Agriculture enzymes Market Overview

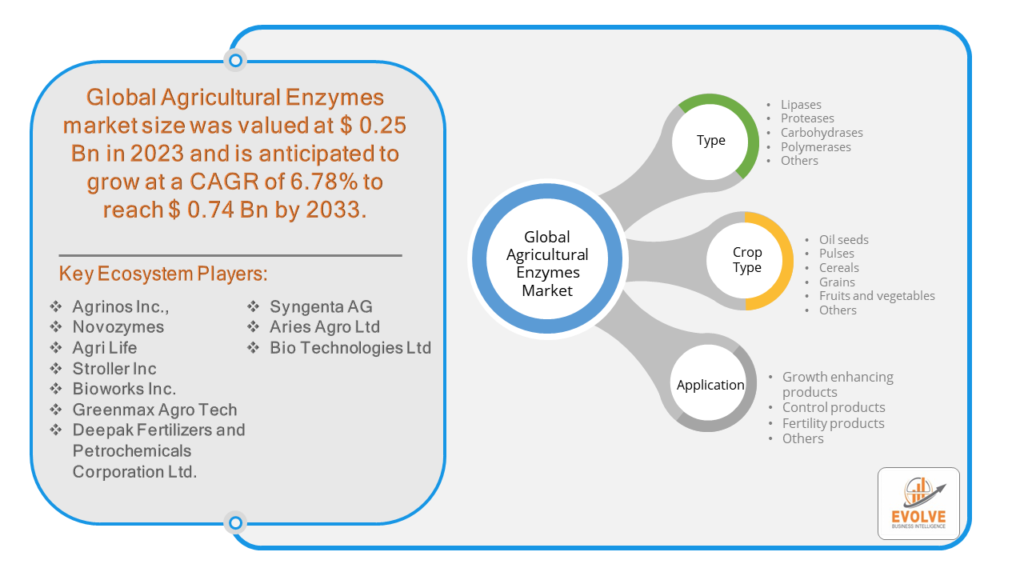

The Agriculture enzymes Market Size is expected to reach USD 0.74 Billion by 2033. The Agriculture enzymes industry size accounted for USD 0.25 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.78% from 2023 to 2033. The agricultural enzymes market involves the use of biological molecules to enhance crop production, soil fertility, and plant growth regulation. Key industry players include DuPont, BASF SE, Bayer AG, Novozymes A/S, and others. North America leads the market, driven by advanced agricultural practices and significant investments in technology. The market is projected to reach around USD 623 million by 2033, growing at a CAGR of 6.9%. Enzymes are crucial for various applications like crop protection, soil fertility, and plant growth regulation across different crop types such as grains, cereals, oil seeds, fruits, and vegetables.

Global Agriculture enzymes Market Synopsis

The Agriculture enzymes market experienced a positive impact due to the COVID-19 pandemic. Due to supply chain disruptions brought on by the COVID-19 pandemic, there are either shortages or decreased demand in the market for agricultural enzymes. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, leading manufacturers, developers, and service providers to implement several measures in an attempt to stabilize their businesses.

Global Agriculture enzymes Market Dynamics

The major factors that have impacted the growth of Agriculture enzymes are as follows:

Drivers:

⮚ Advancements in Biotechnology and Enzyme Engineering

Continuous advancements in biotechnology, particularly in enzyme engineering and microbial bioprospecting, have led to the development of novel enzymes with enhanced efficacy and specificity for agricultural applications. These technological innovations have expanded the range of enzymes available to farmers, offering tailored solutions for various agricultural challenges.

Restraint:

- Limited Awareness and Understanding

espite increasing awareness, there remains a lack of comprehensive understanding among farmers regarding the efficacy, application methods, and benefits of enzyme-based products. Many farmers may be hesitant to adopt these products due to a lack of familiarity or skepticism about their performance relative to traditional chemical

Opportunity:

⮚ Expanding Organic and Sustainable Agriculture

The increasing demand for organic and sustainably produced food presents a significant opportunity for enzyme manufacturers. Enzyme-based products align well with organic farming principles, offering natural and environmentally friendly solutions for soil health management, pest control, and nutrient optimization. As consumer awareness and demand for organic products continue to rise, there is a growing market for enzyme-based inputs in organic and sustainable agriculture.

