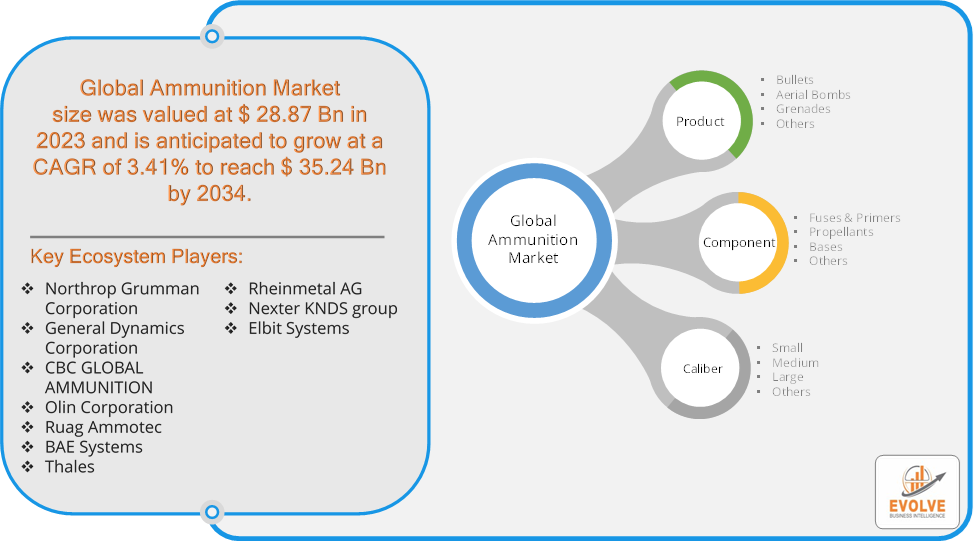

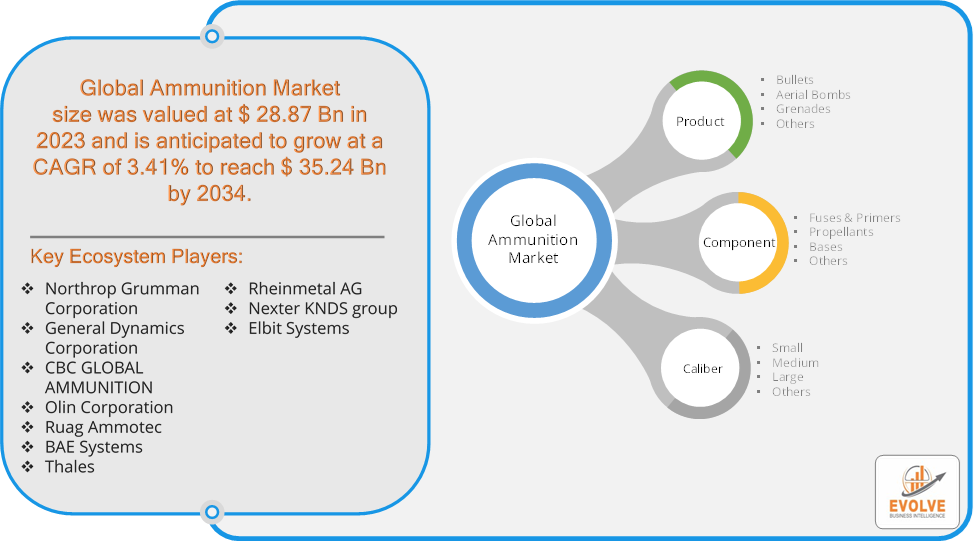

Ammunition Market Overview

The Ammunition Market size accounted for USD 28.87 Billion in 2023 and is estimated to account for 29.10 Billion in 2024. The Market is expected to reach USD 35.24 Billion by 2034 growing at a compound annual growth rate (CAGR) of 3.41% from 2024 to 2034. The Ammunition Market encompasses the production, distribution, and sale of projectiles such as bullets, shells, bombs, and other explosive devices used by military, law enforcement, and civilian sectors. It is driven by rising defense budgets, increasing geopolitical tensions, and the need for military modernization. The market is segmented by product type (small, medium, and large caliber), application (defense, law enforcement, hunting, sports), and end-user. Technological advancements, such as smart munitions and guided projectiles, are key trends, along with a growing demand for non-lethal ammunition in law enforcement. The market is highly competitive, with both established defense contractors and new entrants.

