Evolve Business Intelligence has published a research report on the Global Fintech Lending Market, 2021–2034. The global Fintech Lending market is projected to exhibit a CAGR of around 4.41%during the forecast period of 2021 to 2034.

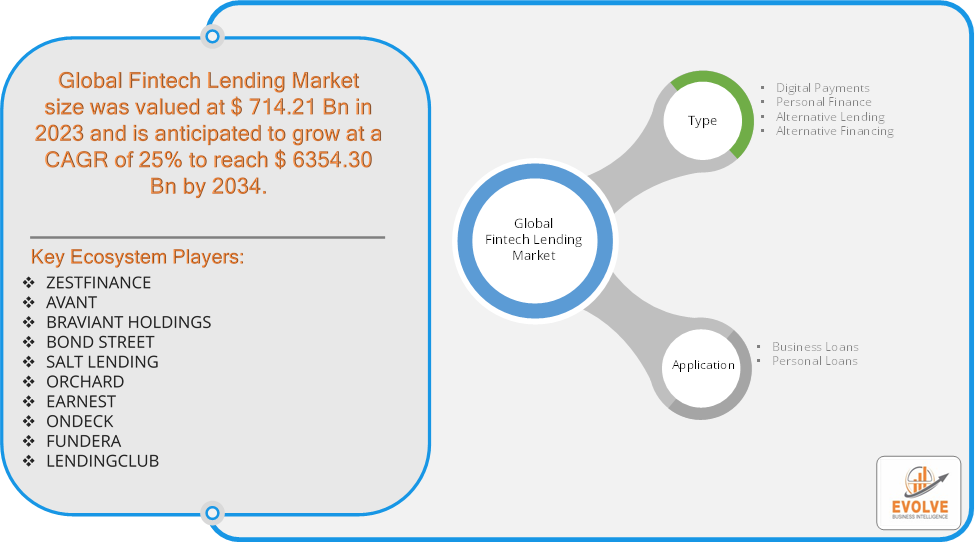

Evolve Business Intelligence has recognized the following companies as the key players in the global Fintech Lending Market: ZESTFINANCE, AVANT, BRAVIANT HOLDINGS, BOND STREET, SALT LENDING, ORCHARD, EARNEST, ONDECK, FUNDERA, LENDINGCLUB

More Information: https://evolvebi.com/report/fintech-lending-market-analysis/

More Information: https://evolvebi.com/report/fintech-lending-market-analysis/

Market Highlights

The Fintech Lending Market size accounted for USD 714.21 Billion in 2023 and is estimated to account for 910.74 Billion in 2024. The Market is expected to reach USD 6354.30 Billion by 2034 growing at a compound annual growth rate (CAGR) of 25% from 2024 to 2034. The Fintech Lending Market refers to the use of technology and innovative platforms to provide loans to consumers and businesses, bypassing traditional financial institutions like banks. This market leverages artificial intelligence (AI), machine learning (ML), and big data analytics to assess creditworthiness, streamline the lending process, and offer faster approvals. Fintech lenders typically operate via online platforms, offering products such as personal loans, business loans, and peer-to-peer lending. The market is characterized by increased accessibility, lower operational costs, and flexible borrowing terms, often attracting underserved or unbanked populations. Growth is driven by digitalization, changing consumer preferences, and regulatory advancements in financial services.

Segmental Analysis

The global Fintech Lending market has been segmented based on Type, Application

Based on Type, the market is segmented based on Digital Payments, Personal Finance, Alternative Lending, Alternative Financing. the Alternative Lending segment dominates, as it encompasses innovative lending models like peer-to-peer (P2P) lending and online lending platforms, which have gained widespread adoption due to their flexibility, speed, and accessibility compared to traditional financing methods

Based on Applications, the market has been divided into the Business Loans, Personal Loans. the Personal Loans segment typically dominates, driven by rising consumer demand for quick and easy access to credit, streamlined approval processes, and growing adoption of digital lending platforms.

More Information: https://evolvebi.com/report/fintech-lending-market-analysis/

Regional Analysis

The Fintech Lending market is divided into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East, &Africa. North America holds a dominant position in the Fintech Lending Market. In North America, the Fintech Lending Market is experiencing significant growth, driven by advanced technological infrastructure, high internet penetration, and widespread adoption of digital financial services. The U.S. leads the region, with increasing demand for alternative lending models like peer-to-peer and online loans. Regulatory support and innovation further boost the market’s expansion in both personal and business loan segments. The Asia-Pacific region has indeed emerged as the fastest-growing market for the Fintech Lending industry. In the Asia Pacific, the Fintech Lending Market is rapidly growing due to the region’s large unbanked population, increasing smartphone and internet usage, and supportive government policies promoting financial inclusion. Countries like China and India are leading the market, with significant demand for alternative lending models, including peer-to-peer and digital lending platforms, especially in underserved rural areas.