Agriculture enzymes Market Segment Overview

By Type

By Crop Type

Based on the Crop Type, the market has been divided into Oil seeds, Pulses, Cereals, Grains, Fruits and vegetables and Others. The cereals & grains categories have the largest market share. For the majority of people on the planet, especially in the Asia-Pacific area, rice is the most widely consumed staple meal. After maize, rice is the grain that is produced worldwide on the second largest scale.

By Application

Based on Application, the market has been divided into Growth enhancing product, Control products, Fertility products and Others. The agricultural enzymes market’s application segment is categorized into fertility products, control products, and growth augmenting products. These enzymes play a crucial role in enhancing soil fertility, crop protection, and promoting plant growth regulation, contributing to improved agricultural practices and increased crop yields.

Global Agriculture enzymes Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Agriculture enzymes, followed by those in Asia-Pacific and Europe.

North America dominates the Agriculture enzymes market due to several factors. The market for agricultural enzymes is anticipated to be dominated by North America. The need for agricultural enzymes has surged in the region due to the growing demand for organic products and the implementation of precision farming and organic farming methods.

Agriculture enzymes Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. From 2023 to 2032, the Asia-Pacific Agricultural Enzymes Market is anticipated to develop at the quickest compound annual growth rate (CAGR). This is a result of farmers’ growing awareness of the advantages of using agricultural enzymes into their farming methods. In addition, the agricultural enzymes market in China had the most market share, while the market in India had the quickest rate of growth in the Asia-Pacific area.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Agrinos Inc., Novozymes, AGRI LIFE, Stroller Inc, and Bioworks Inc are some of the leading players in the global Agriculture enzymes Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Agrinos Inc.

- Novozymes

- AGRI LIFE

- Stroller Inc

- Bioworks Inc

- Greenmax Agro Tech

- Deepak Fertilizers and Petrochemicals Corporation Ltd.

- Syngenta AG

- Aries Agro Ltd

- Bio Technologies Ltd.

Key development:

In June 2022, Belgian and Novozymes formed a partnership to expand Evoca’s potential. Novozymes is the world’s largest supplier of enzyme and microbial technologies for agriculture and a variety of other sectors. Evoca, Biotalys’ new eco-friendly bio fungicide, has not yet been approved. However, the company has already formed a relationship to investigate future prospects for protein-based goods.

Scope of the Report

Global Agriculture enzymes Market, by Type

- Lipases

- Proteases

- Carbohydrases

- Polymerases

- Others

Global Agriculture enzymes Market, by Crop Type

- Oil seeds

- Pulses

- Cereals

- Grains

- Fruits and vegetables

- Others

Global Agriculture enzymes Market, by Application

- Growth enhancing products

- Control products

- Fertility products

- Others

Global Agriculture enzymes Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $0.74 Billion |

| CAGR | 6.78% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Crop Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Agrinos Inc., Novozymes, AGRI LIFE, Stroller Inc, Bioworks Inc, Greenmax Agro Tech, Deepak Fertilizers and Petrochemicals Corporation Ltd., Syngenta AG, Aries Agro Ltd, Bio Technologies Ltd. |

| Key Market Opportunities | • Adoption of organic and precision farming practices. |

| Key Market Drivers | • Rising Demand for Organic Agricultural Products |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Agriculture enzymes Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Agriculture enzymes market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Agriculture enzymes market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Agriculture enzymes Market.

Frequently Asked Questions (FAQ)

Who are the key players in the Agriculture enzymes industry?

Key players include DuPont, BASF SE, Bayer AG, Novozymes A/S, among others

What are the major factors driving the growth of the Agriculture enzymes market?

Advancements in biotechnology and enzyme engineering are significant drivers

Which region dominates the Agriculture enzymes market?

North America leads the market, followed by Asia-Pacific and Europe

What are the primary applications of agricultural enzymes?

Agricultural enzymes are used for growth enhancement, control, and fertility products, improving soil health and crop yield