection and Disruption

Global Anti-Drone Market, by Vertical

- Military & Defense

- Commercial

- Homeland Security

Global Anti-Drone Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $12.65 Billion/strong> |

| CAGR | 28.14% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Platform Type, Application, Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | SRC, Raytheon Technologies Corp., Lockheed Martin Corp, Thales Group, Blighter Surveillance Systems Ltd, Israel Aerospace Industries Ltd, Leonardo, Rafael Advanced Defense Systems Ltd, DroneShield and Liteye Systems |

| Key Market Opportunities | • The growing demand for AI and Machine Learning • Public Awareness and Education |

| Key Market Drivers | • Technological Advancements • Rising Awareness and Adoption |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Anti-Drone Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Anti-Drone Market historical market size for the year 2021, and forecast from 2023 to 2033

- Anti-Drone Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Anti-Drone Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Anti-Drone Market?

The global Anti-Drone Market is growing at a CAGR of 28.14% over the next 10 years

Which region has the highest growth rate in the market of Anti-Drone Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Anti-Drone Market?

North America holds the largest share in 2022

Who are the key players in the global Anti-Drone Market?

SRC, Raytheon Technologies Corp., Lockheed Martin Corp, Thales Group, Blighter Surveillance Systems Ltd, Israel Aerospace Industries Ltd, Leonardo, Rafael Advanced Defense Systems Ltd, DroneShield and Liteye Systems. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.