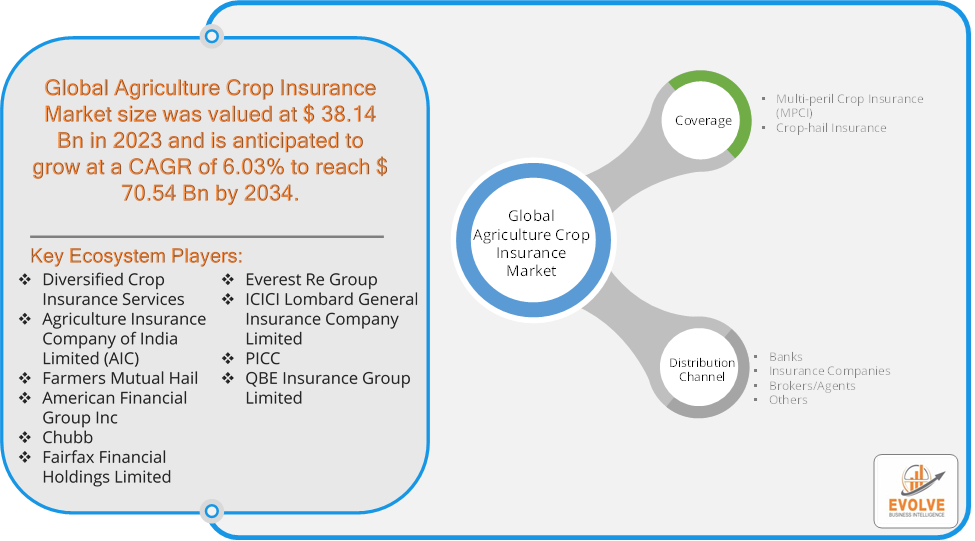

Evolve Business Intelligence has published a research report on the Global Agriculture Crop Insurance Market, 2024–2034. The Global Agriculture Crop Insurance Market is projected to exhibit a CAGR of around 6.03% during the forecast period of 2024 to 2034.

Evolve Business Intelligence has recognized the following companies as the key players in the Global Agriculture Crop Insurance Market: Diversified Crop Insurance Services, Agriculture Insurance Company of India Limited (AIC), Farmers Mutual Hail, American Financial Group Inc, Chubb, Fairfax Financial Holdings Limited, Everest Re Group, ICICI Lombard General Insurance Company Limited, PICC and QBE Insurance Group Limited.

The Global Agriculture Crop Insurance Market is projected to be valued at USD 70.54 Billion by 2034, recording a CAGR of around 6.03% during the forecast period. The Global Agriculture Crop Insurance Market refers to the market that provides insurance coverage to farmers and agricultural producers to protect against losses due to natural disasters, weather-related events (like drought, floods, or storms), pests, diseases, or other unforeseen incidents that can affect crop yields. Crop insurance helps to mitigate the financial risks that farmers face by offering them a safety net, ensuring income stability, and encouraging investment in agriculture.

The market’s growth is influenced by factors such as the increasing frequency of extreme weather events, government support and subsidies for crop insurance, and growing awareness among farmers about the benefits of such protection. The Global Agriculture Crop Insurance Market plays a vital role in supporting the agricultural sector and ensuring food security.

Segmental Analysis

The Global Agriculture Crop Insurance Market has been segmented based on Coverage and Distribution Channel.

Based on Coverage, the Global Agriculture Crop Insurance Market is segmented into Multi-peril Crop Insurance (MPCI) and Crop-hail Insurance. The Multi-peril Crop Insurance (MPCI) segment is anticipated to dominate the market.

Based on Distribution Channel, the Global Agriculture Crop Insurance Market has been divided into Banks, Insurance Companies, Brokers/Agents, Others. The Insurance Companies segment is anticipated to dominate the market.

Regional Analysis

The Global Agriculture Crop Insurance Market is divided into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East, & Africa. North America, particularly the U.S., is one of the largest markets for agricultural crop insurance, primarily driven by strong government support programs like the Federal Crop Insurance Program (FCIP). This program provides extensive subsidies, making insurance affordable for farmers and the region has a well-established infrastructure for insurance, with advanced technologies like satellite monitoring and weather data integrated into risk assessment and claims processing. Europe has a mixed crop insurance market with both government-backed programs and private-sector participation and Countries like France and Spain have well-established insurance programs with government support for premium subsidies, while others rely more on private-sector-driven models. The Asia-Pacific region is experiencing rapid growth in agricultural crop insurance, driven by large agricultural economies like India and China and In India, government initiatives like the Pradhan Mantri Fasal Bima Yojana (PMFBY) are crucial for expanding crop insurance coverage among small and marginal farmers. Latin America is an emerging market for crop insurance, with Brazil and Argentina leading the way due to their large agricultural sectors and farmers in the region face climate-related risks, including droughts, floods, and extreme weather events, which are driving the adoption of crop insurance. The Middle East and Africa have relatively underdeveloped crop insurance markets, but there is growing interest due to rising climate risks and food security concerns and in many parts of Africa, farming is highly vulnerable to droughts and other natural disasters, making crop insurance a potentially important tool for risk management.