Price range: $ 1,390.00 through $ 5,520.00

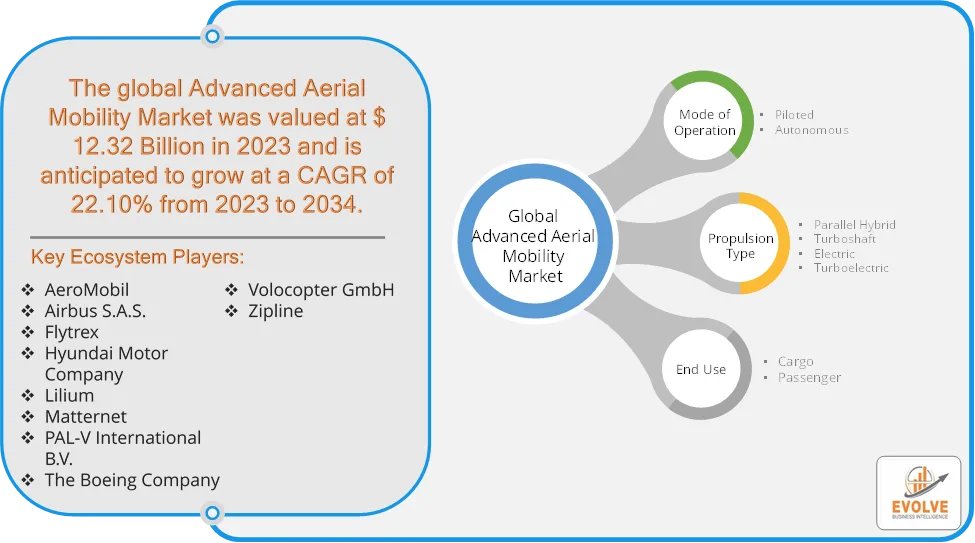

Advanced Aerial Mobility Market Research Report: Information By Mode of Operation (Piloted, Autonomous), Propulsion Type (Parallel Hybrid, Turboshaft, Electric, Turboelectric), By End-Use (Cargo, Passenger), and by Region — Forecast till 2033

Page: 129

Description

Advanced Aerial Mobility Market Overview

The Advanced Aerial Mobility Market size accounted for USD 12.32 Billion in 2023 and is estimated to account for 15.47 Billion in 2024. The Market is expected to reach USD 45.63 Billion by 2034 growing at a compound annual growth rate (CAGR) of 22.10% from 2024 to 2034. Advanced Aerial Mobility (AAM), also known as Advanced Air Mobility, refers to the development and integration of innovative aircraft technologies aimed at transforming air transportation. Its goal is to enhance transportation efficiency across diverse environments, from urban areas to remote locations, by enabling passenger travel, cargo transport, emergency response, and other services through advanced technologies and air traffic management systems.

The Advanced Aerial Mobility market is poised to revolutionize transportation by leveraging cutting-edge technology to create more efficient, sustainable, and accessible air travel. The AAM market presents substantial opportunities for innovation, economic growth, and the transformation of transportation systems globally.

Global Advanced Aerial Mobility Market Synopsis

Advanced Aerial Mobility Market Dynamics

Advanced Aerial Mobility Market Dynamics

The major factors that have impacted the growth of Advanced Aerial Mobility Market are as follows:

Drivers:

Ø Advancements in Electric Propulsion and Battery Technology

Improvements in battery energy density, charging infrastructure, and lightweight materials have made electric and hybrid-electric propulsion systems viable for AAM. The development of hydrogen fuel cells and next-gen lithium-ion batteries is further enhancing aircraft range and performance. Autonomous flight technologies, AI-driven navigation, and advanced sense-and-avoid systems are improving the safety and efficiency of AAM vehicles and 5G connectivity and AI-powered traffic management systems will enable seamless integration of AAM into urban mobility networks.

Restraint:

- High Initial Costs and Investment Requirements

The development and deployment of eVTOLs, vertiports, and air traffic management systems require significant capital investment. The high cost of R&D, manufacturing, and infrastructure development makes it difficult for startups and smaller companies to enter the market. Potential mid-air collisions, mechanical failures, or cyberattacks raise concerns about the safety of AAM and Noise pollution from eVTOLs in urban environments could lead to public resistance against widespread adoption.