Global Ammunition Market Synopsis

The major factors that have impacted the growth of Ammunition are as follows:

Drivers:

⮚ Increasing Defense Spending and Military Modernization

One of the most significant drivers of the ammunition market is the continuous rise in global defense budgets. Governments across the world, particularly in regions such as North America, Europe, and Asia-Pacific, are investing heavily in modernizing their armed forces to maintain military readiness. Countries are expanding their arsenals and upgrading outdated ammunition systems to incorporate more advanced technologies, such as smart munitions and precision-guided ammunition, improving accuracy and reducing collateral damage.

Restraint:

- Risk of Obsolescence Due to Technological Advancements

While technological advancements, such as smart ammunition and precision-guided munitions, offer opportunities for the market, they also pose a restraint for traditional ammunition manufacturers. Companies that are unable or unwilling to invest in R&D to keep pace with innovations may find their products becoming obsolete. The rapid development of new technologies can outdate older, conventional ammunition, making it less attractive to military customers who seek advanced, high-tech solutions for modern warfare.

Opportunity:

⮚ Growing Demand for Non-Lethal Ammunition

As governments and law enforcement agencies increasingly focus on crowd control, counter-terrorism, and public safety, the demand for non-lethal ammunition is rising. This includes rubber bullets, stun grenades, bean bags, and tear gas, which are used during riots, protests, and situations requiring non-lethal force

Ammunition Market Segment Overview

Based on the Product, the market is segmented based on Bullets, Aerial Bombs, Grenades, Others. the bullets segment dominates, primarily due to their extensive use in military, law enforcement, and civilian applications like personal defense, hunting, and shooting sports.

By Component

Based on the Component, the market has been divided into Fuses & Primers, Propellants, Bases, Others. the propellants segment dominates, as they are a critical component in generating the explosive force needed to launch projectiles, making them essential across various ammunition types.

By Caliber

Based on Caliber, the market has been divided into Small, Medium, Large, Others. the small caliber segment typically dominates, driven by its widespread use in military, law enforcement, and civilian applications such as personal defense, hunting, and shooting sports.

Global Ammunition Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Ammunition, followed by those in Asia-Pacific and Europe.

North America dominates the Ammunition market due to several factors. North America held a 37.2% share of the ammunition market in 2022, with shares of 30.2%, Asia-Pacific, and Europe coming in second and third, respectively. Developing nations like China and India are anticipated to show significant growth over the course of the forecast period.

Ammunition Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. The Asia Pacific Ammunition Market is experiencing rapid growth due to increased defense spending, rising regional tensions, and military modernization efforts in countries like China, India, and South Korea. The region’s growing focus on border security and defense capabilities drives demand for both small and large-caliber ammunition, making it a key market for global manufacturers.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Northrop Grumman Corporation, General Dynamics Corporation, CBC GLOBAL AMMUNITION, Olin Corporation, and Ruag Ammotec are some of the leading players in the global Ammunition Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Northrop Grumman Corporation

- General Dynamics Corporation

- CBC GLOBAL AMMUNITION

- Olin Corporation

- Ruag Ammotec

- BAE Systems

- Thales

- Rheinmetal AG

- Nexter KNDS group

- Elbit Systems

Key development:

February-2023, Northrop Grumman, Global Military Products was awarded $522M worth of ammunition contracts for Ukrainian aid.

Scope of the Report

Global Ammunition Market, by Product

- Bullets

- Aerial Bombs

- Grenades

- Others

Global Ammunition Market, by Component

- Fuses & Primers

- Propellants

- Bases

- Others

Global Ammunition Market, by Caliber

- Small

- Medium

- Large

- Others

Global Ammunition Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 35.24 Billion |

| CAGR (2021-2034) | 3.41% |

| Base year | 2023 |

| Forecast Period | 2021-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Component, Caliber |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Northrop Grumman Corporation, General Dynamics Corporation, CBC GLOBAL AMMUNITION, Olin Corporation, Ruag Ammotec, BAE Systems, Thales, Rheinmetal AG, Nexter KNDS group, Elbit Systems |

| Key Market Opportunities | · Increasing focus on development of smart ammunition technologies. |

| Key Market Drivers | · Rising number of armed conflicts and border disputes

· Modernization of military and law enforcement agencies |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Ammunition market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Ammunition market historical market size for the year 2022, and forecast from 2021 to 2034

- Ammunition market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Ammunition market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What are the 10 Years CAGR (2021 to 2034) of the global Ammunition market?

The global Ammunition market is growing at a CAGR of ~3.41% over the next 10 years

Which region has the highest growth rate in the market of Ammunition?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Ammunition?

North America holds the largest share in 2023

Major Key Players in the Market of Ammunition?

Northrop Grumman Corporation, General Dynamics Corporation, CBC GLOBAL AMMUNITION, Olin Corporation, Ruag Ammotec, BAE Systems, Thales, Rheinmetal AG, Nexter KNDS group, Elbit Systems

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.