Opportunity:

⮚ Integration of AI and Autonomous Flight Technologies

AI-driven autonomous flying systems can reduce the need for pilots, lowering operational costs. Advanced sense-and-avoid systems and AI-powered traffic management will enable safer AAM deployment. Drone deliveries and eVTOL-based cargo transport present major growth opportunities, especially for e-commerce and medical supplies. AAM can revolutionize medical transport, disaster relief, and organ delivery by reducing response times and Air ambulance services using eVTOLs are gaining traction in regions with limited infrastructure.

Advanced Aerial Mobility Market Segment Overview

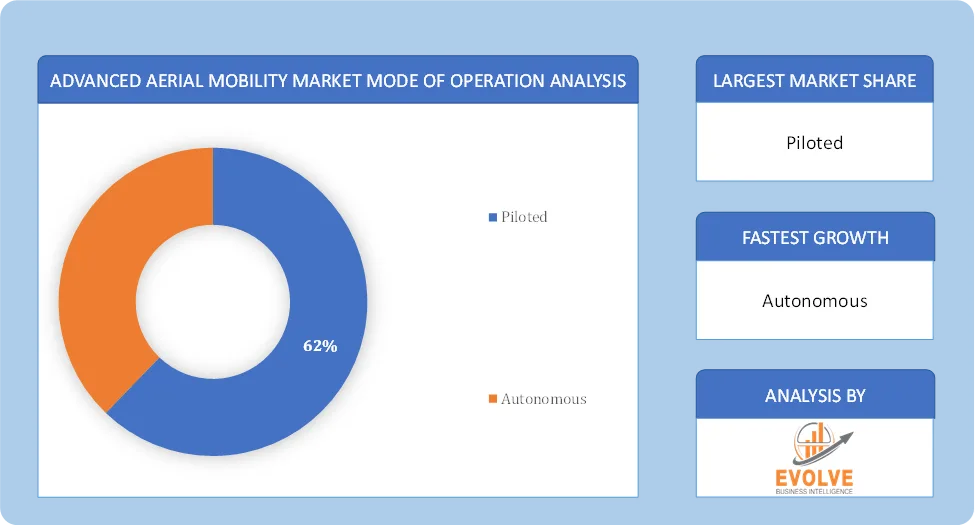

Based on Mode of Operation, the market is segmented based on Piloted and Autonomous. The Piloted segment held a dominant market position. Piloted operations are perceived as safer and more reliable, especially in the early stage of advanced aerial mobility technology development. Having a human pilot on board could aid in managing unexpected situations and ensure passenger confidence.

By Propulsion Type

Based on Propulsion Type, the market segment has been divided into Parallel Hybrid, Turboshaft, Electric and Turboelectric. The Electric segment dominant the market. The electric segment is a major driver of growth in the AAM market. Investors and companies are heavily focused on developing and commercializing electric-powered AAM solutions.

By End Use

Based on End User, the market segment has been divided into the Cargo and Passenger. The Cargo Delivery segment held a dominant market. Cargo delivery through aerial mobility offers faster transportation as compared to traditional ground-based methods, especially for urgent or time-sensitive deliveries. Moreover, using aerial routes aids bypass road traffic and congestion, leading to quicker and more reliable delivery times.

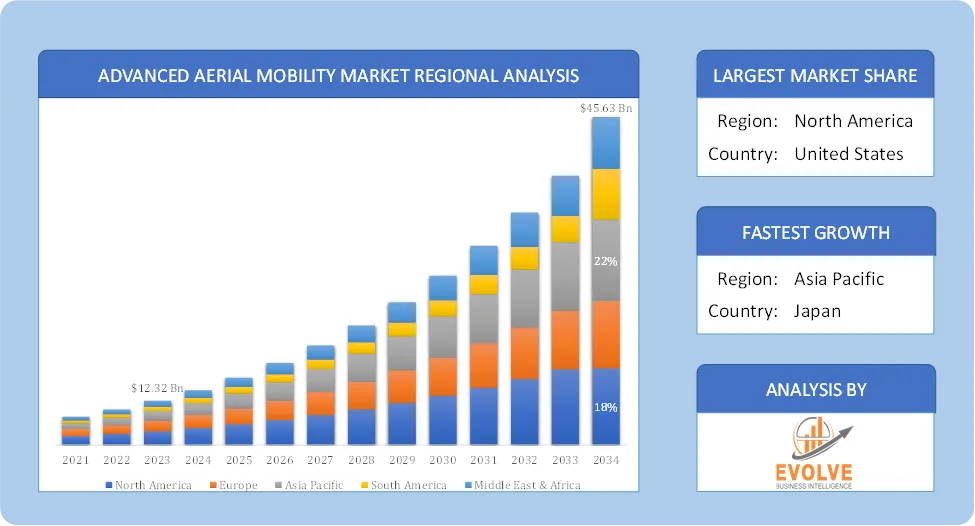

Global Advanced Aerial Mobility Market Regional Analysis

Based on region, the global Advanced Aerial Mobility Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Advanced Aerial Mobility Market followed by the Asia-Pacific and Europe regions.

North America Global Advanced Aerial Mobility Market

North America holds a dominant position in the Advanced Aerial Mobility Market. North America leads the AAM market. The United States, in particular, has demonstrated strong support for AAM technologies, with major aerospace companies like Boeing and Joby Aviation spearheading developments. Government agencies, including the Federal Aviation Administration (FAA), are actively working on certifications and regulations to facilitate the integration of eVTOL (electric Vertical Take-Off and Landing) aircraft into national airspace.

Asia-Pacific Global Advanced Aerial Mobility Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Advanced Aerial Mobility Market industry. The Asia-Pacific region is projected to be the fastest-growing AAM market. Countries like China, Japan, and South Korea are heavily investing in AAM technologies to address increasing urbanization and the demand for advanced transportation solutions. Increasing demand for efficient transportation, government support for technological innovation and China is making large strides in autonomous drone technology, and implementation.

Competitive Landscape

The global Advanced Aerial Mobility Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- AeroMobil

- Airbus S.A.S.

- Flytrex, Hyundai Motor Company

- Lilium

- Matternet

- PAL-V International B.V.

- The Boeing Company

- Volocopter GmbH

Key Development

- In June 2024, Airbus and Avincis, a well-established European helicopter operator, signed a Memorandum of Understanding (MoU) to partner on the development of Advanced Air Mobility (AAM). The companies will collaborate to explore opportunities for operating electric vertical take-off and landing (eVTOL) aircraft throughout Europe.

Scope of the Report

Global Advanced Aerial Mobility Market, by Mode of Operation

- Piloted

- Autonomous

Global Advanced Aerial Mobility Market, by Propulsion Type

- Parallel Hybrid

- Turboshaft

- Electric

- Turboelectric

Global Advanced Aerial Mobility Market, by End Use

- Cargo

- Passenger

Global Advanced Aerial Mobility Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 45.63 Billion |

| CAGR (2023-2033) | 22.10% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Mode of Operation, Propulsion Type, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | AeroMobil, Airbus S.A.S., Flytrex, Hyundai Motor Company, Lilium, Matternet, PAL-V International B.V., The Boeing Company, Volocopter GmbH and Zipline. |

| Key Market Opportunities | · Integration of AI and Autonomous Flight Technologies

· Emergency and Healthcare Servicess |

| Key Market Drivers | · Advancements in Electric Propulsion and Battery Technology

· Technological Innovations in Autonomous Flight and AI |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Advanced Aerial Mobility Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Advanced Aerial Mobility Market historical market size for the year 2021, and forecast from 2023 to 2033

- Advanced Aerial Mobility Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Advanced Aerial Mobility Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

[/woodmart_responsive_text_block]

Frequently Asked Questions (FAQ)

What is the growth rate of the global Advanced Aerial Mobility Market?

The global Advanced Aerial Mobility Market is growing at a CAGR of 22.10% over the next 10 years

Which region has the highest growth rate in the market of Advanced Aerial Mobility Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Advanced Aerial Mobility Market?

North America holds the largest share in 2022

Who are the key players in the global Advanced Aerial Mobility Market?

AeroMobil, Airbus S.A.S., Flytrex, Hyundai Motor Company, Lilium, Matternet, PAL-V International B.V., The Boeing Company, Volocopter GmbH and Zipline. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|